Spot Bitcoin ETFs Part 1: A Game-Changer Approved for Retail Investors

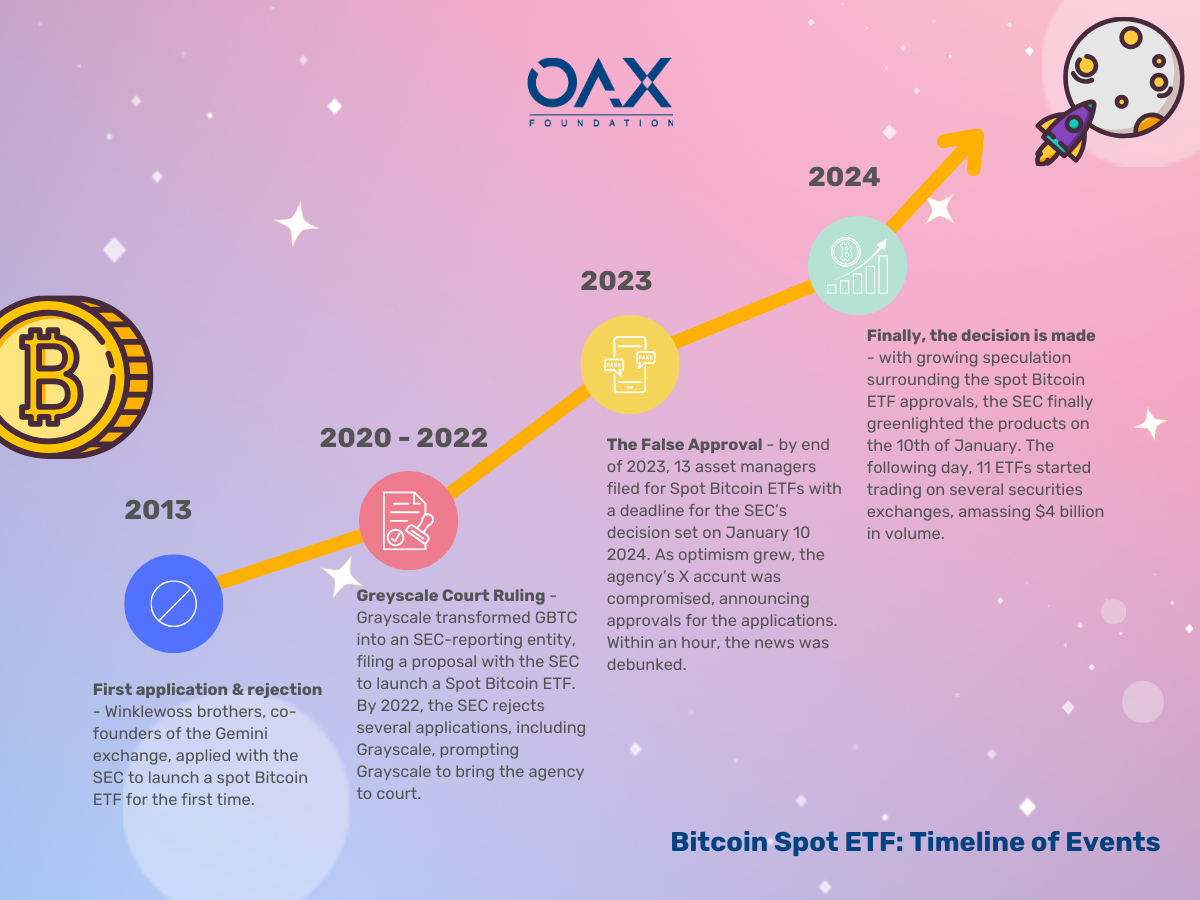

The Securities and Exchange Commission (SEC) recently granted approval to spot Bitcoin exchange-traded funds (ETFs) in the United States, marking a significant milestone for the cryptocurrency market. On January 10, 2024, a total of 11 spot Bitcoin ETFs from prominent providers such as Bitwise, Grayscale, BlackRock, and VanEck received the green light. Trading for these approved ETFs officially commenced on January 11, 2024. However, the approval process was not without its share of chaos and confusion. The SEC’s social media account on X was compromised on January 9, 2024, leading to false announcements of ETF approval and a temporary surge in Bitcoin’s price. The SEC later clarified that the account had been compromised and no ETFs had been approved at that time. The following day, the Chicago Board Options Exchange prematurely announced the start of ETF trading. Despite these hiccups, the spot Bitcoin ETFs were indeed approved.

Before we dive in further, here’s a small recap and timeline of key events in recent years, leading up to the approval:

So, what exactly is a spot Bitcoin ETF? Unlike futures-based ETFs that derive their value from contracts speculating on future Bitcoin prices, a spot Bitcoin ETF holds actual Bitcoin. It directly tracks the price of Bitcoin and allows investors to trade shares of the ETF on a stock exchange. This provides investors with exposure to Bitcoin’s price movements without the need to own the cryptocurrency directly.

