Bitcoin Series: Macro Forces Driving Bitcoin’s Surge and Future Outlook

Following our deep dive into the technology behind Bitcoin last month, this second installment examines the macroeconomic catalysts propelling Bitcoin’s astounding 2025 performance. Having reached an all-time high of $124,000 in August 2025, this surge is driven by powerful macro trends including corporate and national treasuries, lenient global policies, soaring mining costs and more. In this article, we aim to explore key factors that amplify demand and reinforce Bitcoin’s ascent as a global store of value, shedding light on how this trend may unfold.

Corporate Treasuries Embracing Bitcoin

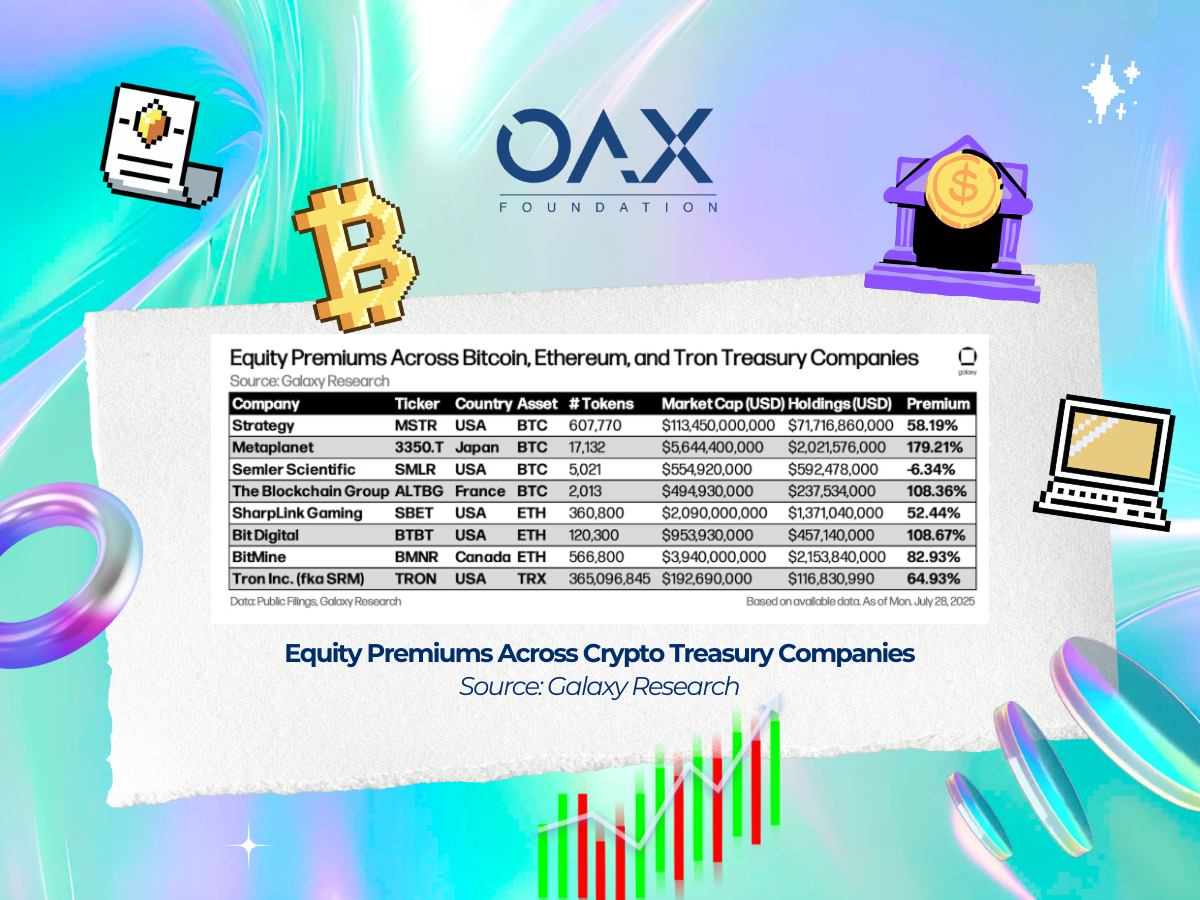

Public companies have increasingly adopted Bitcoin as a treasury asset, viewing it as a hedge against inflation and fiat currency devaluation. Leading the charge is MicroStrategy, now Strategy, holding 576,230 BTC ($60 billion, average purchase price $66,384), or 2.75% of Bitcoin’s total supply, with its stock soaring 440% in 2024.

