June 2025 Community Updates

Market Overview

June 2025 has been a whirlwind for the crypto and Web3 markets, riding a wave of regulatory tailwinds and market resilience. The passage of the Genius Act in the U.S. has catalyzed a surge in digital asset innovation, with Circle’s IPO debut marking a milestone for stablecoin legitimacy and Coinbase’s stock rally signaling robust investor confidence in crypto equities. Despite geopolitical tensions, including the ongoing Israel-Iran conflict and U.S. involvement, the crypto market has shrugged off macro uncertainties, closing the month near all-time highs.

With murmurs of the Federal Reserve potentially lowering interest rates as early as Q3 2025, risk-on assets like tech stocks and cryptocurrencies could see renewed capital inflows. The market’s resilience signals a maturing ecosystem, the institutional shift is signaling a new wave of development.

Hong Kong: A Web3 Powerhouse in the Making

Hong Kong is doubling down on its ambition to become a global Web3 hub. Following the U.S. Genius Act, the Hong Kong government has fast-tracked regulatory clarity for digital assets, greenlighting stablecoin issuance and rolling out Policy 2.0 this week. This framework aims to foster blockchain adoption across institutions and startups, with clear guidelines for custody, trading, and tokenized assets. Hong Kong’s proactive stance, predicting a surge in enterprise-grade blockchain integrations by Q4 2025. Expect to see projects bridging TradFi and DeFi, with Hong Kong at the forefront of this convergence.

Ecosystem Support: Fueling Web3 Innovation

Hong Kong’s Cyberport, a leading tech incubator, has launched a $500K Web3 fund to accelerate blockchain startups, aligning with the city’s vision as a Web3 epicenter. The response has been overwhelming, with applications flooding in for limited spots.

This initiative is a catalyst for real-world use cases, from supply chain tokenization to decentralized identity solutions. Our team is actively engaging with Cyberport to support these efforts, and we’ll keep you posted on standout projects driving the ecosystem forward.

Community Engagement: Your Voice Matters

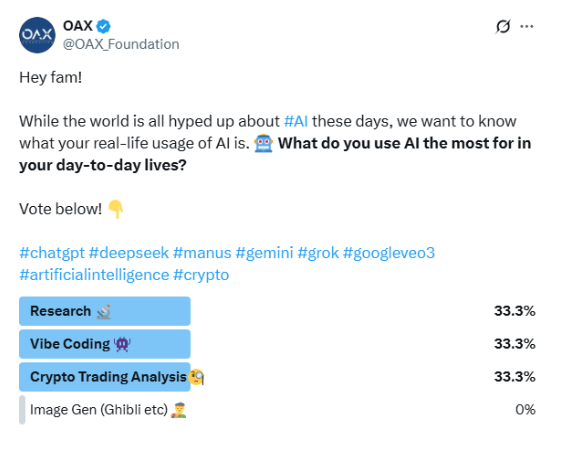

Thank you for participating in our recent community poll! The results are in, and while results were quite even, there was significant interest in AI integration in Web3, reflecting the community’s excitement for AI-driven tools like smart contract auditing, predictive analytics for DeFi, and vibe-based coding platforms.

Our in-house research team is diving deep into these trends, and we’re committed to delivering content that aligns with your interests. Expect upcoming deep dives into how AI is reshaping Web3, from Chainlink’s CCIP enabling cross-chain AI workflows to Decentralized AI marketplaces like SingularityNET gaining momentum.