The approval of Bitcoin ETFs has far-reaching implications for retail investors. It offers increased accessibility and credibility, making it easier for a wider range of investors, including retail investors and institutional fund managers, to add Bitcoin to their portfolios. This development is expected to attract more capital into the market and facilitate diversification in investment strategies.

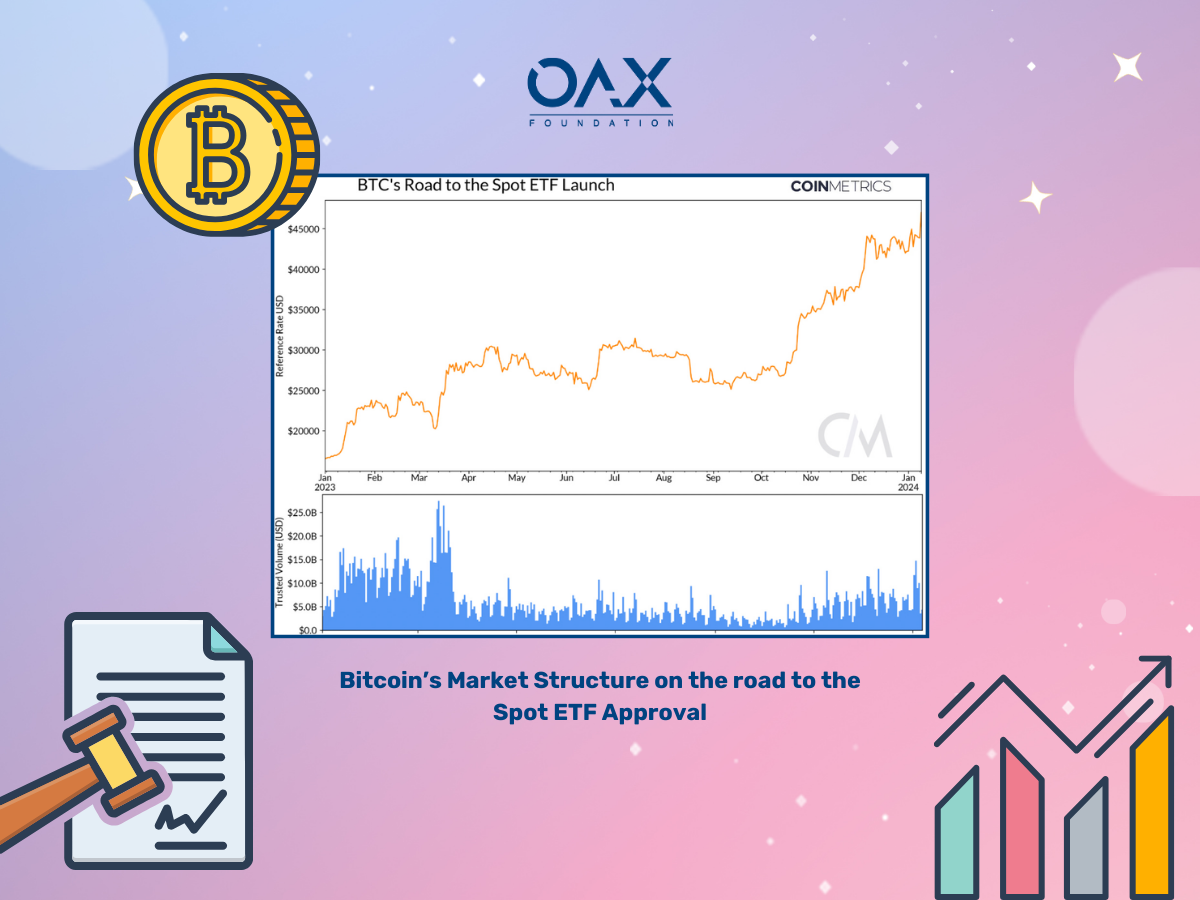

Bitcoin token pricing and trading volume up to the ETF approval - Bitcoin’s certainly had quite the journey.

Bitcoin token pricing and trading volume up to the ETF approval - Bitcoin’s certainly had quite the journey.

Investing in a Bitcoin ETF provides several advantages for retail investors. Firstly, it offers accessibility and convenience, as ETFs can be bought and sold on traditional stock exchanges and through existing brokerage accounts. This eliminates the need for investors to directly purchase and store Bitcoin. Secondly, it mitigates risks associated with owning Bitcoin directly, as ETFs are subject to additional oversight and regulation. Lastly, Bitcoin ETFs allow for portfolio diversification, enabling investors to spread their risk across different asset classes while still benefiting from potential Bitcoin returns. To access spot Bitcoin ETFs, investors can utilize various channels, including traditional stock exchange platforms like Cboe, NASDAQ, and NYSE, as well as investment apps like Robinhood. However, it is crucial for investors to conduct thorough research, understand the associated risks, and consider their investment goals before venturing into spot Bitcoin ETFs or any investment vehicle.

