Back to the Future: Blockchain in 2021

Last year’s global pandemic, extensive lockdowns, and resulting market volatility – one of the biggest recessions on record followed by one of the fastest recoveries – were unprecedented, with the result that no one can be sure of what to expect in the new year.

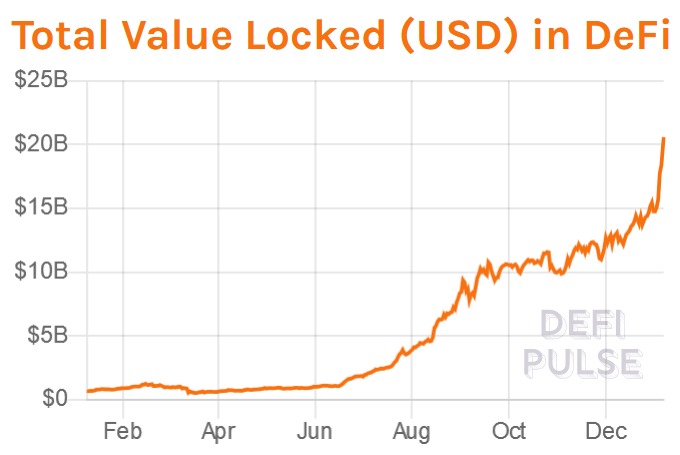

That said, in the technology world some trends are clear: with millions under lockdown in their homes, the value of resilient internet-based access was reemphasised. And for cryptoassets, token price volatility driven by global markets disruption and the uncertainty generated by concerns about pump-and-dump scams answered long-standing questions about whether cryptocurrencies are a safe-haven asset – and they are not. But we concluded that the volatility failed to dent the long-term potential of DeFi and other blockchain-based platforms.

These events did reveal which current iterations of blockchain-based services have potential to deliver practical benefits in a relatively short time. Essentially, the pandemic acted in a Darwinian fashion, intensifying progress for stronger propositions that were under development and causing less-promising projects to be shelved. Even during the pandemic, projects supported by institutions, banks and regulators continued to move toward fruition.

Forrester research indicates that projects requiring research and development (R&D) investment are now less likely to be funded, but those that have a pragmatic, useful application are receiving even more support and continue to progress. On this basis, 30% of current projects will reach production – and China is set to progress most rapidly, drawing on favourable government policies and investment.

Virtual Banking

The explosion of virtual banking start-ups in Asia and approvals illustrates the pandemic’s Darwinian effect. These all-digital banks are more agile and efficient than the large incumbent operators, but offer competitive deposit-taking, lending, money transfers and other retail and wholesale services. They leverage the advantages of the internet: a lean, decentralised system without the costly infrastructure of traditional banking, from branch real estate to antiquated legacy IT systems.

With three virtual banks opening in Hong Kong during 2020, and the Monetary Authority of Singapore (MAS) awarding four new licenses for establishments to proceed in 2021, the changes demonstrate an expected shift in consumer comfort. As mainstream banking begins to shift to virtual banking, the acceptance of the general public to explore alternative methods of traditional finance may further open their willingness to understand and eventually move into digital assets as well.

Institutional Developments

In the blockchain space, a similar trend has emerged through 2020’s disruptions. While DeFi filled the news in 2020, the spotlight hasn’t dimmed for larger businesses which are now more in favour of focusing on private – or permissioned – blockchains. The distributed ledger technology is the same, but applications with the security and robustness to appeal to professional and institutional users will advance in scale and liquidity more quickly.

This intensified focus on institutional-level services lies behind recent news of two decentralized trading platforms with mainstream institutional backing. Singapore’s DBS Bank announced that it will launch a digital venue that has in-principle approval from the Monetary Authority of Singapore (MAS). The exchange will host trading in Bitcoin, Ether, XRP and Bitcoin Cash against major fiat currencies as well as facilitating security token offerings (STOs).

Around the same time, Hong Kong’s Securities and Futures Commission (SFC) granted a licence to digital asset trading platform OSL. The platform will be regulated to banking standards and audited by a ‘Big 4’ global consultancy and offers client asset protection in segregated wallets. OSL hosts trading in Bitcoin, Ethereum, and others established cryptocurrencies, and likewise is expected to enable STOs: an attractive value proposition for sophisticated and professional investors accustomed to high regulatory standards and protections.

Regulation also reared its head with the U.S. Treasury’s December proposal to introduce new know-your-customer (KYC) rules for users moving funds from centralized crypto exchanges to their decentralized wallets – a measure to deter money-laundering and other illicit transfers. Users would need to provide personal details before making larger transfers, while exchanges may have to keep records of users’ activities. Currently subject to market consultation, this traditional market-style oversight would bring further comfort to institutional investors looking to access cryptocurrencies as an asset class.

A Blockchain Future

In light of this increasing institutionalisation of cryptoassets and the corresponding demand for enhanced security, it’s useful to recall that blockchain was created to be fundamentally secure by nature. This strength is one of the key features of DeFi’s value proposition, which signals that a potentially fruitful opportunity is opening up for the industry: how to integrate the security of blockchain into larger-scale applications while continuing to make it user-friendly and functional for institutional users.

We still expect plenty of updates and advancements in the DeFi space with protocols like Uniswap offering non-institutional traders quick and easy token-swapping using smart contracts instead of a centralised order book. Smart contracts will also be harnessed to aggregate liquidity through automated market-making, while finetuning problem areas such as liquidity can be expected. Decentralised stablecoins like DAI continue to enable holders to collateralise their assets securely, pegged against the US dollar.

Source: DefiPulse.com

Source: DefiPulse.com

Thanks to the evolutionary stresses imposed by Covid-19, the immediate 2021 outlook may well favour projects that bring blockchain-based financial services to a professional client base. But the potential scale and liquidity this sector represents could provide the step-change long acknowledged as necessary to propel cryptoassets into the mainstream – and this is where DeFi’s long-term prospects are bright. By providing secure and easy-to-use services, DeFi stands to benefit from mainstream cryptoasset adoption.