A Look Back and Recap of the Year 2023

Hi OAX Community,

Hope everyone had a wonderful Christmas break and Happy New Year in advance!

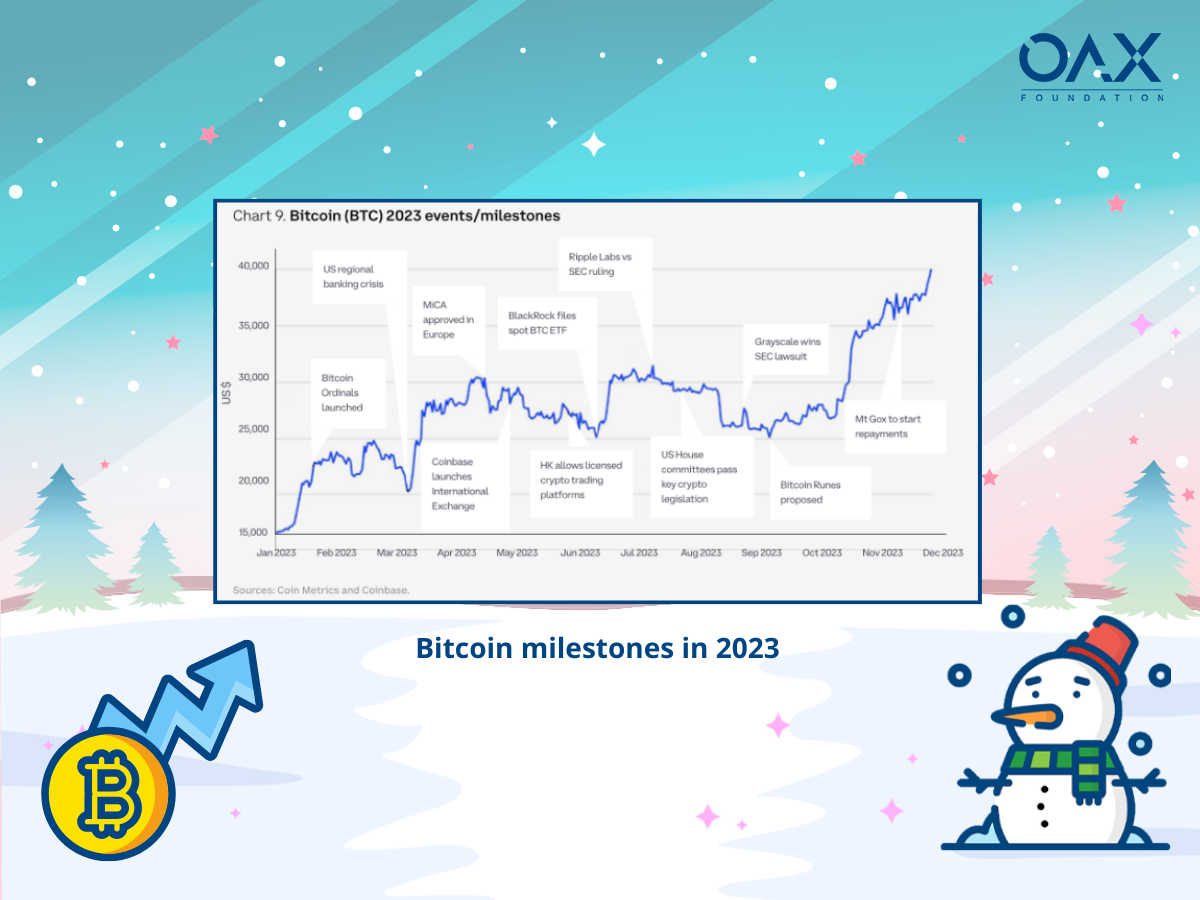

As we bid farewell to 2023, it’s time to reflect on the incredible year that unfolded in the crypto market. The last quarter, we witnessed massive revivals that breathed new life into the industry. December stood out as Bitcoin demonstrated an upward trend. It marked a significant recovery from the previous year’s crypto market downturn, which was characterized by hedge fund collapses and substantial losses. In this update, we will like to share with you a summary that we believe shaped the crypto space in 2023.