Japan’s Metaplanet, with 20,136 BTC ($2.2 billion, average price $90,194), saw its stock surge 1,923% in 2024, using zero-interest bonds and covered call options to fund purchases. Other players include Mara Holdings (20,000 BTC), Semler Scientific (4,449 BTC), GameStop (4,710 BTC), and Twenty One Capital, targeting 210,000 BTC by 2028 via share swaps with Tether and Bitfinex.

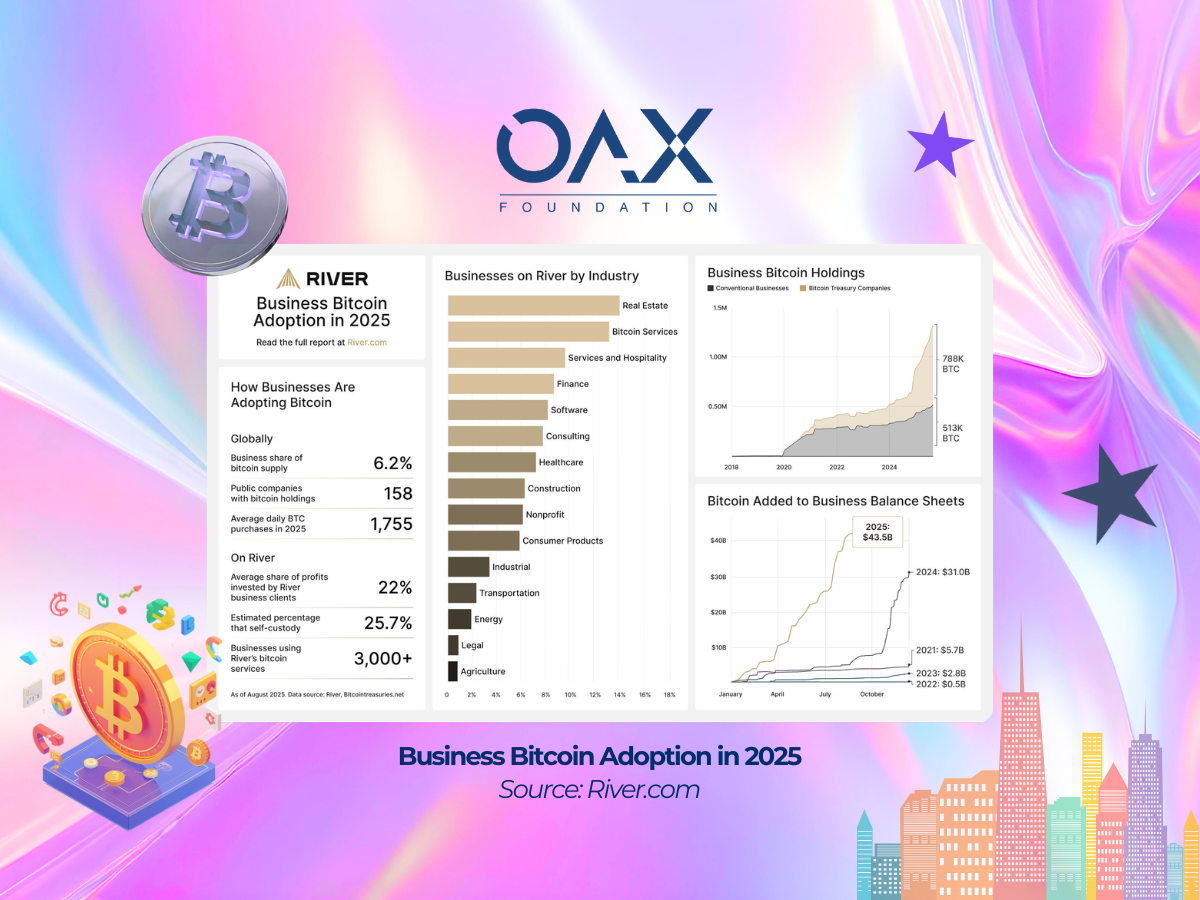

Globally, 145 public companies hold 855,000 BTC, absorbing 159,107 BTC in Q2 2025 alone. Corporate adoption reduces circulating supply, driving scarcity and price appreciation. By treating Bitcoin as a strategic reserve, companies signal its legitimacy, attracting institutional and retail investors, further fueling demand and cementing Bitcoin’s role in corporate finance.

