The State of NFT in Q4 2023: Insights and Trends

It’s been a year since we had our last NFTs update where we explored the growing adoption by mainstream players like major sports leagues to global coffee giants. As we are seeing recovery in the broader digital asset market, it’s time to revisit the latest developments in the NFT sector. In this article, we will dive into the state of NFTs in Q4 2023, examining market trends, notable projects, performance and new mainstream collaborations.

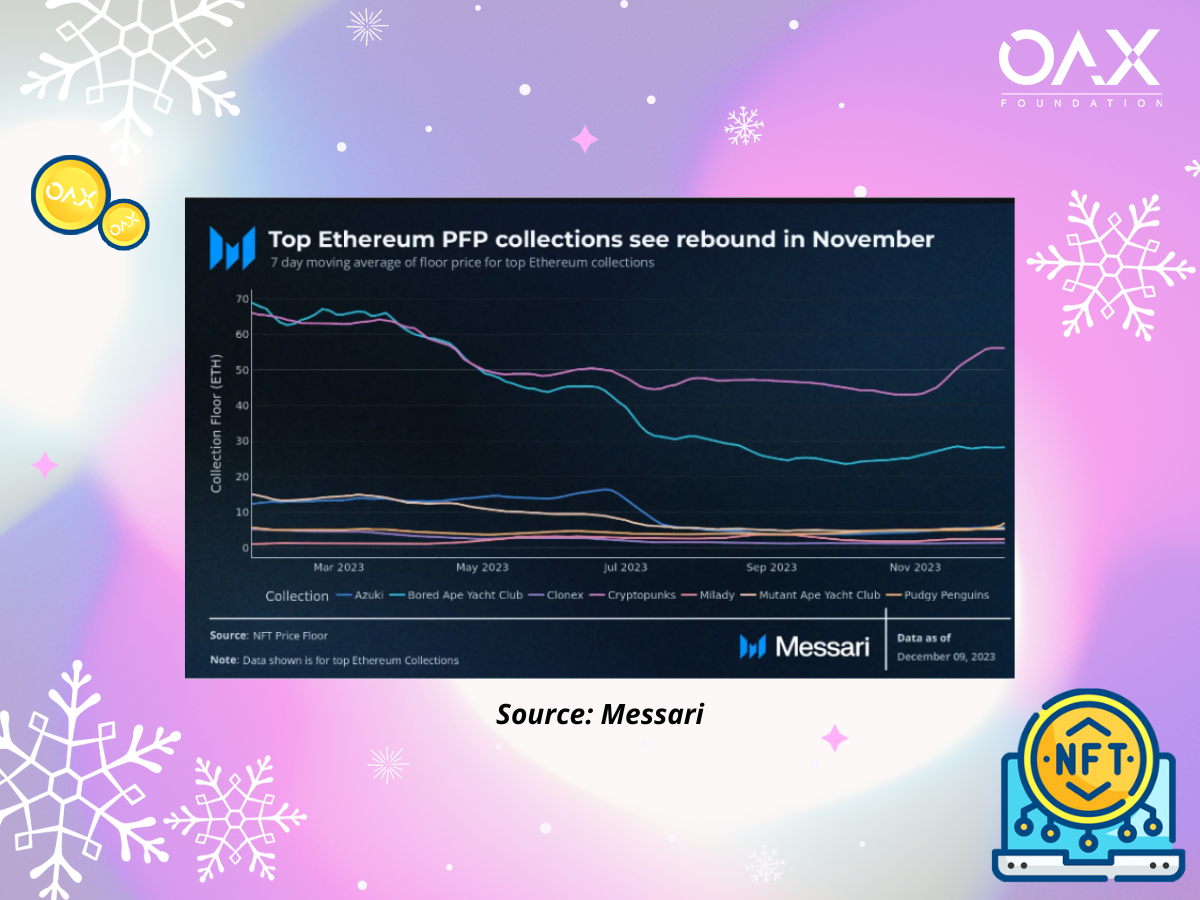

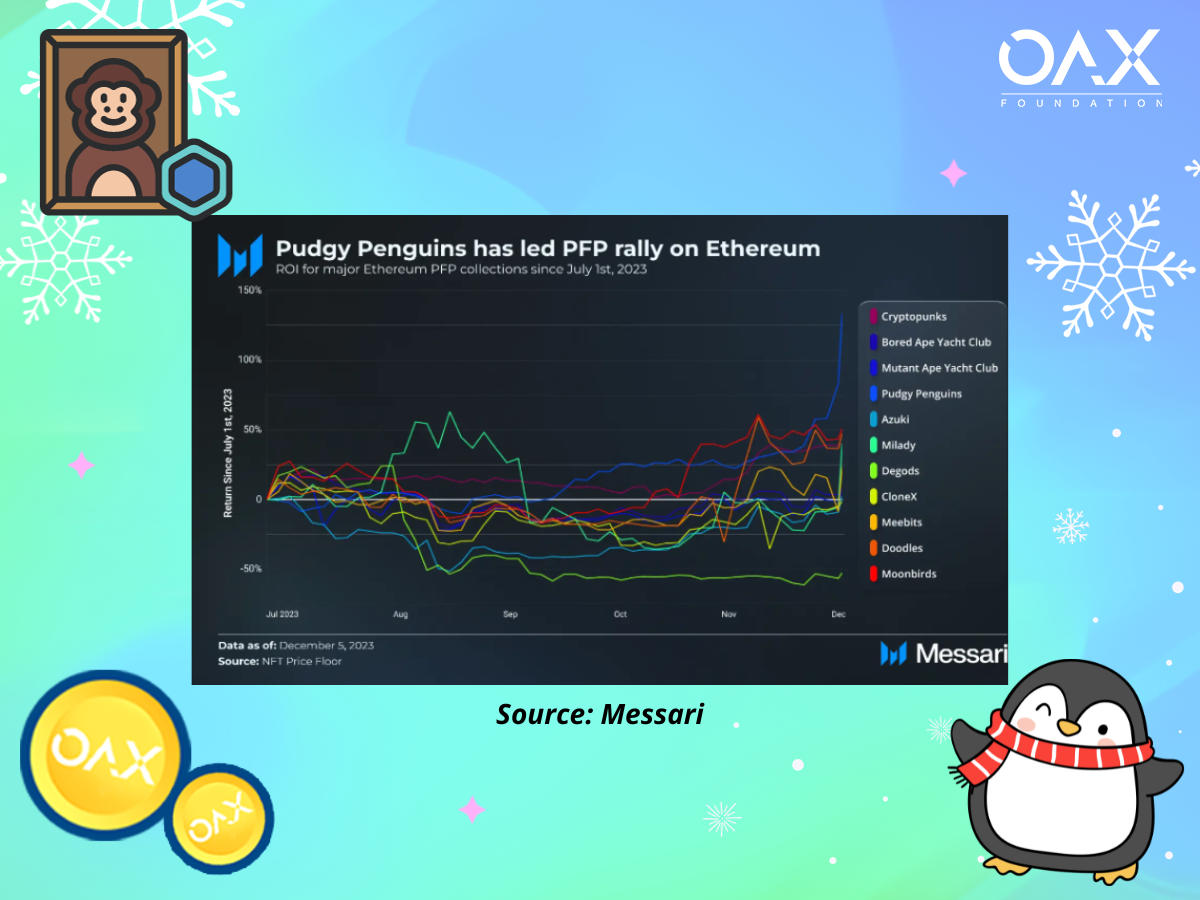

The market for profile picture (PFP) NFTs has taken some of the largest hits over the past year, but it’s experiencing a revival as we are seeing rising floor prices and increased trading activity on Ethereum and Solana NFT marketplaces. Mid-tier collections like Pudgy Penguins, Mad Lads, and Milady Maker are witnessing significant increases in floor prices and trading volume, indicating a growing market interest. Bluechip collections such as CryptoPunks, Azuki, and Bored Ape Yacht Club have also experienced price spikes.

However, while the overall crypto market has seen a 70% increase in the value of Ether (ETH) this year, NFTs have not experienced the same level of growth. Figures indicate that NFT prices have lagged behind, with the NFT-500 index dropping 50% year-to-date in Ether terms, and the Blue-Chip 10 index is down 44% in Ether terms. Experts attribute the lag to the lack of utility and technological advancements in the NFT sector.

In the meantime, we are seeing both existing and new projects making shifts in their utility strategy in the areas of ticketing, loyalty and IP. PFP projects are transitioning towards brand-building and app specific loyalty benefits. This shift is seen in projects like Pudgy Penguins, which is diversifying into merchandise, IP rights, and toys that are to be distributed in Walmart stores. Similarly, projects on Solana like Tensorians, introduced by the rising NFT market place Tensor. They are offering additional utility beyond pure artistic value or airdropping derivative projects; they are taking a broader brand development approach, indicating a dynamic future for NFT projects.

Meanwhile, the blockchain gaming and metaverse sector has seen a rise in daily unique active wallets, the growth has been covered in our blog in October. This sector accounts for 34% market dominance in decentralized applications (DApps) with these numbers expected to greatly rise in 2024, remaining to be one of the solid use cases for NFTs.

Take Gods Unchained for example, an NFT blockchain card game developed by ImmutableX has striked partnership with Amazon prime to distribute the game to its users. Other mainstream entities like Sotheby’s, FIFA, and Disney are entering the NFT space, launching their own collections or offering NFT-related promotions. Despite the bearish sentiment over the past year, we are seeing a continuation of mainstream collaborations, indicating the growing acceptance of NFTs from various industries.