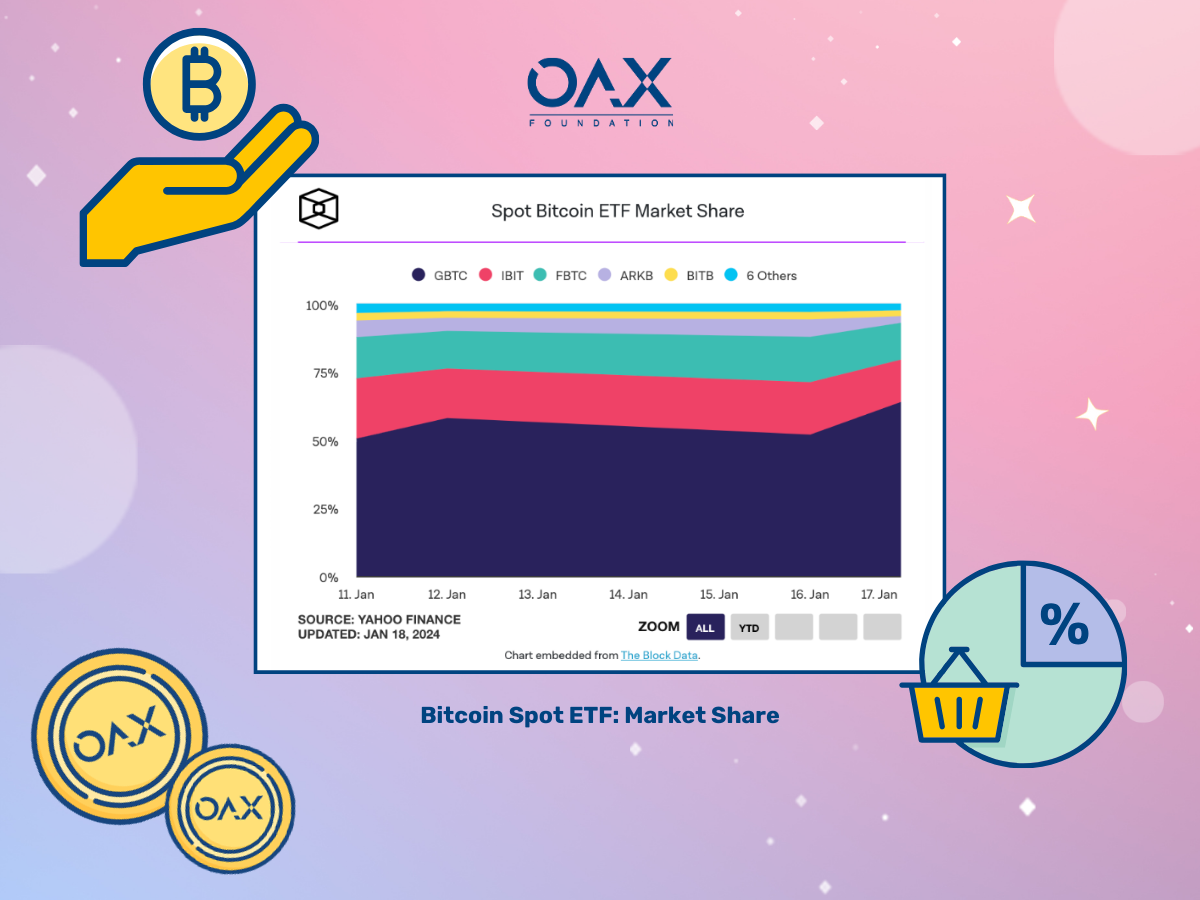

Spot bitcoin ETFs have seen significant trading volumes in their first three days on the market, reaching a total of approximately 10 billion. Grayscale Investments’ Bitcoin Trust ETF (GBTC) recorded the highest trading volumes among others. BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Wise Origin Bitcoin Fund (FBTC) also saw substantial trading volumes. However, despite the high trading volumes, GBTC experienced net outflows of $579 million last week. Industry experts expect trading volumes to increase further as spot bitcoin ETFs become more mainstream.

In conclusion, the approval of spot Bitcoin ETFs is a monumental development for retail investors, marking a significant progress forward not only in the crypto industry but also in the global investment landscape. As the market embraces this new investment vehicle, retail investors must carefully evaluate the opportunities and risks associated with spot Bitcoin ETFs to make informed investment decisions. The OAX Foundation recognizes the immense implications of this ETF approval and is committed to providing valuable insights to keep you informed on the latest developments and what you need to know. As part of our dedication, we will be presenting a three-part series that delves into the implications of the spot ETF, ensuring you have a comprehensive understanding of this game-changing development. Stay tuned for the upcoming parts of our series, where we will continue to provide you with valuable insights and analysis.

Disclaimer: The above is an opinion piece written by an authorized author, but in no way represents the official standpoint of OAX Foundation Limited, nor should it be meant to serve as investment advice.