DeFi Trends for Q4 2021

The broad definition of DeFi allows so many different facets to be labelled under its umbrella. As we enter the final quarter of 2021, we summarize three key trends that have been picking up over the last few months.

However, while these trends are picking up within the digital asset market, their value may lie in the new audiences that are being introduced to digital assets rather than the trend itself. For digital assets to become mainstream, a wide audience base must go through their own “journey” to familiarize themselves with the task, rather than just the ‘techies’ in this space.

So what are the trends and who are the new communities that are engaging with digital assets as a result?

1. NFTs

There is no doubt the buzz that NFT has created over the last year. As even mainstream media who were slowly introducing “what is crypto” are now introducing “what are NFTs”, while the transition to NFTs has opened the door to artists, auction houses, luxury brands, consumer brands, sports aficionados and more.

From the likes of Coca-Cola and their “Friendship Box” to Christie’s “Everydays: The first 5000 days” to NBA’s Top Shot highlights, brands have been reaching out to their audiences with a wide variety of relevant content and through that, incentivizing their followers to understand more about digital assets and potentially dabble in its space.

While it’s unlikely that some of those eye-watering bids for NFTs are coming from new players in the market, the uptick in interest and exposure through more accessible items can be seen as a “gateway” into the space.

2. GameFi

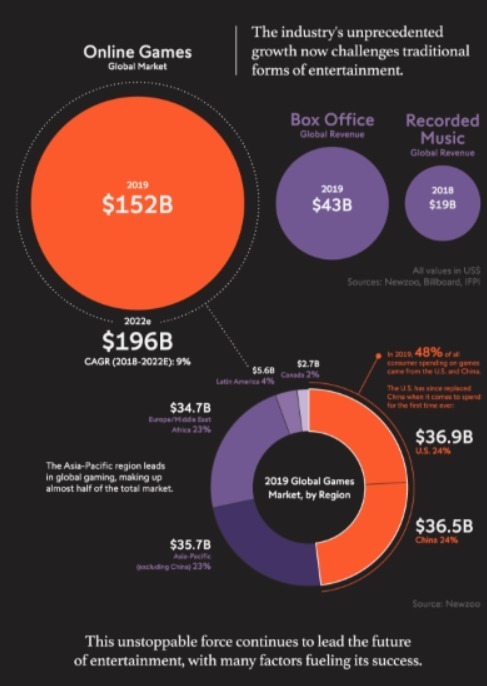

In 2019, the gaming industry was worth $152 billion, with it expected to hit $196 billion by next year. Gaming and technology have long gone hand-in-hand and it is of no surprise that the digital asset industry is looking to capitalize on an easily linked audience.

Source: Visual Capitalist

The appeal of gaming on DeFi brings a host of possibilities of earning or mining tokens based on gameplay. Now gaming companies can explore ways to create their own tokens and monetize it, whether through the platform itself but also through tournaments and other real life use.

3. KYC Platforms

As we grapple on the debate of how digital assets should be regulated and how to bring the space to eventually become the primary form of institutional finance, one thing that remains clear from the regulators in charge is the necessity of compliance and KYC/AML services to help detect fraudulent activity or market manipulation.

Earlier this year, our partners at Solidus Labs, one of the leaders in the digital asset risk surveillance space, announced a $20M investment from their latest VC funding round. More recently, the likes of Mastercard also announced their purchase of CipherTrace , a blockchain intelligence firm to boost their crypto security and compliance capabilities.

As more headlines like these herald the cooperation of major institutions, and these platforms become increasingly popular, regulators may warm to the idea of allowing digital assets to reach into more traditional finance spaces that would allow users to have more touchpoints and open access to institutional investors.

Three key trends, multiple potential new audiences and joiners to the digital asset space. What DeFi trends do you think will be the most influential in the market and will have the largest effect in shaping the future of digital assets? Join us in our social communities, we want to hear from you!