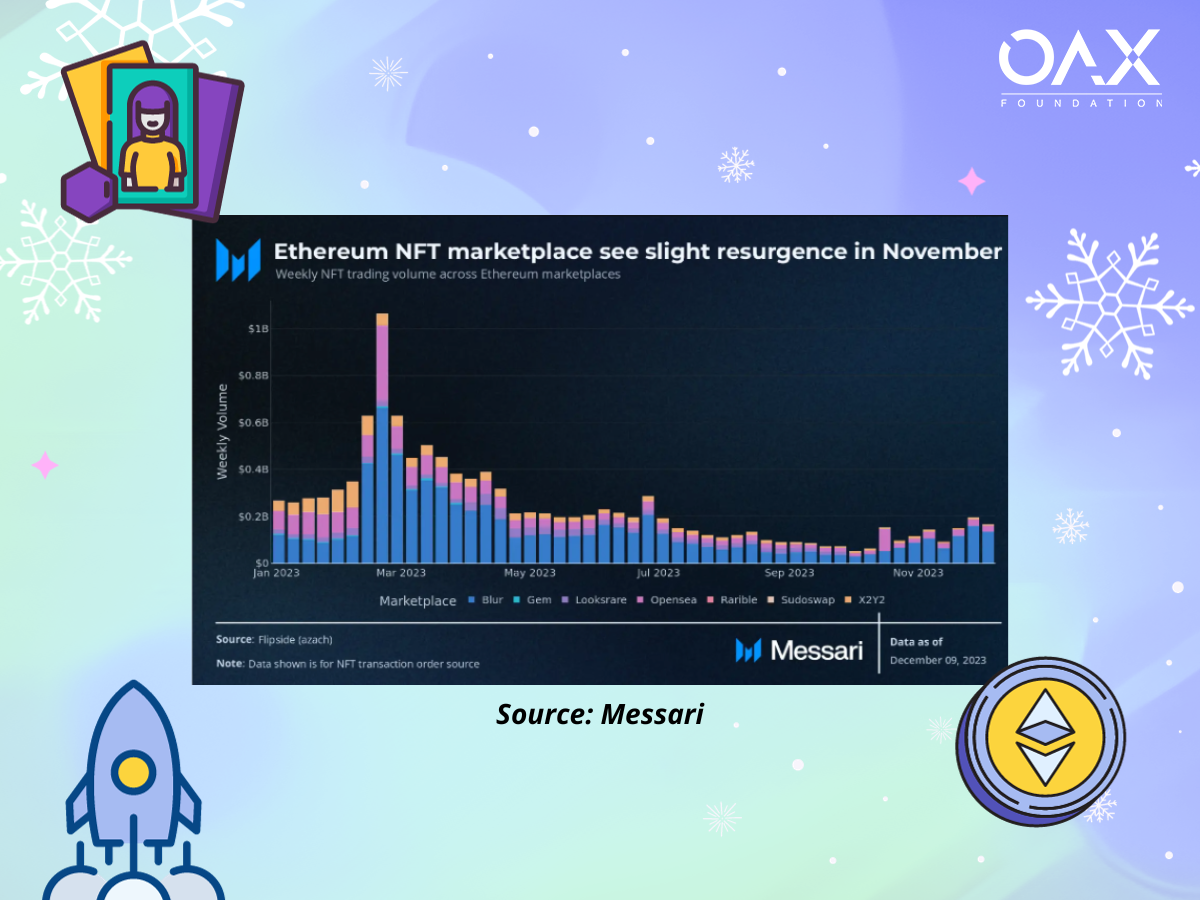

Overall, while the recent bounce back of the NFT market has instilled some optimism, it is still down compared to its peak. The largest NFT marketplace, OpenSea, has also seen a decline in fees and revenue, over 90% drop in monthly fees was recorded compared to peak last year in Jan 2022, along with its layoffs, highlighting the challenges faced by the NFT market.

There is optimism surrounding the NFT market, fueled by the launch of competing marketplaces and potential spot bitcoin ETF approvals, but analysts remain cautious about the sustainability of the revival. The recent surge in prices should be approached with caution, and it is essential to exercise due diligence and thorough research before engaging in the NFT market.

The market is showing signs of life and began to attract mainstream attention again and reaching over 1 billion in volume just in November, but challenges and uncertainties persist as we have yet to see stable activity among these NFT projects. The OAX foundation believes these are phases that a growing industry encounters as it continues to mature. It has been positive to see more examples where projects are tying back to real world experiences and new mainstream collaborators in order to drive the adoption of NFT technology. Concurrently, there’s high anticipation of digital asset ETFs getting approval in January 2024, it is almost certain that this will further bring awareness in the NFT space in attracting new retail users participation.