The Centralization Debate: Winners and Losers in a Post-GENIUS Act Stablecoin Ecosystem

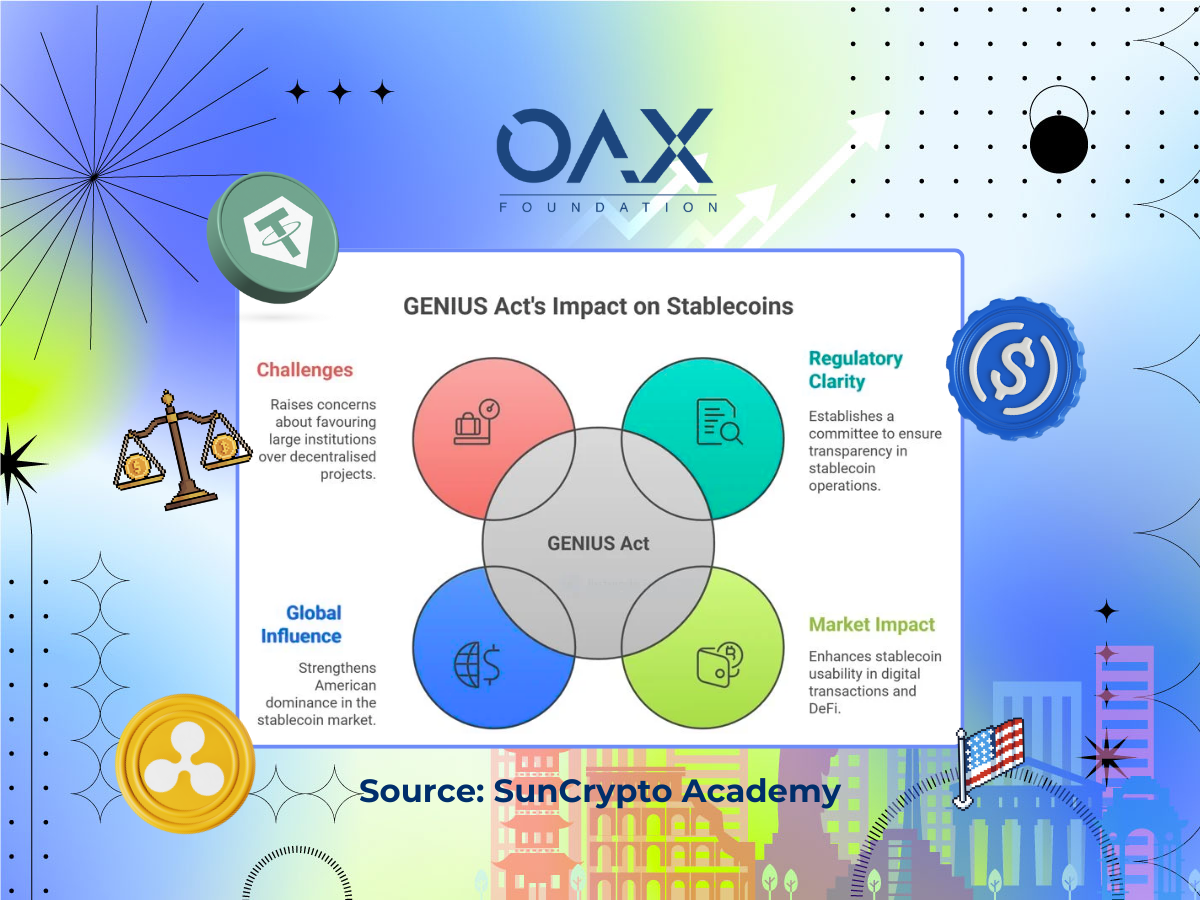

Stablecoins have rapidly grown into a financial powerhouse since we last discussed its significance in 2024. Once viewed as a niche crypto utility, they now handle over $6.3 trillion in monthly settlements, rivaling major payment networks like Visa. With the GENIUS Act clearing its path through Congress, the U.S. has taken a decisive step to regulate and legitimize this booming sector.

On paper, the Act’s promise of strict reserve requirements and transparency checks seems like the perfect recipe to bring stability and trust. But beneath this progress lie concerns that the future of stablecoins may be written by a few centralized giants, leaving little room for the decentralized innovation that defined their origins.

