Part Three: Stablecoins – Asia’s Race and Hong Kong’s Ambition Post-GENIUS Act

In our stablecoin series, Part 1 dissected the U.S. Guiding and Establishing National Innovation for U.S. Stablecoins Act (GENIUS Act), signed July 18, 2025, highlighting its role in legitimizing stablecoins while balancing innovation and regulation. Part 2 explored their global rise, capturing a $250 billion market, and macro risks, including U.S. Treasury concentration flagged by the Financial Times. Now, Part 3 zooms into Asia’s dynamic response, led by Hong Kong, to this historic U.S. legislation, examining adoption trends, competitive positioning, and implications for global finance.

The GENIUS Act, mandating 1:1 USD-backed reserves in U.S. Treasuries or cash and stringent oversight, has ignited a regulatory race in Asia. Financial hubs like Hong Kong, Singapore, and Japan view it as a catalyst to refine their frameworks, aiming to attract issuers and maintain global relevance.

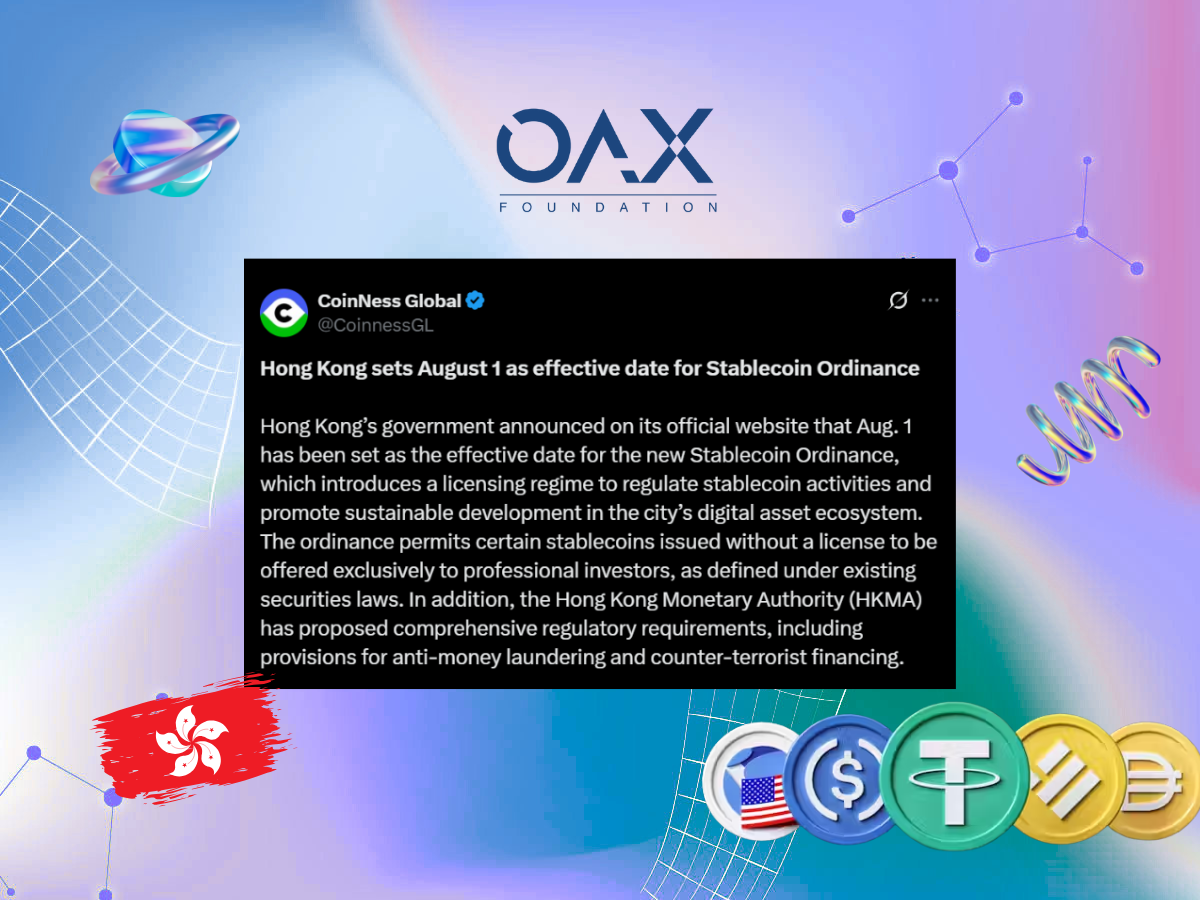

Industry surveys reveal 49% of Asian stakeholders cite market expansion as the top driver for stablecoin growth, showcasing the region’s ambition to capitalize on this moment. Hong Kong, in particular, has emerged as a frontrunner with its Stablecoins Ordinance (effective August 1, 2025), positioning itself as a bridge between traditional finance and Asia’s digital economy.

Hong Kong’s Strategic Response

Hong Kong’s Ordinance mirrors the GENIUS Act’s core principles, 1:1 reserve backing and AML/CFT compliance, but diverges with flexibility to peg stablecoins to HKD, offshore RMB, or USD.

