2025 in Review: A Pivotal Year for Blockchain and AI Convergence

As we close out 2025, it’s clear that the themes we’ve explored throughout the year,driven by relentless innovation in macroeconomics, blockchain, and artificial intelligence,have shaped the narrative and propelled the industry forward. From regulatory breakthroughs to institutional adoption and technological leaps, 2025 marked a turning point where crypto matured amid volatility, and AI emerged as an unstoppable accelerator.

Here’s a flashback to the top developments that defined the year, and how they position OAX Foundation for a transformative 2026.

The Top 5 Blockchain Trends of 2025

1. A Supportive Policy Shift Under the Trump Administration

The year saw President Trump’s executive orders strengthening U.S. leadership in digital financial technology, including the establishment of a Strategic Bitcoin Reserve using seized assets. Landmark legislation like the GENIUS Act provided a clear regulatory framework for stablecoins, positioning them as a trusted gateway to blockchain while providing alternatives to traditional banks.

2. Bitcoin’s New All-Time Highs and Institutional Momentum

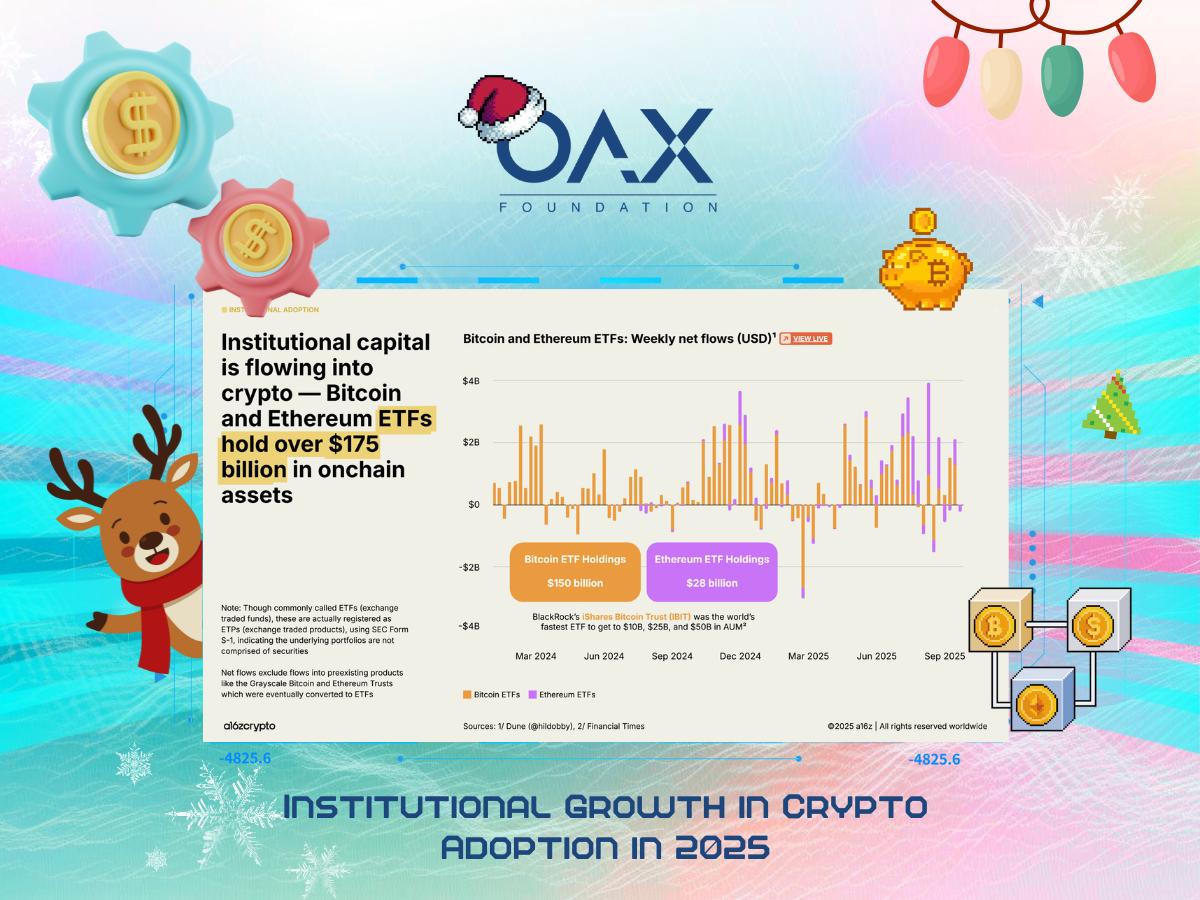

A pro-innovation stance fostered institutional confidence, paving the way for broader adoption. Bitcoin surged to new highs, peaking at $126,200 in October, driven by massive institutional inflows via ETFs and corporate treasuries. This milestone underscored crypto’s growing role as a macro asset, driving mainstream adoption even as markets navigated volatility.

