Revisiting Key Moments in 2020

Covid-19 sent 2020 down the rabbit hole, altering our day-to-day lives, changing the pace and working habits of all of us around the world. But time stops for no one, and 2020 has seen some amazing work done in the digital asset space.

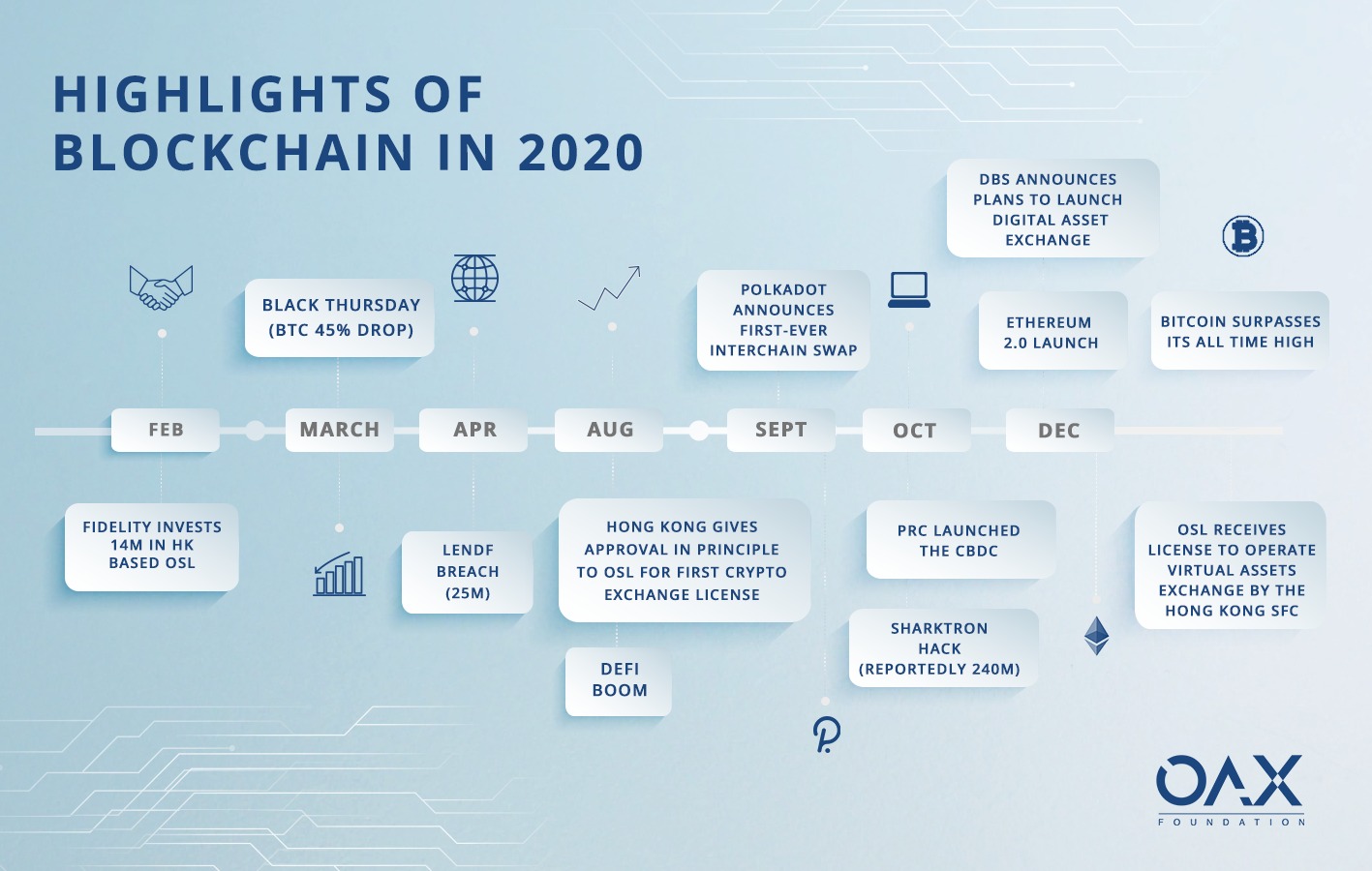

Our team likes to gather at the end of every year and take the time to reflect on some of the milestones that marked the last 12 months– for the industry, our partners and the space we work in. Which were the headlines that stuck out to us? For better or worse, we know that each will be critical in shaping the future of our industry.

We began and ended 2020 with strong indicators from the traditional finance industry of their willingness to step into the digital asset space. With a strong start in February, we recall Fidelity International’s investment of $14 million in Hong Kong’s OSL. The very same OSL that was also granted the first Hong Kong SFC-licensed, listed and insured digital asset trading platform last week. That wasn’t all the news we got this month, with DBS’ launch of their own digital exchange in conjunction with Singapore Exchange.

With promising news such as that, you’d be forgiven for getting a rosy picture if you just looked at the very beginning and end of the year. However, we all know that 2020 was far from ideal. Covid-19 fears became very real in March, affecting traditional financial markets as well as crypto liquidity in what we will know as “Black Thursday of 2020”. Many of us revisited the debate of whether crypto markets were truly a safer alternative. But likewise, we all began to take a closer look to see how DeFi might be able to play a bigger role in protecting the markets in future crisis scenarios. At the end of 2019 we expected the DeFi conversation to take off, and while we were distracted for a little while, it soon came to be.

DeFi dominated the news and conversations in the second half of the year: good and bad. While the Black Thursday caused us to step on the accelerator with ambitions on how we could develop the space, we were also reminded of how new the technology was. And with new technology came the loopholes, and real-life testing of where the weaknesses existed. Such weaknesses were discovered in examples such as the Lendf Breach where $25 million was drained from a smart contract exploit. Yet DeFi truly began surging in August demonstrating that the space was far from reaching its full potential.

2020 was always going to be a highlight year for big industry milestones: from Bitcoin Halving to the Ethereum 2.0 at the end of the year. While these were anticipated milestones that will definitely make it into the history books, likewise we expect the progress taken by nations alike to step foot into the digital currency market to change the path of digital assets. Who’s been leading the charge? Check out our timeline highlights!

What headlines come to your mind when you think back in 2020? What else would you have put on the list?

It’s been quite the eventful 2020 and we’re so excited for 2021! We’ll find out what’s ahead for us in the new year, but in the meantime, we wish you and your families a safe, happy and healthy New Year!

Timeline: Feb: Fidelity Invests 14M in HK Based OSL Mar: Black Thursday (BTC 45% Drop) Apr: Lendf Breach (25M) May: Bitcoin Halving Aug: DeFi Boom Aug: HK gives approval in principle to OSL for first crypto exchange license Sep: Polkadot Announces First-Ever Interchain Swap Oct: PRC Launched the CBDC Oct: SharkTron Hack (Reportedly 240M) Dec: Ethereum 2.0 Launch Dec: Genesis Block Acquires OMG Network Dec: DBS to Launch Digital Exchange Dec: OSL Receives Virtual Asset Exchange License