The Centralization Debate: Part 2 – Macro Implications and Systemic Risks

Stablecoins: From Crypto Niche to Macro Player

Stablecoins were once a crypto curiosity, a tool for navigating volatile markets without touching fiat. Now, they’ve become a major force in global finance overnight, following the GENIUS Act’s approval, Circle has soared to a record high, positioning stablecoins as a new force in global finance, especially within the U.S. Treasury market.

In 2024, stablecoin issuers purchased over $40 billion in short-term U.S. Treasury bills, surpassing traditional foreign investors like China. This is no small feat. Stablecoins are now deeply intertwined with the bedrock of the global financial system, turning what was once a sideshow into a potential systemic risk.

What makes this shift significant is the sheer scale of stablecoin growth. These digital assets, which are pegged to fiat currencies, now settle trillions in monthly transactions. With every dollar of inflows, issuers like Tether and Circle are buying Treasuries to back their reserves. While this has provided liquidity to the market and marginally reduced borrowing costs for the U.S. government, it has also introduced a new and largely unregulated player into a space traditionally dominated by central banks and institutional investors.

The Treasury Liquidity Dilemma

Stablecoin issuers have become significant buyers of short-term U.S. debt, particularly Treasury bills. Their role in this market is akin to a double-edged sword. On the one hand, their purchases provide liquidity and keep yields stable. A recent study by the Bank for International Settlements found that inflows of just $3.5 billion into stablecoins over five days can lower short-term Treasury yields by 0.025 percentage points over 10 days, a small but notable impact comparable to quantitative easing.

However, the flip side is far more concerning. When stablecoin redemptions spike, say, during a crypto crisis, issuers are forced to sell their Treasury holdings quickly to meet demands. This creates massive outflows, which have two to three times the impact of inflows. In such scenarios, yields could spike, destabilizing the market. Unlike institutional investors or central banks, stablecoin issuers lack the flexibility to time their sales, making them a volatility amplifier in times of stress.

Amplifying Financial Instability

The growing influence of stablecoins in the Treasury market introduces a fragile dynamic. Their reliance on liquid assets like Treasury bills makes them highly sensitive to market conditions. If a major stablecoin like Tether or USDC were to face a crisis, whether due to regulatory action, loss of confidence, or a de-pegging event, it could trigger a cascade of forced Treasury sales. This would disrupt the very market that central banks rely on to implement monetary policy.

The risks extend beyond the financial sector. Stablecoin redemptions could lead to sudden liquidity shortages, destabilizing other markets dependent on short-term borrowing. For example, banks and corporations that rely on short-term debt markets for operational funding could face higher borrowing costs, creating ripple effects across the economy.