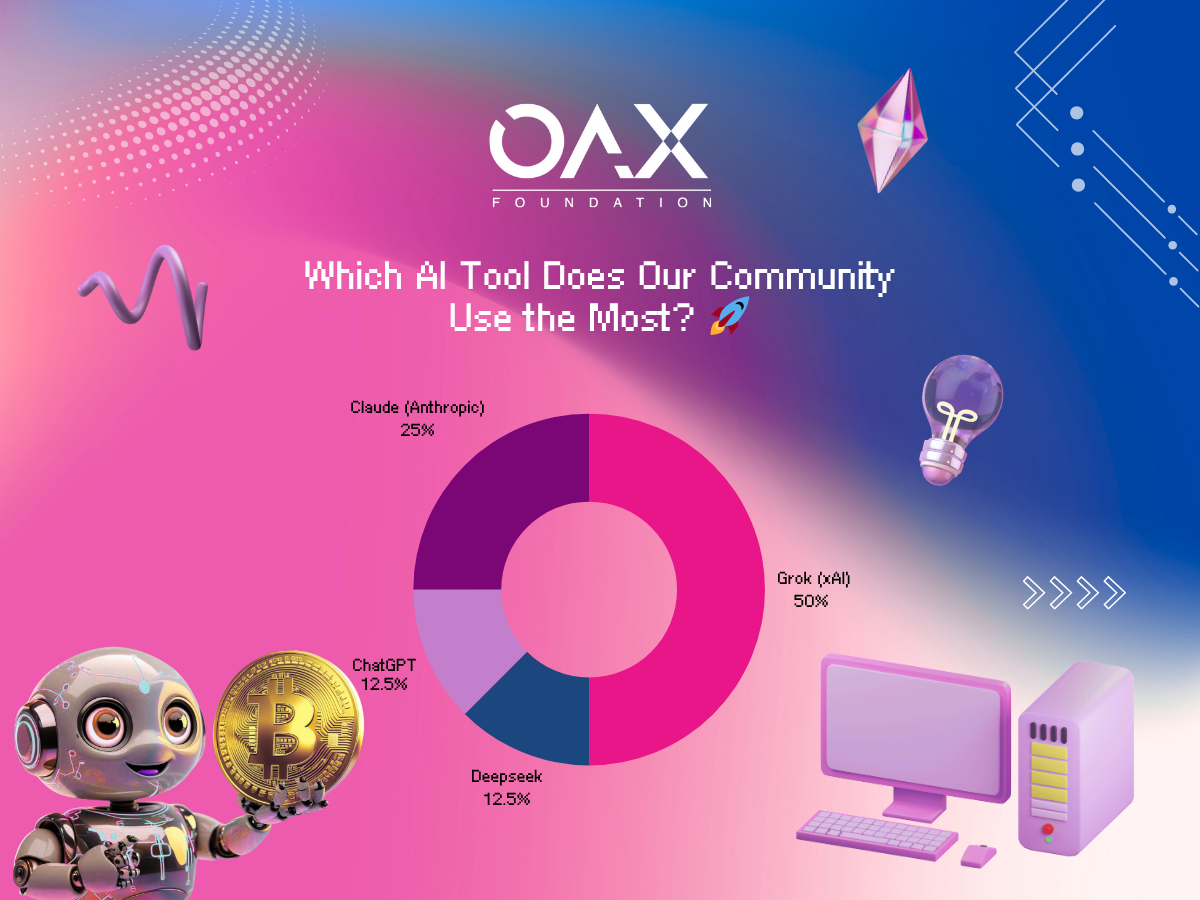

We also launched a poll on which AI tool our community uses the most in their day-to-day lives for productivity or work, and surprisingly, Grok AI leads the pack over tools like Deepseek and ChatGPT.

Foundation’s Initiative: Building the Future with AI

We’re thrilled to announce our latest initiative: a new AI-powered Web3 platform built using vibe coding principles. This platform aims to empower the Web3 community with an interface to facilitate collaboration. By leveraging AI, we’re exploring use cases like automated data and meaningful analysis. Our team is excited to share learnings from this journey, particularly around vibe coding’s potential to democratize Web3 development. Stay tuned for a sneak peek in the coming months.

What’s Next?

We’re excited to deliver AI-driven insights to elevate your projects, workflows, and investments, alongside deep dives into the growing convergence of TradFi and DeFi, with major players like BlackRock leading the charge in tokenized assets. Stay tuned for updates on our AI-powered Web3 platform and community showcases at global events, as we collectively shape the decentralized future.

Disclaimer: The above is an opinion piece written by an authorized author, but in no way represents the official standpoint of OAX Foundation Limited, nor should it be meant to serve as investment advice.