This multi-currency approach aligns with China’s Belt and Road Initiative, targeting cross-border trade in the Asia-Pacific and challenging the dominance of USD stablecoins like USDC. Industry leaders like YeFeng Gong of HashKey have praised Hong Kong’s regulatory clarity, calling it a global benchmark, rivaling the EU’s MiCA and Singapore’s frameworks.

Major players are seizing this opportunity. Standard Chartered, in collaboration with Hong Kong Telecom and Animoca Brands, is testing HKD-pegged stablecoins in the HKMA’s sandbox, while Ant Financial explores RMB-pegged options. These trials signal market optimism, reflecting Hong Kong’s appeal to institutional issuers. Benchmarking the U.S., Hong Kong’s sandbox fosters innovation within a controlled environment, balancing risk and creativity.

Factors that influence stablecoin exploration in Asia and across the globe - in Asia, notably 49% have noted Market Expansion as the top factor influencing stablecoin growth.

Factors that influence stablecoin exploration in Asia and across the globe - in Asia, notably 49% have noted Market Expansion as the top factor influencing stablecoin growth.

Asia’s Broader Reaction

Other Asian jurisdictions are responding to the GENIUS Act’s global ripple effect. Singapore’s Monetary Authority (MAS) enforces strict reserve and capital rules, attracting issuers like Paxos and Circle for USD-pegged stablecoins. Its innovation-friendly tax incentives make it a magnet, though it lacks Hong Kong’s multi-currency flexibility.

Japan, classifying stablecoins as “electronic payment instruments,” allows up to 50% of reserves in low-risk Japanese or U.S. bonds (≤3 months), boosting efficiency. SBI VC Trade’s handling of USDC since April 2025 reflects Japan’s growing market, with JPY 1.9 trillion (USD 13.1 billion) in crypto trading volume in February 2025.

Mainland China, despite its crypto ban, sees Hong Kong’s RMB-pegged stablecoins as a testing ground for future digital asset policies, particularly for Belt and Road payments.

China’s digital yuan (e-CNY), a leading central bank digital currency (CBDC), shapes Asia’s stablecoin landscape, particularly in Hong Kong, but introduces both synergy and tension.

While Mainland China bans private stablecoins, Hong Kong’s Stablecoins Ordinance enables RMB-pegged stablecoins, positioning the city as a testing ground for China’s digital finance ambitions, aligning with the Belt and Road Initiative for cross-border payments. The e-CNY prioritizes domestic control, while Hong Kong’s private stablecoins foster global RMB use, complementing the GENIUS Act’s USD focus. However, China’s centralized approach clashes with stablecoins’ decentralized nature, creating friction as private issuers may compete with the e-CNY in international markets, requiring careful regulatory coordination to avoid fragmentation. This dual dynamic demonstrates Hong Kong’s pivotal role in balancing innovation with China’s strategic control.

Systemic Risks: A Comparative Lens

The Financial Times warns that U.S. stablecoins’ heavy reliance on U.S. Treasury bills risks a bubble if mismanaged, as surging demand could inflate prices, vulnerable to interest rate hikes or liquidity shocks.

Hong Kong’s stablecoins share some exposure, particularly for HKD/USD-pegged issuers leveraging U.S. Treasuries. However, the Ordinance allows diverse reserves, short-term bank deposits, Hong Kong government bonds, or HKMA-approved funds, reducing dependence on Treasuries.

For RMB-pegged stablecoins, issuers may hold offshore RMB bonds or deposits, further mitigating bubble risks tied to U.S. markets.

Hong Kong’s stringent oversight, including daily reserve statements and weekly HKMA reporting, contrasts with the U.S.’s dual federal-state model, where smaller issuers face varied state standards.

The HKMA’s localization requirements, local incorporation, HKD 25 million (USD 3.2 million) capital, and Hong Kong-based management, enhance accountability, lowering mismanagement risks like redemption runs. Yet, high compliance costs (0.3%–0.5% of issuance) may consolidate the market among large players.

Near-Term Growth and Risks

The GENIUS Act has spurred a money supply surge, with Circle leading U.S. adoption and banks integrating and issuing stablecoins. Hong Kong’s framework drives global emulation, with institution issuance interest signaling momentum. Yet, systemic risk like bond volatility highlighted in Part 2 demands vigilance.

Asia’s stablecoin market limits global systemic impact, but local disruptions could affect regional trade. Hong Kong’s Stablecoins Ordinance paves the way for China to compete in the stablecoin race through RMB-pegged stablecoins, aligning with the Belt and Road Initiative while safeguarding the e-CNY’s controlled domestic economy. Yet, tensions persist between China’s centralized approach and the decentralized nature of stablecoins, requiring careful regulatory coordination to avoid market fragmentation.

Stablecoins are a crypto milestone, enabling cross-border payments and financial inclusion, as envisioned by the OAX Foundation. Through OAX Learn, the Foundation promotes education to navigate this era responsibly.

As Asia, led by Hong Kong, rises to the GENIUS Act’s challenge, the question is not whether stablecoins will reshape finance, but whether industry players can harness their potential while managing risks.

Disclaimer: The above is an opinion piece written by an authorized author, but in no way represents the official standpoint of OAX Foundation Limited, nor should it be meant to serve as investment advice.