National Treasuries and Strategic Reserves

Sovereign adoption has emerged as a significant driver, with nations recognizing Bitcoin’s potential as a reserve asset. The U.S. Strategic Bitcoin Reserve, established via President Trump’s March 2025 executive order, holds 200,000 BTC ($24 billion) from forfeitures, legitimizing Bitcoin on a national stage.

El Salvador, a pioneer since 2021, holds 6,102 BTC ($550 million), adding one BTC daily. Bhutan (12,000–13,000 BTC), the Czech Republic (exploring 5% of its $146 billion reserves), Japan (pension fund diversification), and Brazil (RESBit initiative) are also testing Bitcoin reserves.

Sovereign accumulation locks up significant BTC, reducing available supply and creating upward price pressure. As nations diversify away from fiat, Bitcoin’s status as a decentralized store of value strengthens, driving global adoption and reinforcing its growth trajectory.

Lenient Global Policy Environment

A crypto-friendly regulatory landscape has accelerated Bitcoin’s institutional adoption. The U.S. SEC’s 2024 approval of spot Bitcoin ETFs, alongside Project Crypto, has lowered barriers for institutional investors.

The EU’s MiCA framework provides regulatory clarity, encouraging corporate participation. Japan’s Financial Services Agency plans to classify digital assets as financial products by 2026, with proposed tax cuts on crypto gains from 55% to 20%.

The Trump administration’s push to make the U.S. the “crypto capital of the world,” including the Strategic Bitcoin Reserve and relaxed custody rules, has further boosted confidence.

Regulatory clarity reduces risk for institutions, driving capital inflows and mainstreaming Bitcoin as a portfolio asset. This fosters broader adoption, stabilizes markets, and supports sustained price growth by attracting risk-averse investors.

Spot Bitcoin ETFs: Retail and Institutional Access

Spot Bitcoin ETFs have been a cornerstone of 2025’s rally, providing regulated exposure for retail and institutional investors. Managing $219 billion in assets by September 2025, with BlackRock’s iShares Bitcoin Trust (IBIT) at $80 billion, ETFs absorbed 51,500 BTC in December 2024, nearly three times the 13,850 BTC mined that month.

Retail investors, contributing 80% of ETF demand, and institutions like Millennium Management have driven $54.75 billion in inflows since January 2024. ETFs democratize Bitcoin access, deepening liquidity and reducing volatility by 75%. Their ability to absorb supply far exceeding new issuance creates a structural demand driver, pushing prices higher and normalizing Bitcoin in traditional portfolios.

Soaring Mining Costs

Bitcoin mining costs have reached all-time highs in 2025, driven by rising energy prices and the April 2024 halving, which reduced block rewards to 3.125 BTC. The Cambridge Bitcoin Electricity Consumption Index estimates annual consumption at 1174 TWh, with 67% from fossil fuels, elevating operational costs and Bitcoin’s price floor. Daily mining output of 450 BTC struggles to meet institutional demand.

High mining costs and reduced block rewards amplify Bitcoin’s scarcity, supporting price increases. As miners face higher breakeven costs, new BTC enters the market at elevated prices, reinforcing Bitcoin’s value as demand outpaces supply.