The Opacity Problem

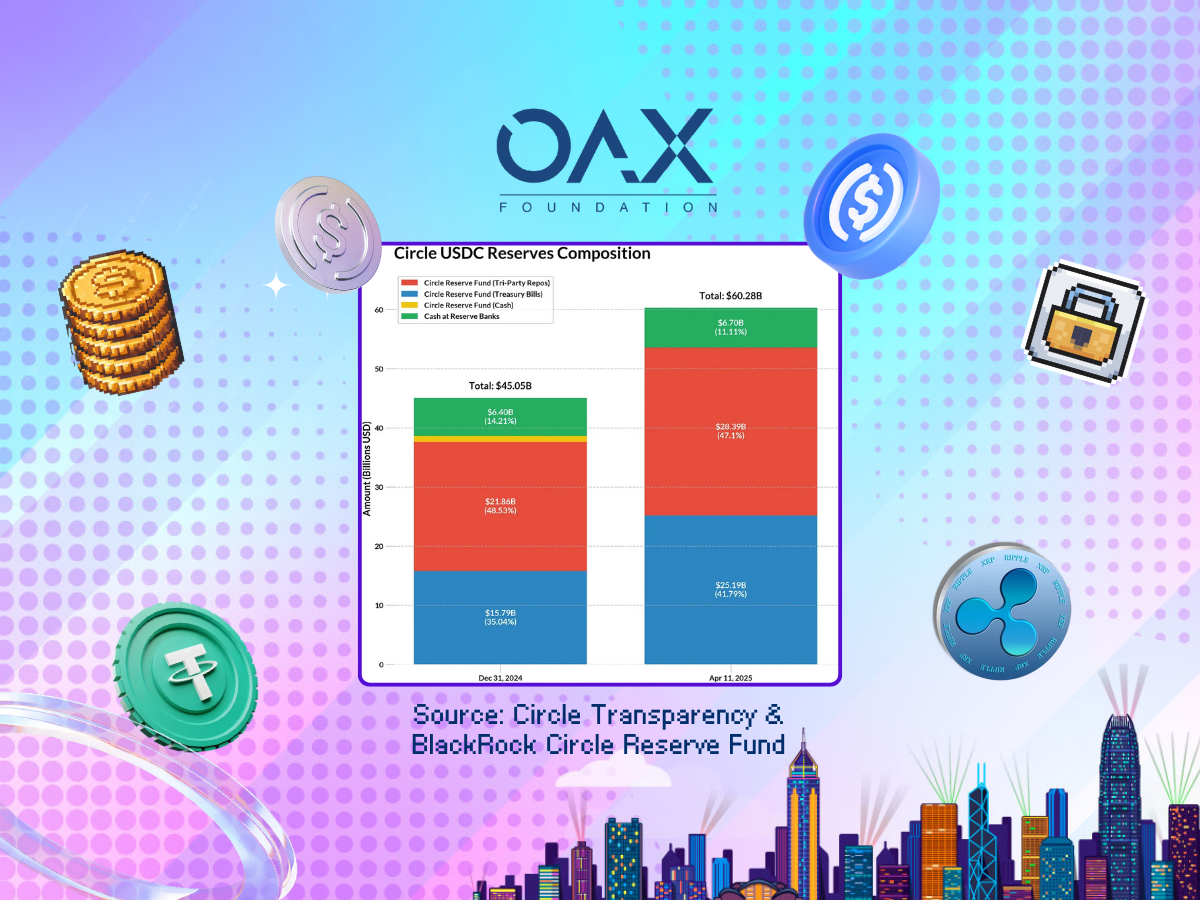

A major issue compounding these risks is the lack of transparency in stablecoin reserve holdings. While Circle’s USDC provides monthly attestations and detailed breakdowns of its reserves, Tether remains opaque, offering only vague assurances about its backing. The “secret sauce” approach, as Tether executives have called it, raises questions about whether these issuers are adequately prepared for large-scale redemptions.

This opacity makes it difficult for regulators and policymakers to assess the true risks stablecoins pose to financial stability. If a major issuer were to collapse, the market shock could be amplified simply because no one knows the full extent of their exposure until it’s too late.

A Delicate Balancing Act

The rise of stablecoins creates a paradox for the U.S. government. On one hand, they are a powerful tool for cementing the dollar’s global dominance. By allowing anyone with an internet connection to hold and transact in dollar-pegged assets, stablecoins extend the reach of the U.S. financial system, even in regions with failing currencies or restrictive regimes.

On the other hand, their rapid growth introduces risks that could destabilize the very system they’re helping to bolster. The GENIUS Act attempts to strike a balance by imposing reserve requirements and transparency mandates, but it may not be enough. As stablecoins grow larger, their ability to move billions in and out of Treasury markets creates a fragility that could ripple through the broader financial system.

Closing Summary

Stablecoins have evolved into a macroeconomic force, significantly influencing short-term debt markets and monetary policy. Their growth has delivered benefits like enhanced liquidity and reduced borrowing costs, but it also introduces substantial risks. As both stabilizers and potential disruptors, stablecoins present a delicate balancing act for regulators, central banks, and investors.

If managed effectively, stablecoins could become a cornerstone of the digital financial system, extending the U.S. dollar’s global dominance into the 21st century. However, if mismanaged, they risk destabilizing the very markets they currently support. While their future seemingly hinges on policymakers’ ability to address these risks, regulation often lags behind technological innovation, allowing market demand to shape its course.

