5 Key Narratives to Lookout for in 2024

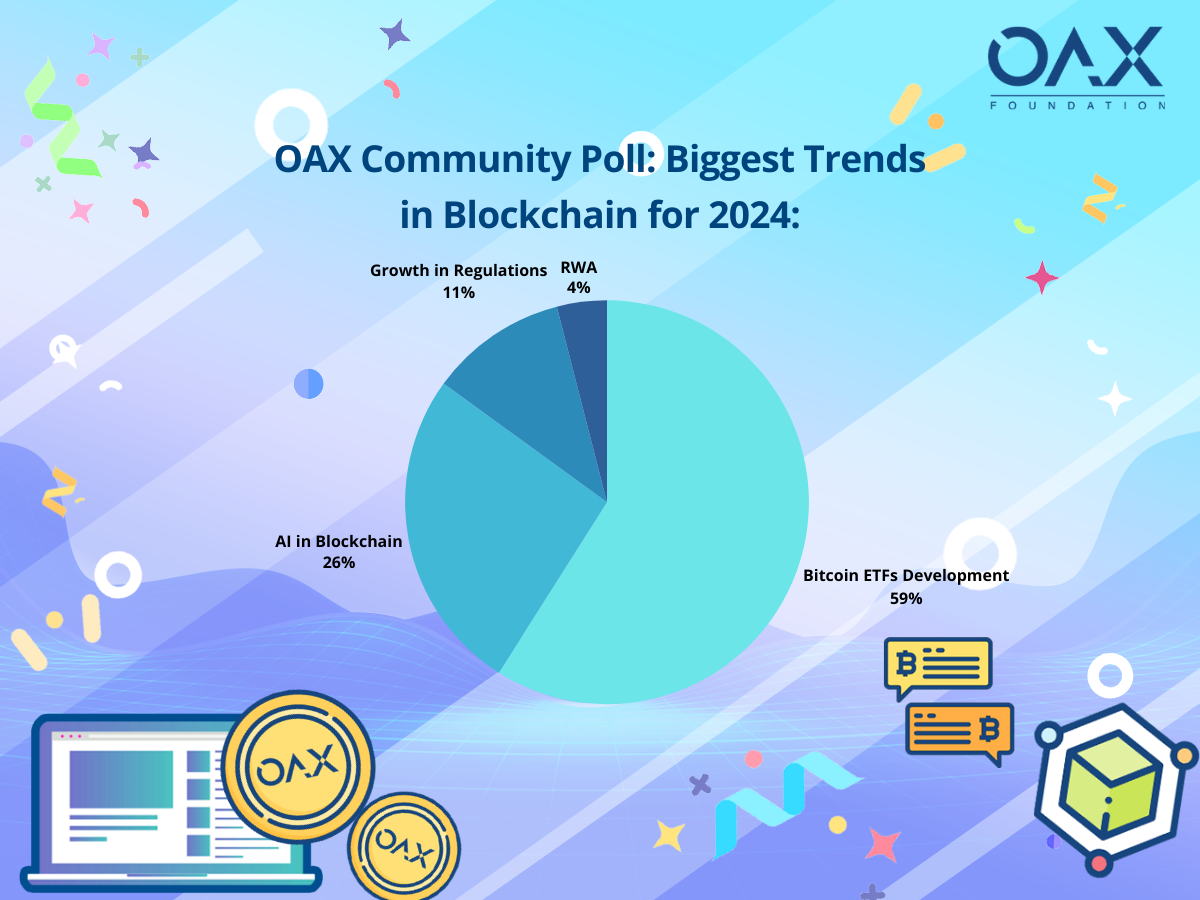

As we bid farewell to 2023 and welcome the dawn of a new year, the digital assets industry stands at an exciting crossroads. In our recent community update, we explored the pivotal events that propelled the industry forward last year, setting the stage for continued progress in 2024. Just last week, we’ve also hosted a poll with our community - getting them to weigh in on their thoughts on key trends to watch for the coming year.

Based on the results from our poll, it seems like our community is definitely the most excited about all the hype and progress surrounding Bitcoin ETFs, with AI’s implications on the blockchain industry coming in second. Thank you to everyone who participated in our poll!

Now, as we embark on this journey into 2024, we unveil the top five key narratives and events that have the potential to shape the digital assets industry moving forward. It is crucial to stay attuned to these developments, as they hold the power to influence the trajectory of this dynamic and rapidly evolving sector.