Navigating Regulatory Challenges and Opportunities

Earlier this year, the industry had a rocky start. The total market value of cryptocurrencies surpassed $1 trillion, but Bitcoin experienced a sharp decline to its lowest point of the year at $16,800 in January. Amidst an environment of intensified regulatory scrutiny in the United States, the crypto industry found itself in the crosshairs of authorities. The Securities and Exchange Commission (SEC) made a resounding impact by stepping into the realm of Kraken’s staking operations, exacting a hefty fine of $30 million. This forceful action served as a stark reminder of the regulatory authorities’ unwavering vigilance within the crypto space and underscored the criticality of strict compliance with established guidelines.

In the second quarter, various prominent asset management firms resubmitted its proposal for a Bitcoin Exchange-Traded Fund (ETF). This strategic move exemplified the ongoing efforts to establish a connection between digital assets and the more traditional financial structures. Furthermore, BlackRock put forward a proposal for a spot Bitcoin exchange-traded fund (ETF) that was listed on the Depository Trust & Clearing Corporation (DTCC). This listing hinted at the potential approval of the ETF by the Securities and Exchange Commission (SEC). These events shed light on the profound impact that U.S. regulation has on the movements of cryptocurrency prices, emphasizing the critical role of regulatory decisions in shaping the market.

The month of June brought forth a sharpening of regulatory pressures, with the Securities and Exchange Commission (SEC) directing its attention towards prominent exchanges such as Binance and Coinbase. As July unfolded, the legal landscape became embroiled in clashes, as the SEC engaged in a contentious legal battle over Ripple’s XRP sales. The subsequent court ruling provided a measure of clarity, distinguishing between institutional and retail sales and prompting contemplation regarding the classification of crypto assets.

During the tightening regulatory scrutiny by the SEC, the crypto industry continued to witness notable developments, showcasing a dual narrative of traditional players driving mass adoption while native projects pushed the boundaries of innovation within the crypto realm.

Mainstream Acceptance and Web3 Native Innovations

On one hand, traditional players made significant strides towards mainstream acceptance of cryptocurrencies. Mastercard’s announcement to integrate blockchain technology into financial applications exemplified a major step towards wider acceptance and utilization of crypto-based solutions. Additionally, PayPal made its mark by launching its stablecoin, marking a significant milestone in the incorporation of cryptocurrencies into everyday payment systems.

A look back at the evolution of the concept of ‘currency’ as we know it.

A look back at the evolution of the concept of ‘currency’ as we know it.

Meanwhile, native projects brought forth their own wave of innovation. The emergence of SocialFi, which combined cryptocurrency with social media platforms, generated a sense of hype and excitement within the industry. The tokenization of real-world assets gained traction, with several countries and financial institutions adopting asset tokenization programs, demonstrating the potential for increased liquidity and efficiency in traditional asset markets. The concept of Ordinals, where Bitcoin satoshis were inscribed with unique identifiers, gained popularity and contributed to the surge in Bitcoin’s price, showcasing the creative ways in which the crypto community engaged with digital assets.

