Spot Bitcoin ETFs Part 2: More Highlights & Updates

The recent buzz around Bitcoin ETFs has continued with BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Wise Origin Bitcoin Fund (FBTC) have emerged as top-performing ETFs of 2024, based on inflows. In our previous part 1 of the ETF series, we delved into the positive aspects of how ETFs could drive adoption. However, it is equally important to explore the other side of the coin - the voices from the decentralized realm. What are their concerns, and what implications could the approval of Bitcoin ETFs have on the narrative surrounding digital assets. In this article, we aim to uncover the undercurrent for us to consider the broader backdrop against which these developments unfold.

A Bitcoin Spot ETF Will Never Be Your Bitcoin

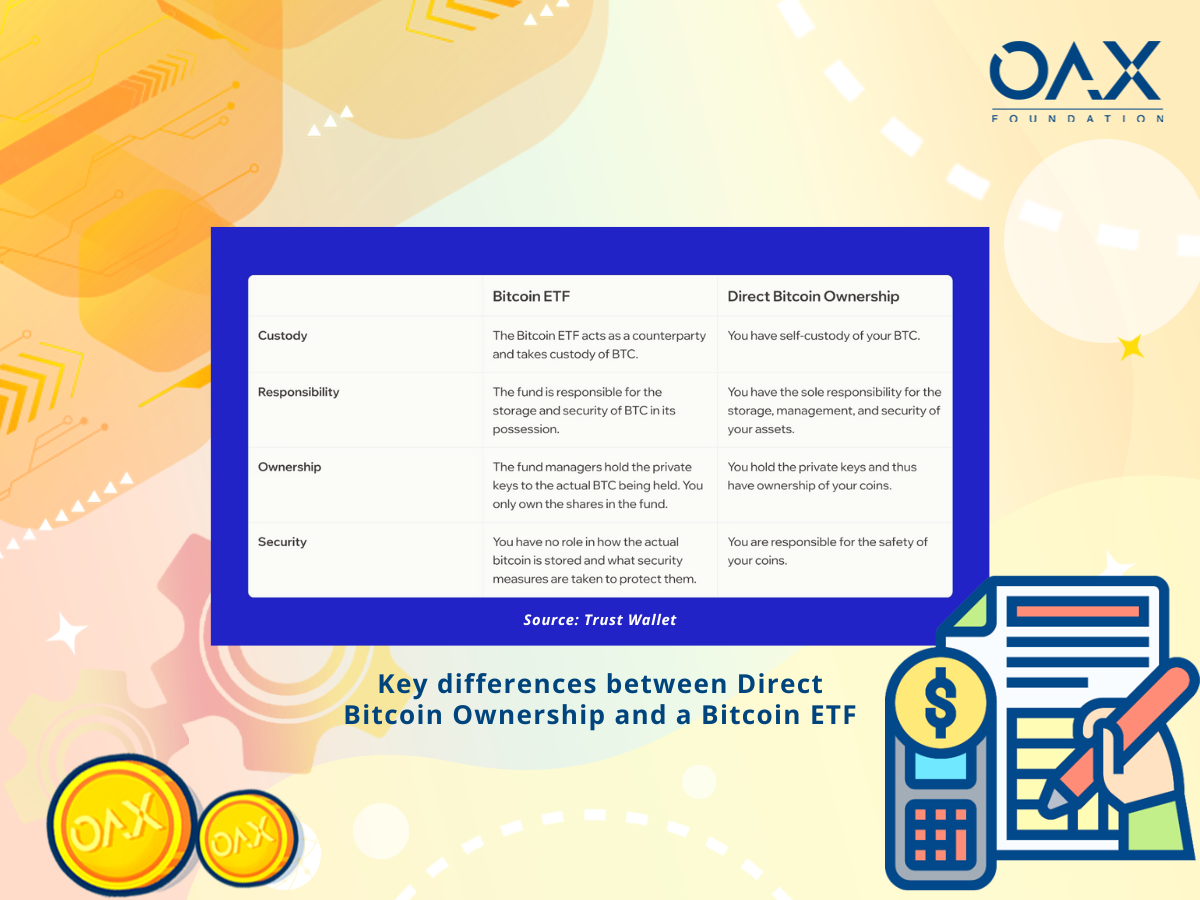

While Bitcoin ETFs offer exposure to the price movements of Bitcoin, they fall short in providing the same benefits as owning actual Bitcoin. One crucial distinction is that Bitcoin ETFs do not grant investors the financial ownership and sovereignty that come with owning and transacting with Bitcoin directly. According to the Bitcoin whitepaper, the true utility of Bitcoin lies in its ability to facilitate peer-to-peer transactions and bypass traditional intermediaries, a feature that is not achieved through ETFs. By design, Bitcoin aims to empower individuals to have control over their own finances, free from the constraints and dependencies of centralized systems. ETFs, on the other hand, reintroduce counterparty risks and confine investments within the financial system, limiting the full potential of cryptocurrencies’ permissionless and decentralized nature.