Imminent Spot ETF Approval

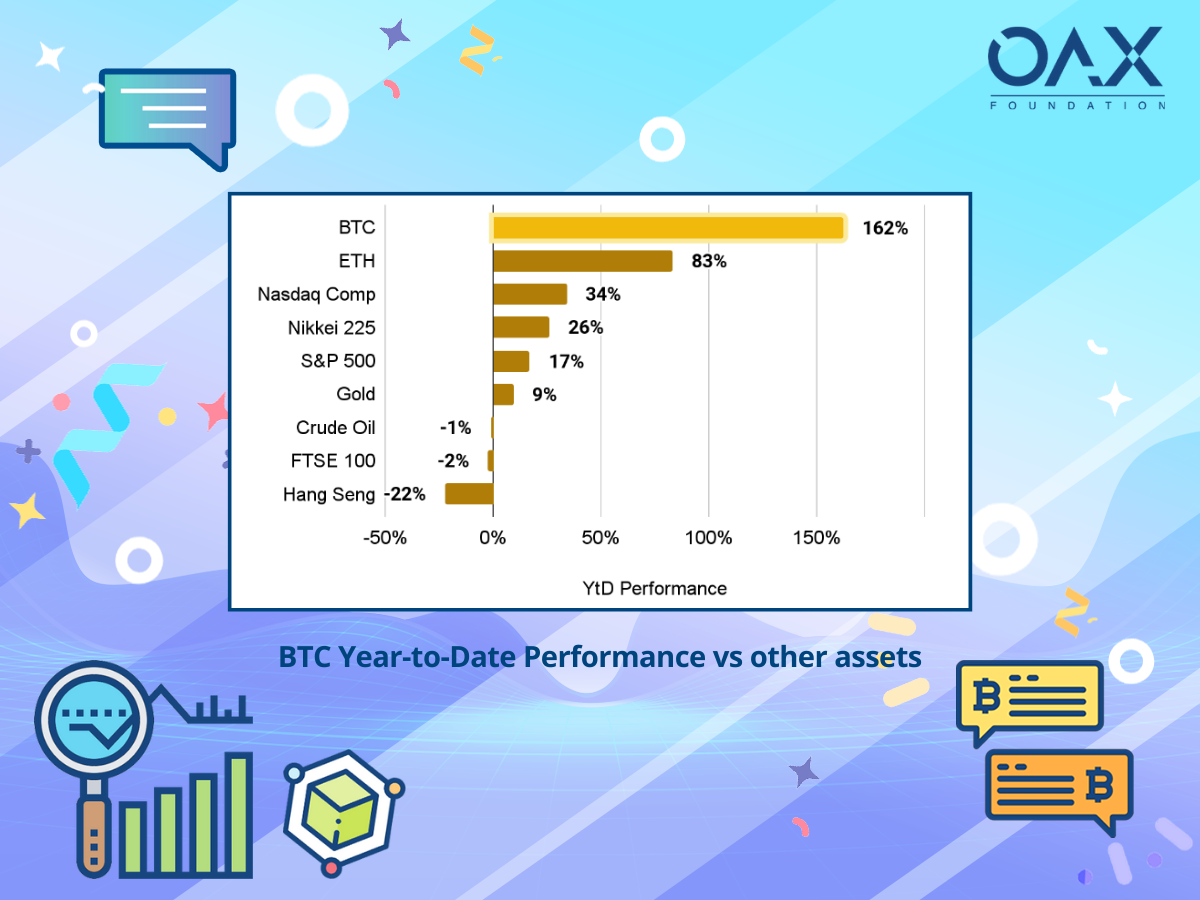

The optimism surrounding the potential approval of spot Bitcoin exchange-traded funds (ETFs) in the U.S. attracted traditional institutional investors to the cryptocurrency ecosystem. Bitcoin’s performance in 2023 has outperformed many other assets and indices, with a 162% increase in market capitalization year-to-year as of December. Looking ahead to 2024, one of the most important developments to watch is the approval of spot Bitcoin ETFs in the U.S. In August, a favorable ruling was made in favor of Grayscale regarding its dispute with the U.S. Securities and Exchange Commission (SEC) over the conversion of its Grayscale Bitcoin Trust (GBTC) into a spot Bitcoin ETF. Currently, there are 13 spot Bitcoin ETF applications under review by the SEC, with different final deadlines set between January and August 2024. This regulatory decision will have significant implications for the mainstream adoption and integration of Bitcoin into traditional finance. Approval would signal the increasing acceptance and integration of Bitcoin into both the crypto and traditional finance worlds. These developments have the potential to attract more institutional investors and bring further legitimacy to the cryptocurrency market. As such, OAX is working to include spot ETF tracking in the Notifs app in the near future to support this major milestone and the growing user demand.

