Bitcoin: The Unstoppable Asset Class and What You Need to Know (Part 1)

Bitcoin has solidified its place as a powerhouse asset class, outpacing the S&P 500 year to date of about 50 percentage points. The past few months have seen Bitcoin dominate global headlines, smashing through all-time highs since Donald Trump’s re-election in November 2024.

This rally has been fueled by multiple tailwinds: a more crypto-friendly U.S. administration under Trump’s leadership, significant inflows into spot Bitcoin ETFs, and growing corporate treasury adoption by firms like Microstrategy and Metaplanet.

Yet, amidst the hype, it’s critical to revisit Bitcoin’s fundamentals, what it is, how it works, and why it matters. As Bitcoin Asia returns to Hong Kong for its second edition, featuring prominent figures like Eric Trump, Metaplanet’s CEO Simon Gerovich, Nakamoto’s David Bailey, and others, the OAX Foundation is diving back into Bitcoin’s core technology and ecosystem. This blog series will refresh your understanding, unpack the latest developments, and prime you for the exciting week ahead at Bitcoin Asia.

The Cracks in Traditional Systems Bitcoin Addresses

To understand Bitcoin, consider the systems it aims to improve. Physical cash is great for in-person deals but impractical remotely. Digital payments (banks, PayPal) bridge distances but rely on intermediaries, introducing trust requirements, fees, delays, potential censorship, and centralized failure points like data breaches (e.g., Equifax). Furthermore, government-issued (fiat) money can be devalued by inflation as central banks increase supply, challenging the idea of “sound money.” Bitcoin emerged to address these issues, envisioned as “a purely peer-to-peer version of electronic cash” bypassing financial institutions.

Defining Bitcoin in Plain English

So, what precisely is Bitcoin?

Bitcoin, the first cryptocurrency, enables global value transfer using just an internet connection, crucially without trusted middlemen. It’s a decentralized public payments infrastructure, uncontrolled by any single entity. Transactions are peer-to-peer and permissionless; anyone can participate. Introduced in 2008 by the pseudonymous Satoshi Nakamoto, Bitcoin went live in 2009.

Like early email, it’s not perfect but its decentralized function is a breakthrough. Its narrative has also evolved from P2P cash to “digital gold,” a store of value, due to its scarcity.

Is Bitcoin a flawless system? No. As Peter van Valkenburgh of Coin Center aptly noted, “neither was email when it was invented in 1972.” Bitcoin is not yet universally accepted for all purchases, its price can exhibit significant volatility, and it’s not always the standard unit for quoting prices.

However, the very fact that it operates effectively as a decentralized system for value transfer marks a significant computer science breakthrough. Its narrative has also evolved; while conceived as peer-to-peer cash, many now see its primary strength as a “digital gold” or a resilient store of value due to its inherent scarcity.