Bitcoin ETFs are often linked to higher costs, primarily due to institutional fees, when compared to self-custody options. The ongoing debate regarding the safety of centralized versus permissionless custody remains subjective. However, it is worth considering that the majority of investors find decentralized storage solutions a foreign idea, thereby emphasizing offering digital assets in an ETF through a centralized entity has its appeal. It is precisely this point that has sparked tension surrounding the approval.

A Mixed View From the Crypto Industry

The approval of Bitcoin Spot ETFs has generated mixed sentiments. While many view it as a positive development that can bring new participants into the crypto space and potentially serve as a gateway to crypto assets, there are also voices expressing concerns and conflicts with the original mission of Bitcoin.

As discussed above, there are concerns around the potential division between holding keys and synthetic Bitcoin may arise. They worry that this could undermine the mission of Bitcoin, which emphasizes sovereign independence and freedom of money. These individuals draw parallels between the approval of a Bitcoin ETF and historical events, highlighting the potential for changes in Bitcoin’s cultural identity and associations. They believe that such changes are inevitable, given Bitcoin’s cypherpunk roots and its potential as a tool of freedom, arguing that crypto should push investors towards non-custodial and permissionless solutions, rather than relying on intermediaries.

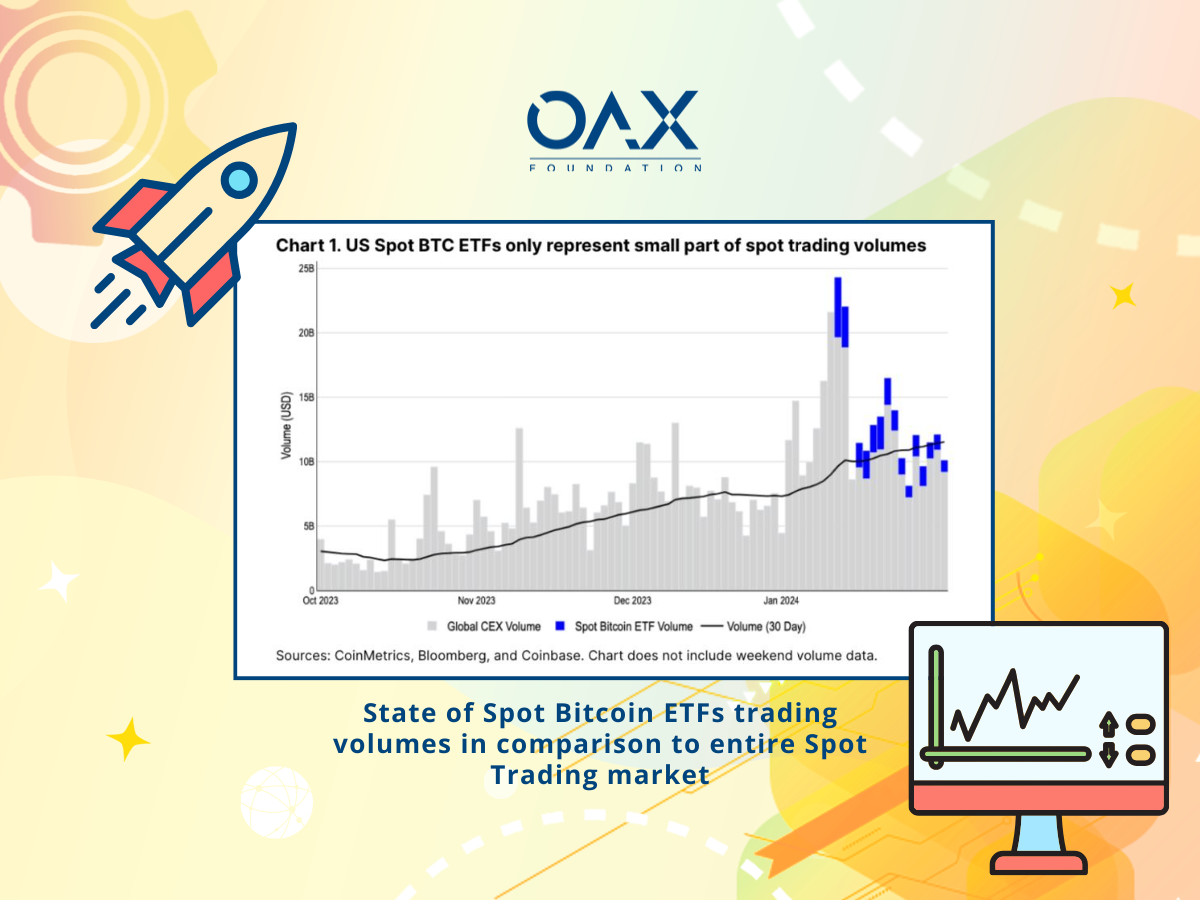

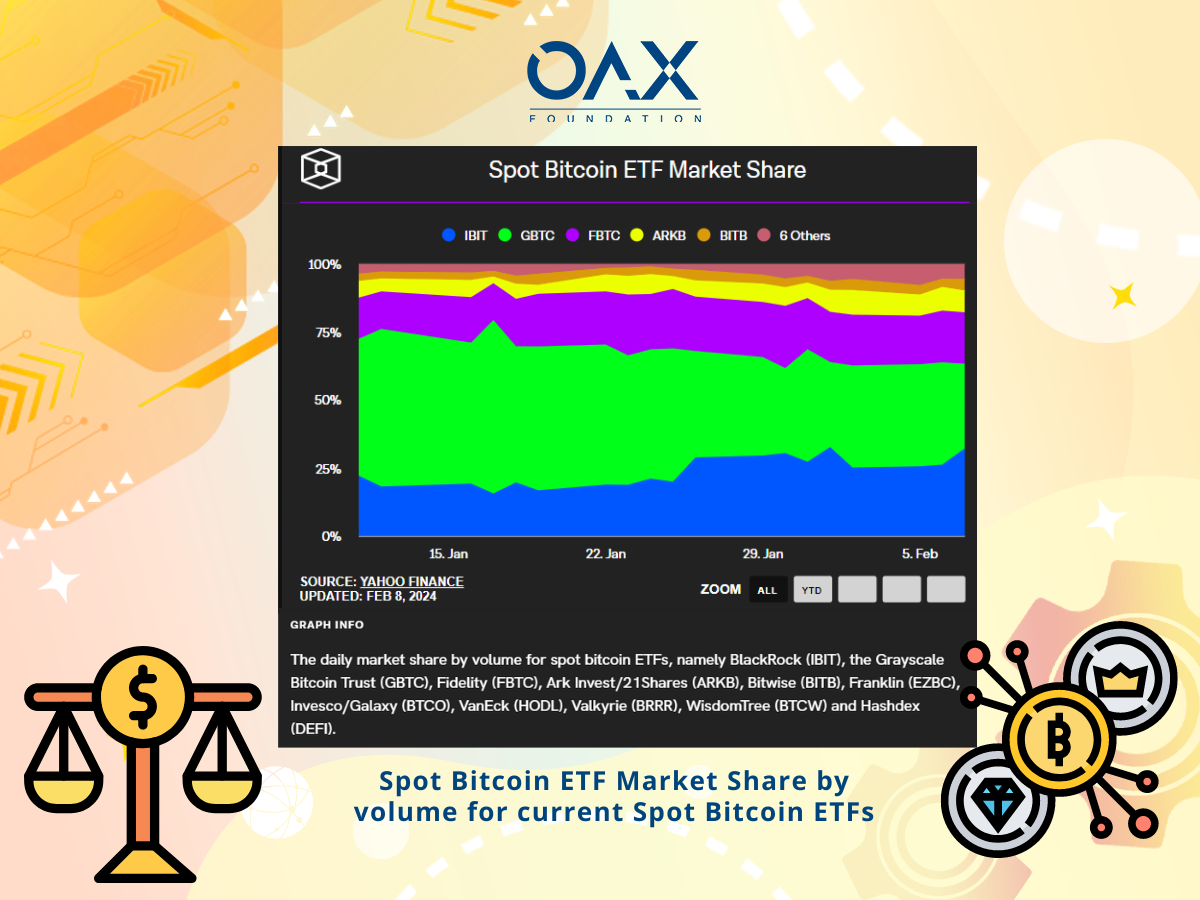

A look at Spot Bitcoin ETF market share based on current industry players in the market.

A look at Spot Bitcoin ETF market share based on current industry players in the market.

Closing thoughts

The Bitcoin ETFs have certainly ignited a diverse range of viewpoints within the crypto industry, encompassing both positive and critical perspectives on various aspects such as Bitcoin’s original mission, cultural identity, custodial solutions, and market dynamics. While the long-term implications of these sentiments remain to be seen, it is crucial to comprehend the underlying backdrop that sets the stage for this ongoing evolution. It could be argued that the acceptance of ETFs is a natural progression for Bitcoin, as it brings awareness through institutional support and regulatory compliance, indirectly fostering adoption. However, whether Bitcoin remains true to its mission ultimately rests in the hands of its users, who will have the autonomy to decide their preferred path towards self-custody and true ownership of crypto assets in the years to come.

Last but not least, we would like to wish everyone a happy and prosperous Lunar New Year in this year of the Dragon. We are excited for the year to come and we hope you are too - greater things are certainly ahead!