The Bitcoin Halving

Bitcoin miners are motivated to validate transactions and secure the blockchain through block rewards and transaction fees. Block rewards, which are paid out for each newly mined block, have traditionally been the primary source of miners’ income. The block rewards are halved approximately every four years, introducing scarcity and increasing Bitcoin’s price over time. This reinforces the perception of Bitcoin as “digital gold” or a safe-haven asset. The initial block reward in 2009 was 50 BTC per block, and after subsequent halvings in 2012, 2016, and 2020, the current reward is 6.25 BTC per block. The next halving is anticipated to occur in April 2024, reducing the block reward to 3.125 BTC per block. The halving of block rewards is significant because it has implications for Bitcoin’s supply and market dynamics. By reducing the rate at which new Bitcoins are created, the halving increases scarcity and potentially leads to an increase in Bitcoin’s price. This scarcity narrative, coupled with the decreasing block rewards, reinforces the long-term value proposition of Bitcoin as a digital asset. The halving events are closely watched by the cryptocurrency community and can have a significant impact on market sentiment and investment behavior.

Layer 1s: Cornerstone of Decentralized Ecosystem

While Ethereum remained the dominant L1 solution, alternative L1s such as Solana showed promise and even outperformed Ethereum in some aspects. Solana’s market capitalization increased significantly, and Toncoin made progress through its partnership with Telegram.