3. The Rise of Digital Asset Treasury Companies (DATCOs)

Companies like Strategy (formerly MicroStrategy) led a wave of public firms allocating treasuries to Bitcoin and other digital assets, with significant holdings across the sector. While innovative, questions remain about long-term sustainability amid market swings and potential systemic risks,yet this trend highlighted crypto’s appeal as a strategic reserve asset, with many followers emulating the pioneers.

4. Stablecoins as the On-Ramp to Blockchain

Bolstered by the GENIUS Act, stablecoins exploded in utility, serving as a bridge for everyday users and institutions. With broader retail appeal, they offered efficient, borderless alternatives, pressuring traditional banking and solidifying their role in onboarding the next wave of blockchain participants.

5. Volatility and Resilience: The Largest Liquidation Event in History

Despite the bull run, October’s massive liquidation cascade,triggered by geopolitical tensions and wiping out over $19 billion in positions,tested the market’s maturity. Yet, amid the chaos, traditional banks quietly advanced their blockchain infrastructure, building rails for the future without fanfare. Institutions continued progressing on blockchain integration even as headlines focused on highs and crashes,development is not correlated with the market.

These developments unfolded against a backdrop of quiet, persistent progress: institutions and banks advancing blockchain integration regardless of short-term price action.

The Parallel Global AI Revolution

Coupled with blockchain’s evolution was AI’s explosive growth, creating tensions and opportunities that could reshape the world order. Nearly every company embraced some form of AI narrative,but the real question is the tangible value generated by AI.

Over the past year, we’ve covered breakthroughs in AI agents, advanced Retrieval-Augmented Generation (RAG) techniques, and multimodal capabilities. “Vibe coding”,describing ideas in natural language and letting AI generate code,democratized development, while scattered concepts coalesced into practical tools. Innovation is brewing, and we’ve extended our efforts to make sense of these for our community.

Experiments proliferated at breakneck speed, pushing boundaries in reasoning, autonomy, and real-world application. For us, the excitement lies in AI’s application to practical use cases. We’re seeing continued investments in foundation models by the Magnificent 7 and tech giants like Alibaba, which is deeply integrating AI into its e-commerce ecosystem,from personalized recommendations to agentic automation.

We’re most excited about the application layer: identifying industry pain points that AI can solve, automating repetitive tasks with agents, and empowering domain experts to spot opportunities in their processes. We’re already seeing waves in legal, accounting, and e-commerce, where Alibaba is leveraging AI for seamless shopping, logistics, and buyer-seller matching.

On OAX Foundation’s end, we ourselves have ventured into the AI space via our support of GMAsia, a new platform that seeks to be a connection point and resource for all Web3 and AI enthusiasts. For now, you can discover useful Web3 and AI events on GMAsia, which could help with your own deep dive of the space.

We don’t need another foundation model; we need a deeper understanding of what each excels at, specialized RAG models, agentic workflows, and targeted automation.

Tying It All Together: AI as the Catalyst for Blockchain’s Next Leap

This convergence is what OAX Foundation is most excited about. Imagine AI-powered shopping evolving into seamless AI trading. Vast data availability in blockchain without interpretation means missing out on valuable insights. The inherent UI challenges of blockchain can be dramatically improved with generative AI and autonomous agents, solving onboarding issues and making complex protocols intuitive. Visionaries anticipate agent-to-agent interactions, where users may no longer directly interface with blockchain at all. We’re pleased to witness the significant development of both sectors over the past year, and continue to look out for use cases where they could potentially converge.

Disclaimer: The above is an opinion piece written by an authorized author, but in no way represents the official standpoint of OAX Foundation Limited, nor should it be meant to serve as investment advice.