This article explores the key implications of the GENIUS Act for existing and emerging players in the stablecoin space.

Winners: Centralized Giants and TradFi Entrants

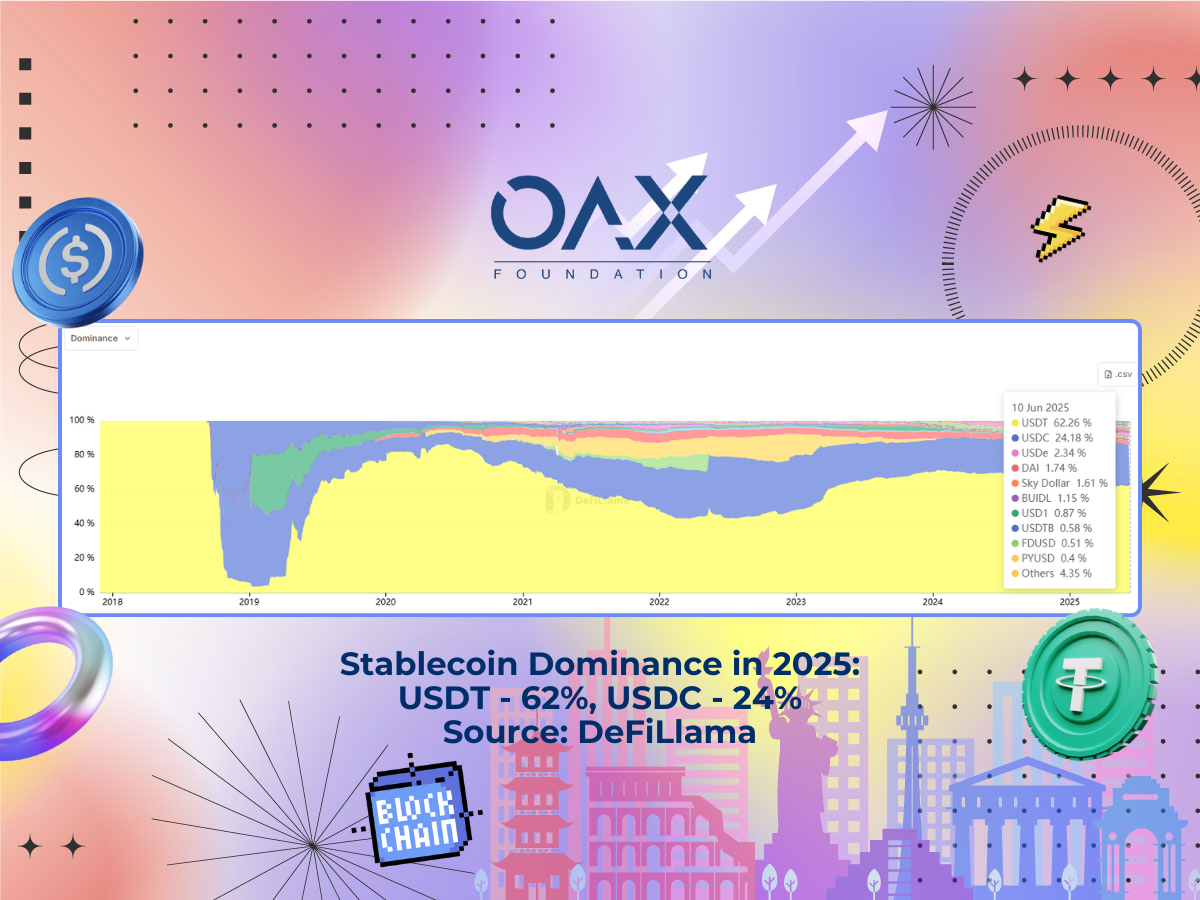

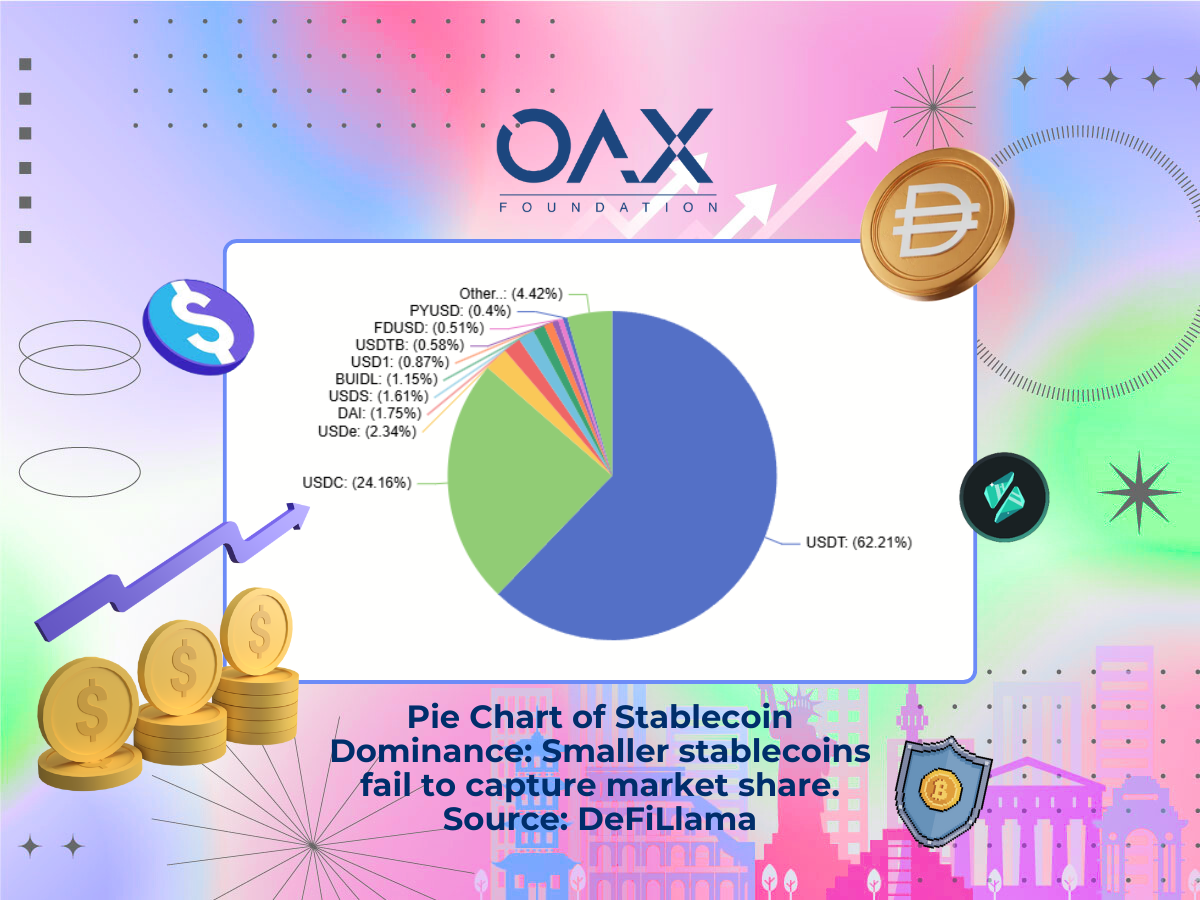

In the stablecoin ecosystem’s new regulatory era, centralized players like Circle’s USDC and Tether’s USDT are the clear frontrunners.

USDC, issued by Circle, is the teacher’s pet of the crypto world, with its one-to-one dollar backing, monthly attestations from third-party auditors, and compliance with U.S. regulations, including the ability to freeze funds for legal purposes. Its $38.9 billion market cap grew by 12% this year, solidifying its reputation as the go-to stablecoin for institutions. USDC is the reliable sedan of the crypto world. It’s not flashy, but it gets the job done, earning the trust of businesses and banks alike.

Tether, issued by Tether Limited, remains the wild card. With a $133 billion market cap commanding nearly 70% of the stablecoin market, it has faced criticism for less transparent reserve reporting compared to USDC, though recent attestations have improved clarity. Its ability to freeze funds underscores its centralized control.

Yet, like an old ship that just refuses to sink, Tether’s liquidity dominance and global reach ensure it remains an essential part of the system, whether regulators like it or not.

The GENIUS Act has also opened the door for traditional finance to enter the arena. U.S. banking giants, including JPMorgan and Citi, are reportedly working on a consortium stablecoin to compete with Tether and USDC. This move highlights a pivotal shift, stablecoins are no longer just a crypto experiment.