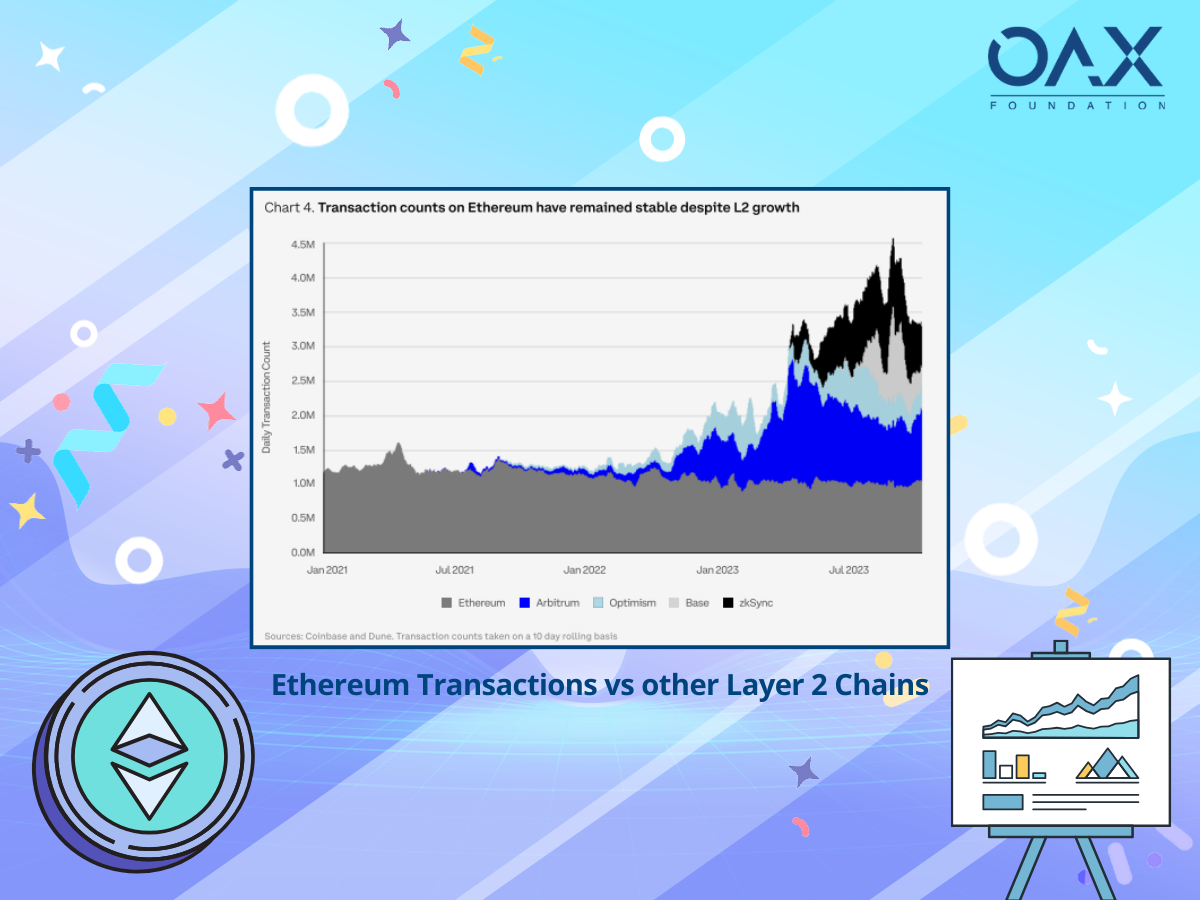

Ethereum introduced staked ETH withdrawals and witnessed the growth of DeFi markets, while BNB Chain launched an optimistic L2 solution and a data storage platform. However, despite the growth in other L2s, transaction counts on Ethereum have remained quite stable, averaging at 1M each day. In comparison, aggregated activity among other L2s like Arbitrum, Base, zkSync and Optimism are averaging at more than 2M transactions each day. Closely monitoring the developments in the alternative L1 landscape in 2024 will determine Ethereum’s continued dominance.

NFTs Making a Comeback?

In 2023, non-fungible token (NFT) trading volumes experienced a significant decline, hitting new lows monthly until October when a notable reversal occurred, leading to a substantial increase in November. Surprisingly, Bitcoin NFTs emerged as the most popular type, surpassing Ethereum in trading volume with over $375 million. This is noteworthy because Bitcoin was previously considered unsuitable for NFTs beyond peer-to-peer transactions. The surge in November’s trading volumes indicates a positive market sentiment and a revival of the NFT scene following a period of low prices and pessimism.

Looking ahead to 2024, there is anticipation for a different wave of NFT products that will focus on producing affordable assets in large quantities, targeting a broader consumer market and prioritizing direct value creation. Major brands and companies are entering the NFT space, conducting experiments with mass-market NFTs as digital collectibles. NFTs are also being explored for applications such as event tickets and fan engagement. The accessibility of digital assets, both in terms of technology and price, is expected to expand the potential market and provide a foundation for brands to build upon. NFTs offer the opportunity for companies and creators to benefit from decentralized value creation by fostering a sense of community among customers, incentivizing ownership and engagement.

AI Continues to Thrive

With AI and the popularity of ChatGPT topping Wikipedia and Google Searches all throughout 2023, there’s definitely no mistaking both the potential and importance of AI towards the blockchain ecosystem. Companies such as multimedia entertainment company Square Enix have also announced an organizational structure modification to aggressively tap into AI, Web3 and other cutting edge technologies in 2024. The convergence of AI and the metaverse is also explored, with a focus on the role of graphics processing units (GPUs) in both AI development and rendering rich virtual spaces. AI will evolve to enable creators to build expansive virtual worlds simply through the power of description, eliminating the need for complex 3D modeling and animation skills.

The team at Notifs also recognizes the growing demand for AI and its practical applications in blockchain and monitoring technology. Last year, Notifs developers created an AI News feature for Notifs App which generates AI news based on tokens users are tracking and learning their preferences along the way.

Full Steam Ahead

With the emergence of new market players and an escalating frenzy surrounding digital assets, it becomes increasingly crucial to keep a vigilant eye on key indicators and stay ahead of significant narratives. The OAX Foundation is committed to supporting the development and advancement of the digital asset industry. The events and trends highlighted in this article demonstrate the growing acceptance and integration of Bitcoin into both the crypto-native and traditional finance sectors. We believe in the potential of digital assets to revolutionize the financial landscape and provide new opportunities for investors.

The Notifs app, one of OAX’s projects, continues to empower retail users and enable them to stay informed about the latest developments in the digital asset space.Users can track important updates, market trends, and potential investment opportunities in real-time. We are dedicated to providing retail investors with user-friendly tools to navigate the dynamic world of digital assets and potentially the monitoring of spot Bitcoin ETF developments.

Stay informed, stay proactive, and embark on this journey of exploration and discovery with us.

Disclaimer: The above is an opinion piece written by an authorized author, but in no way represents the official standpoint of OAX Foundation Limited, nor should it be meant to serve as investment advice.