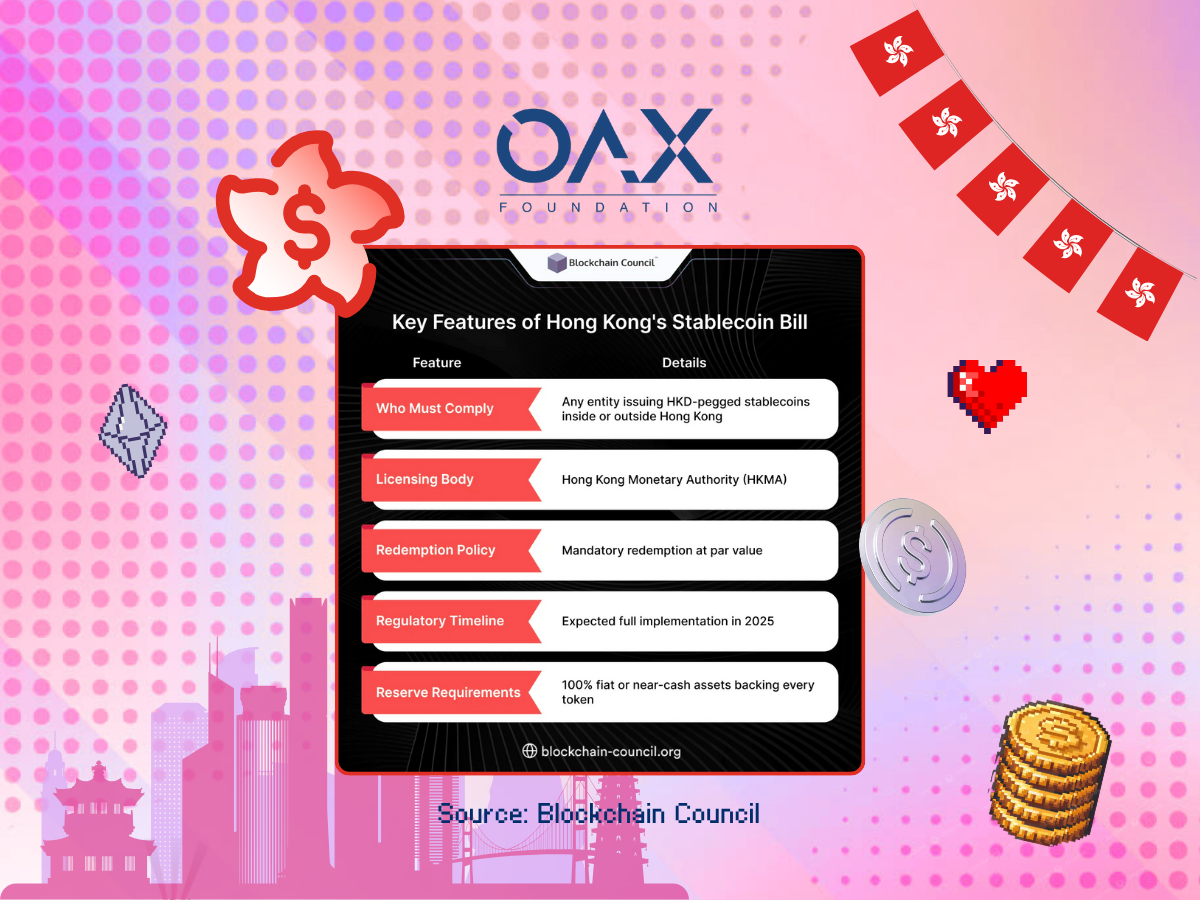

We note strong support from U.S. regulators, and as the OAX Foundation, headquartered in Hong Kong, we’re encouraged by the Hong Kong government’s proactive stance through the Stablecoins Ordinance, effective August 1, 2025, which establishes a robust, risk-based licensing regime for fiat-referenced stablecoin issuers to foster innovation while ensuring financial stability and consumer protection.

Stablecoins are a critical gateway to mainstream digital asset adoption in Hong Kong’s vision as a global financial hub, yet their dual nature demands rigorous oversight. Operating on a knife’s edge, stablecoins are both a boon and a burden for global finance, their trajectory in Hong Kong hinging on balancing cutting-edge innovation with regulatory precision.

Disclaimer: The above is an opinion piece written by an authorized author, but in no way represents the official standpoint of OAX Foundation Limited, nor should it be meant to serve as investment advice.