They’re becoming the bridge that connects blockchain technology with the global financial system. Even emerging players like USD1, backed by World Liberty Financial, are seizing the moment. USD1’s meteoric rise to a $2.17 billion market cap, fueled by a $2 billion investment from Abu Dhabi’s MGX Fund, showcases how quickly new entrants can gain traction.

However, its ties to the Trump family raise questions among the community about practices and favoritism under the GENIUS Act.

Losers: Decentralized and Niche Players

As centralized giants consolidate their dominance, decentralized stablecoins are finding themselves on the sidelines. MakerDAO’s DAI, a DeFi favorite, is decentralized in its governance and issuance, operating via smart contracts and a decentralized autonomous organization (DAO).

However, its reliance on USDC, which recently accounts for approximately 20-30% of its collateral, has sparked criticism for introducing centralization risks. This dependence has led some to question how fully decentralized DAI remains, though its governance model and diverse collateral, including Ethereum and real-world assets, still distinguish it from USDC and USDT.

MakerDAO has been actively working to reduce USDC reliance, incorporating more decentralized collateral as well as real-world assets such as tokenized securities, signaling a commitment to bolstering DAI’s decentralized credentials.

Other decentralized stablecoins, like LUSD and RAI, adhere strictly to decentralized principles, using only non-centralized collateral like Ethereum. This ‘purer’ approach earns them favor among DeFi purists, but their low liquidity and limited adoption confine them to niche markets. In contrast, DAI occupies a middle ground, blending decentralized governance with some centralized collateral, which enhances its scalability but dilutes its ideological purity.

In contrast, DAI occupies a middle ground, blending decentralized governance with some centralized collateral, which enhances its scalability but dilutes its ideological purity.

Algorithmic stablecoins, meanwhile, are still struggling to recover from the catastrophic collapse of Terra’s UST in 2022. That $40 billion implosion left a permanent scar on the sector. Even newer models like FRAX, which blend algorithmic mechanisms with partial reserves, face an uphill battle to regain public trust.

Ethical and Political Concerns

The rise of USD1 highlights the growing intersection of stablecoins and politics. While its rapid growth is impressive, its ties to politically connected figures, namely the Trump family, have sparked doubts. Transparency issues further complicate the picture, as USD1 has yet to match the detailed reserve disclosures of competitors like USDC. Critics argue that this kind of favoritism risks undermining the credibility of the GENIUS Act itself.

Beyond politics, the broader risks of centralization loom large. Both Tether and USDC have frozen user funds in the past, raising concerns about censorship. While such measures are often justified as necessary for compliance, they clash with the crypto ethos of self-sovereignty.

Market Consolidation: Growth vs. Innovation

The stablecoin market is heading toward consolidation, with analysts predicting it will eventually revolve around five to ten major issuers. This is great news for stability but bad news for diversity. The market’s early days were a chaotic free-for-all, akin to the wild west. Now, it’s beginning to look more like an oligopoly, with a few dominant players controlling the narrative.

While regulatory clarity from the GENIUS Act has helped secure mainstream adoption, it has also made the barrier to entry insurmountable for smaller players.

Decentralized stablecoins, once the lifeblood of DeFi, now risk becoming niche products used only by crypto purists. The Act has effectively drawn a line in the sand: big players thrive, while smaller, decentralized innovators are left to fend for themselves.

Conclusion:

Institutions and governments welcome the stability, the crypto community grapples with the partial erosion of decentralization. Hybrid models like DAI, balancing decentralized governance with centralized collateral, may offer a path forward, though their success hinges on navigating regulatory constraints without compromising their decentralized ethos.

The GENIUS Act has brought stablecoins closer to the financial mainstream, but the cost may be a market tilted toward centralized giants like USDC and USDT. From the OAX Foundation’s perspective, while it’s positive to see progress in stablecoin regulation, it seems increasingly tailored toward those large enough to navigate the policies, there is caution in this expanding ecosystem.

As of June 2025, over 200 stablecoins exist, from fiat-backed giants like USDT and USDC to hybrid models like DAI and niche players like LUSD and RAI. The community must evaluate

Disclaimer: The above is an opinion piece written by an authorized author, but in no way represents the official standpoint of OAX Foundation Limited, nor should it be meant to serve as investment advice.