A Simplified Glimpse Under Bitcoin’s Hood

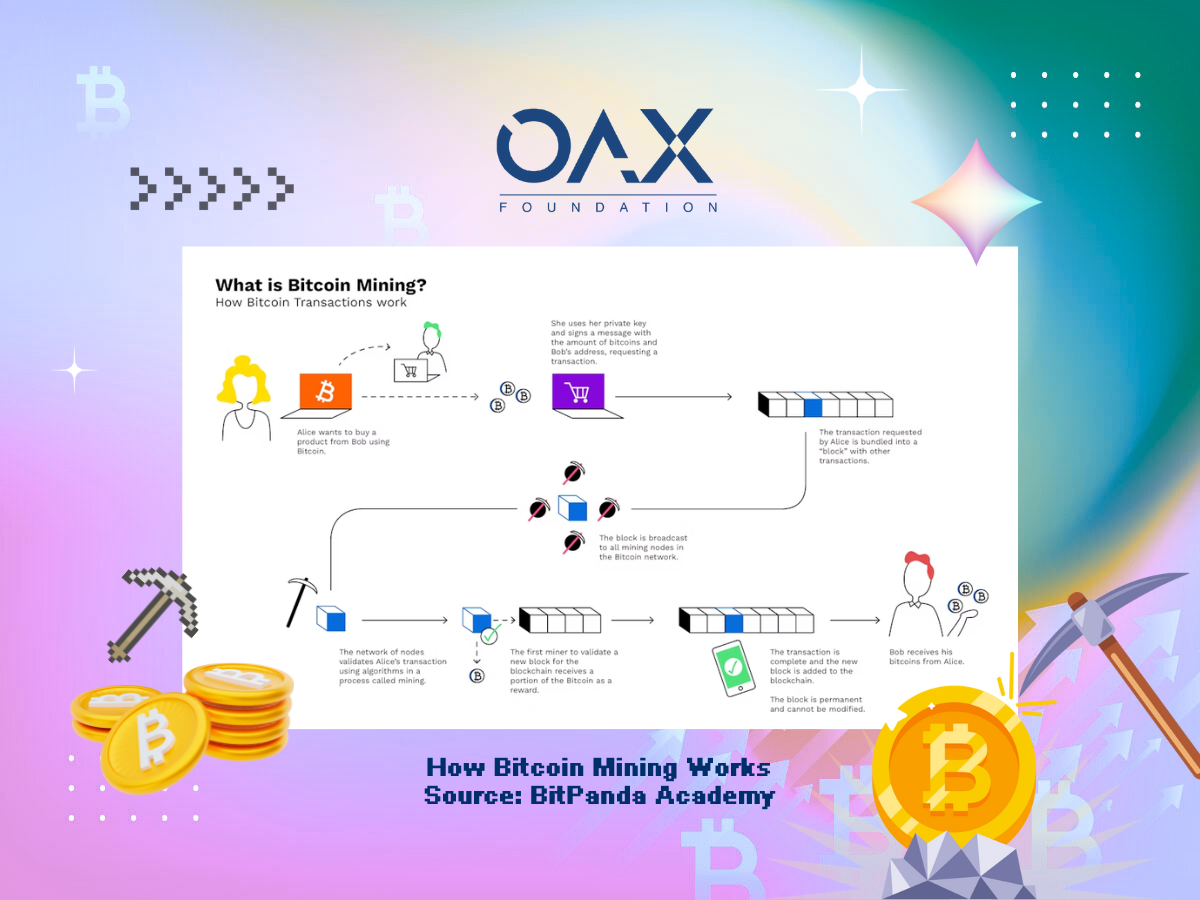

Bitcoin’s decentralized operation relies on the blockchain, mining, and cryptography.

The Blockchain – A Shared, Immutable Ledger:

Imagine a global, public, digital spreadsheet (ledger) duplicated across thousands of computers (“nodes”). Transactions are verified, bundled into “blocks,” and cryptographically linked into a “chain,” forming the blockchain. This makes the record transparent (pseudonymously) and virtually immutable; altering past transactions is computationally prohibitive.

Mining – Securing & Issuing Bitcoin:

“Miners” use powerful computers to solve complex math problems (“Proof-of-Work”) to validate transactions and add new blocks. For this, they earn new Bitcoin (how coins enter circulation) and transaction fees. This incentivizes network security. Block creation averages 10 minutes. When all 21 million Bitcoin are mined (around 2140), miners will be compensated solely by transaction fees, ensuring continued network operation.

Bitcoin Halving: Scarcity in Focus

Bitcoin ”halving” is when the reward for mining new Bitcoin blocks is cut in half, making it harder and slower to create new coins. It happens roughly every four years and is built into Bitcoin’s code to ensure its supply cap is reached gradually, mimicking gold’s scarcity. Supply squeeze often drives price increases over time, but it also raises mining costs. This scarcity has attracted national-level interest, with some officials noting a “space race” to accumulate Bitcoin.

Keys & Wallets - Your Bitcoin Access:

Users interact via “keys” and “wallets.” Private Key: A secret code; your access to and control of your Bitcoin. Lose it, and your Bitcoin is gone. Public Key & Bitcoin Address: Derived from the private key, your shareable address (like an email for Bitcoin) receives funds. The process is one-way, keeping the private key secret. Wallet: Software or hardware storing private keys, enabling transactions. It doesn’t hold coins, but the keys proving ownership on the blockchain.

Key Characteristics That Define Bitcoin

Programmed Scarcity (Digital Gold): Only 21 million Bitcoin will ever exist, a rule embedded in its code. This “hard asset” quality contrasts with inflatable fiat currencies and fuels the “digital gold” narrative.

Decentralization & Resilience: With no central point of failure, Bitcoin is highly resistant to censorship or shutdown.

Permissionless Innovation & Open Development: Anyone can build on Bitcoin. Its open-source development relies on community consensus for changes (BIPs), ensuring cautious evolution.

Comparison with other protocols i.e. ETH and SOL: Bitcoin shines as a scarce, secure store of value, ideal for long-term holding but limited in Web3 functionality. Ethereum drives smart contract innovation, while Solana’s speed and cost-effectiveness attract developers. Investors favoring stability lean toward BTC, while Web3 builders may prefer ETH or SOL for growth.

Getting Started & Crucial Considerations

Most acquire Bitcoin via cryptocurrency exchanges. However, leaving Bitcoin on an exchange means they control your private keys, reintroducing third-party risk (hacks, failures like FTX). The mantra “Not your keys, not your coins” highlights the importance of self-custody: moving Bitcoin to a personal wallet where you control the keys. Be aware of Bitcoin’s price volatility; never invest more than you can afford to lose. The user experience is still evolving.

It is vital to approach Bitcoin with an awareness of volatility. Its price can undergo substantial fluctuations, both upwards and downwards, often within very short timeframes. This is partly because, unlike traditional commodities, Bitcoin’s supply doesn’t elastically respond to shifts in demand; instead, price movements are necessary to incentivize existing holders to sell to newcomers.

Therefore, a prudent approach involves never investing more than you can comfortably afford to lose and thoroughly understanding the inherent risks. The learning curve and user experience for some Bitcoin applications are still evolving, which can also be a barrier to wider, everyday adoption for non-technical users.

Bitcoin and the Dawn of Web3

Bitcoin is more than an asset class, it’s the cornerstone of Web3, a decentralized internet where users reclaim control over their data and digital assets, breaking free from the platform-dominated Web2. As the native monetary layer for this new web, Bitcoin embodies the ethos of decentralized digital assets, redefining value in today’s financial markets.

At the OAX Foundation, our mission is to make this decentralized knowledge accessible to all, transcending age and educational barriers. By understanding Bitcoin, what it is, why it was created, and how its core technology functions you gain a foundation for navigating the broader digital asset ecosystem.

With Bitcoin Asia returning to Hong Kong, bringing together visionaries, the stage is set for deeper exploration on where we will go from here. In part 2 of this series, we’ll dive into Bitcoin’s broader implications for Web3 and the evolving digital economy, equipping you with insights to stay ahead in this transformative era.

Disclaimer: The above is an opinion piece written by an authorized author, but in no way represents the official standpoint of OAX Foundation Limited, nor should it be meant to serve as investment advice.