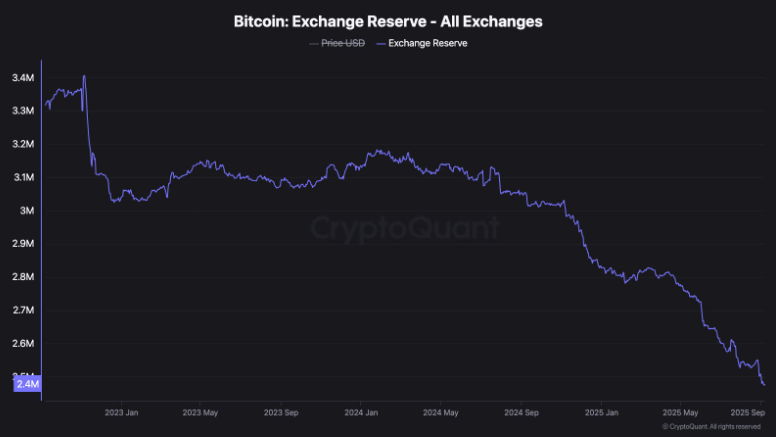

Supply Shock on Exchanges

Exchange reserves have plummeted as long-term holders move BTC to cold storage and institutions absorb supply. On-chain data from Glassnode and CryptoQuant shows declining exchange-held BTC, with institutions acquiring 159,107 BTC in Q2 2025 against 41,400 BTC mined. Daily trading volume has surged 103% to $38.35 billion, amplifying price sensitivity to demand spikes.

Shrinking exchange reserves create a supply shock, making Bitcoin more sensitive to buying pressure. As institutional and retail demand outstrips available supply, even modest inflows can trigger significant price surges, sustaining Bitcoin’s upward momentum.

Closing: Growing Adoption and the Scarcity Imperative

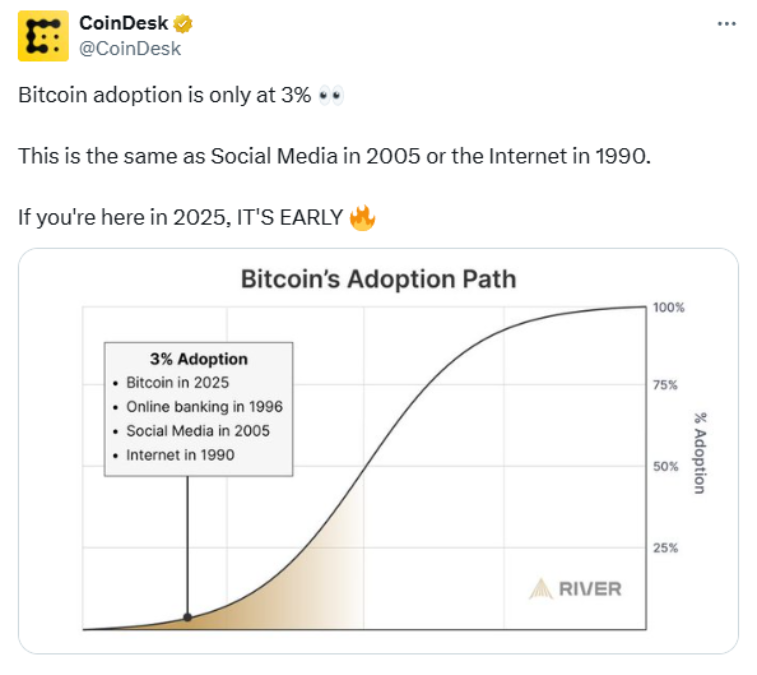

Factors that are driving Bitcoin’s 2025 surge include corporate and sovereign treasuries, lenient policies, ETFs, high mining costs, and exchange supply shocks, explains its explosive adoption rate as a global store of value up to this point.

With only 21 million BTC in existence, less than 1 BTC per 400 people globally, these inflows highlight Bitcoin’s scarcity. At the current pace, where ETFs and corporations absorb supply far exceeding the 450 BTC mined daily, the available float could shrink dramatically.

However, OG whales, holding 5–10% of supply, occasionally cash out after significant gains, as seen in 2025’s $124,000 peak, tempering price spikes but not derailing the bullish trend. Institutional demand, led by ETFs and DATs, dominates over retail, which remains strong via ETF accessibility.

So, what’s next? The OAX Foundation sees Bitcoin’s scarcity and rising adoption as creating a positive feedback loop, driving a bullish trend for the leading cryptocurrency. However, sustaining this growth depends on continued regulatory support and macroeconomic tailwinds that will influence capital inflows.

Disclaimer: The above is an opinion piece written by an authorized author, but in no way represents the official standpoint of OAX Foundation Limited, nor should it be meant to serve as investment advice.