February 2024 Community Updates

Hi OAX community,

The digital asset space has seen a whirlwind of activity in the past month, with a special emphasis on Bitcoin spot ETFs. Since receiving approval from the SEC earlier this year, the industry has experienced significant inflow of capital. Notably, Blackrock has led the charge with an incredible surge in daily trading volume, reaching new highs of 1.3 billion at the time of writing. To delve deeper into the world of ETFs, we invite you to explore our recent in-depth analysis on this subject.

Furthermore, MicroStrategy continues to captivate attention with its latest acquisition of an additional 3,000 bitcoins, bringing their total holdings to $10.28 billion worth of Bitcoin. Meanwhile, the highly anticipated Bitcoin halving event looms on the horizon, acting as a catalyst that drives the narrative of industry development. To gain a comprehensive understanding of this phenomenon, we encourage you to explore the resources we have curated on the topic of halving.

We are also witnessing spill-over effects from the stock market. NVIDIA’s strong earning report has propelled excitement into the crypto AI market. The company’s revenue increase is attributed to accelerated computing and generative AI, leading to notable advancements in projects like Sleepless AI and Fetch.ai. Deutsche Telecom has even partnered with Fetch.ai to harness the power of enterprise AI. Bitget has reported a remarkable 361% increase in weekly trading volume for AI tokens. OpenAI’s Sora text-to-video model has garnered significant market attention, while iExecRLC, part of NVIDIA’s Inception Program, explores AI edge computing. Meanwhile, Y Combinator is funding startups focusing on stablecoin, metaverse, and AI solutions. These advancements highlight the growth and interest in the AI sector, driven by technological advancements and market enthusiasm.

Furthermore, the DeFi space has experienced a resurgence of momentum, spearheaded by a remarkable 50% surge in Uniswap following the introduction of a new proposal to reward users through innovative fee sharing mechanisms. This development has reignited interest and prompted capital rotation back into the sector. While the new proposal holds great potential to inspire other DeFi projects, it is important to acknowledge the potential regulatory challenges and risks that may arise along the way.

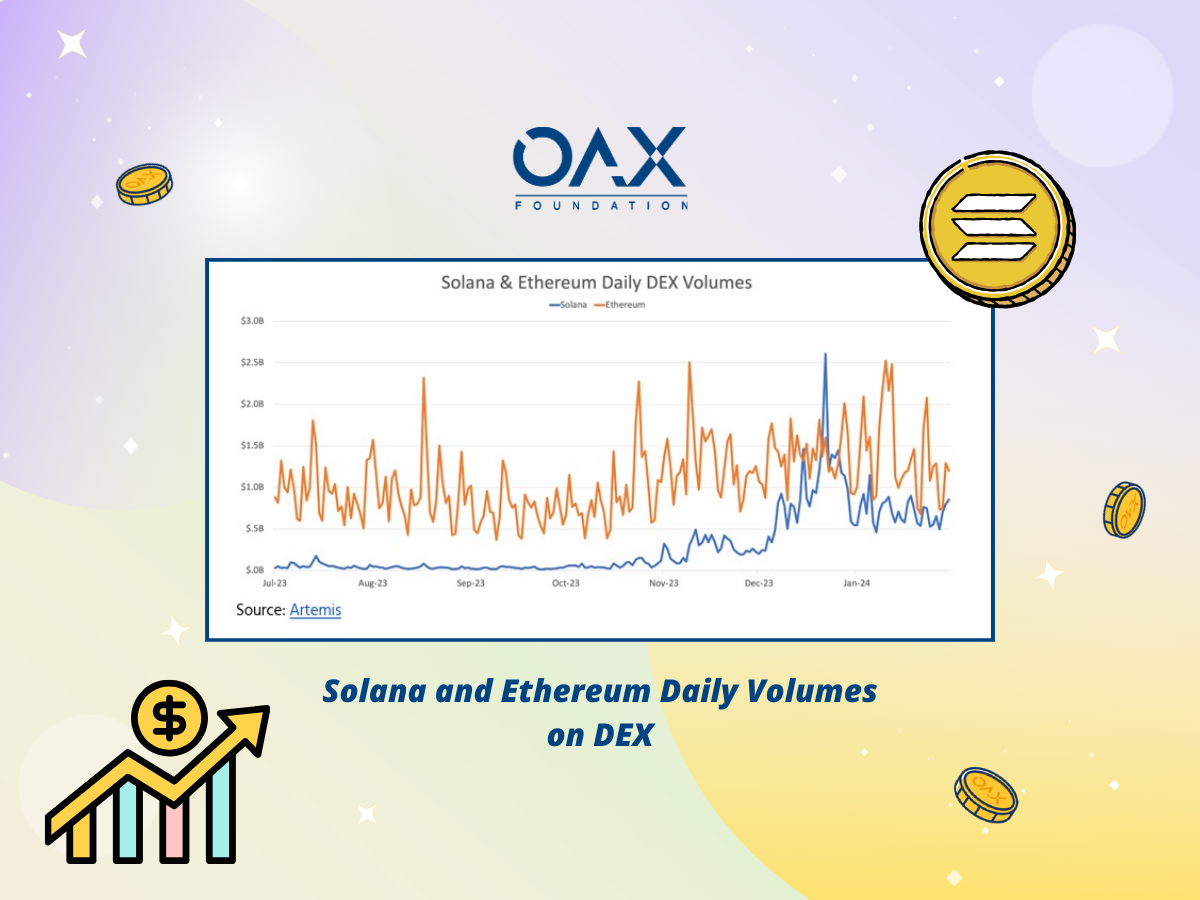

As covered in one of our recent market update tweets, Solana’s Jupiter has achieved a significant milestone in the world of DeFi, surpassing Uniswap on Ethereum, with a daily trading volume of $1.2 billion. The surge in trading activity has been attributed to the JUP token airdrop on Solana, which has resulted in over $500 million in volume generated in less than nine hours, with around 566 million JUP tokens claimed by nearly 392,000 unique wallet addresses. It will be crucial to continually monitor Jupiter’s performance as well as other Solana DeFi related projects to assess whether this milestone will continue to drive momentum for the broader Solana ecosystem.

As the OAX foundation, we are pleased to witness the latest developments in the digital asset space, spearheaded by the Bitcoin ETF and the upcoming halving. However, we would like to remind our community to exercise caution and invest wisely, considering the quick rotations in altcoins and sectors. While bullish sentiment prevails, it is crucial to approach investments with prudence.

Lastly, we’d like to thank everyone who joined, supported or shared our Lunar New Year Gleam campaign - response has been great and we can’t wait to bring more exciting activities to you! In the meantime, we’re sure you’re looking forward to the winner announcements. Please stay tuned and keep an eye out for it over the next few days across our official channels.

Disclaimer: The above is an opinion piece written by an authorized author, but in no way represents the official standpoint of OAX Foundation Limited, nor should it be meant to serve as investment advice.