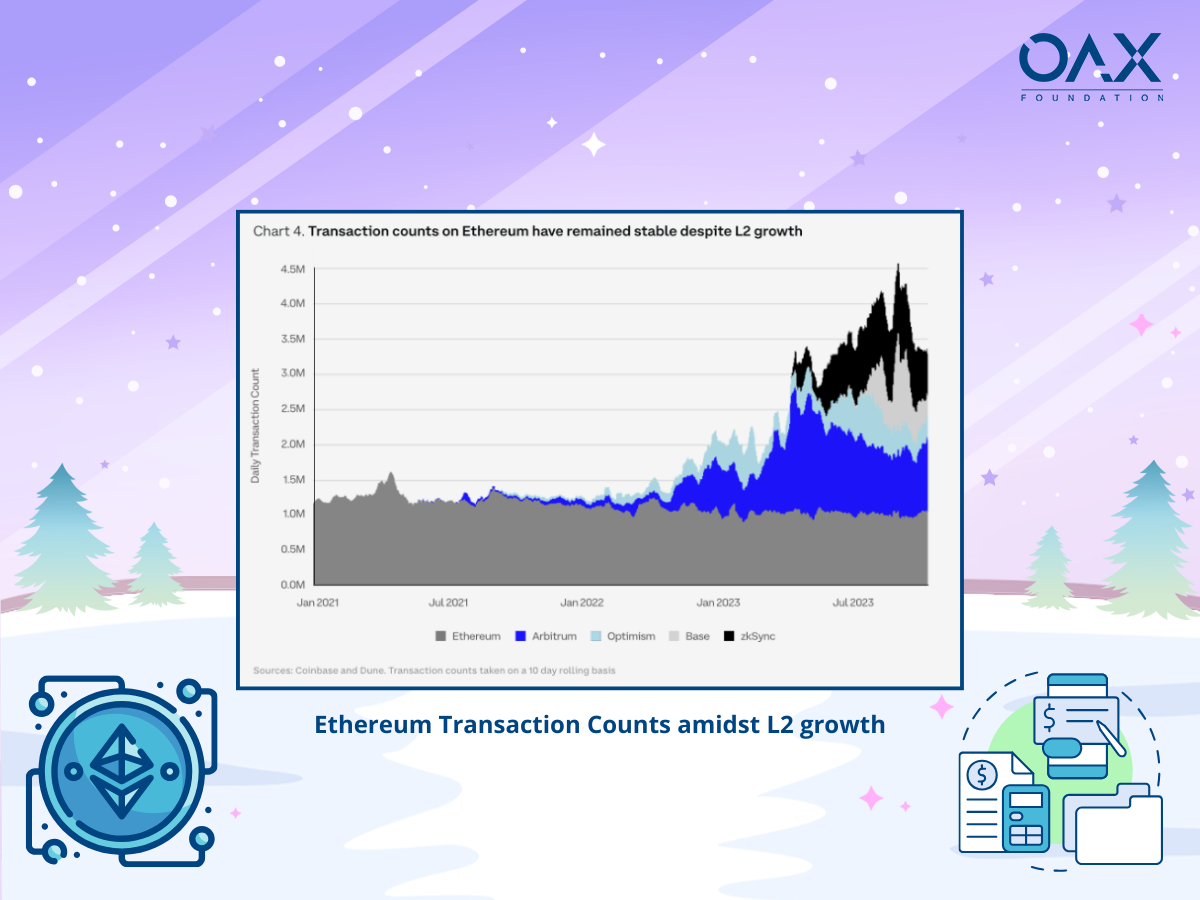

Coinbase, a major cryptocurrency exchange, faced regulatory uncertainties but also took a stand by launching its own layer-two blockchain called Base. Additionally, Coinbase played a role in the potential approval of a spot Bitcoin ETF, further showcasing its influence within the industry. Ethereum also underwent significant upgrades, such as the Shapella upgrade, transitioning to a proof-of-stake chain. This successful transition paved the way for future upgrades like EIP-4844, further solidifying Ethereum’s position as a leading blockchain platform and fueling the growing popularity of staking assets.

Anticipation for the Future: Trust, Reliability, and Optimism

As we entered the fourth quarter, the crypto space witnessed notable developments that relate to trust and reliability. Sam Bankman-Fried, a prominent figure in the industry, faced serious allegations, while CZ, the CEO of Binance, made the decision to step down. These events had a profound impact in the ecosystem, and sparked discussions within the industry regarding trust and reliability.

In December, the upward trajectory of Bitcoin ignited anticipation for the imminent approval of ETFs and clarity on addressing industry’s bad actors have fostered a sense of optimism in the market. This excitement was also fueled by factors such as the approaching 2024 Bitcoin halving.

At OAX Foundation, headquartered in Hong Kong, we have diligently covered key industry topics throughout the past year, and we invite you to revisit our previous articles for a comprehensive view of global market trends.

As we embark on the journey into 2024, we will continue to delve into headline topics that shape the crypto industry in Hong Kong as well as the rest of the world. As it is now more crucial than ever to stay informed, our notification app - Notifs will keep you updated with the latest developments in the realm of digital assets. Additionally, the new on-chain data scanner - Gazer feature will provide users with valuable educational insights and keep track of on-chain activities.

In the meantime, we wish you a fantastic New Year, and we encourage you to stay tuned for our upcoming blog, where we will delve into the outlook for 2024.