The Good News Edit

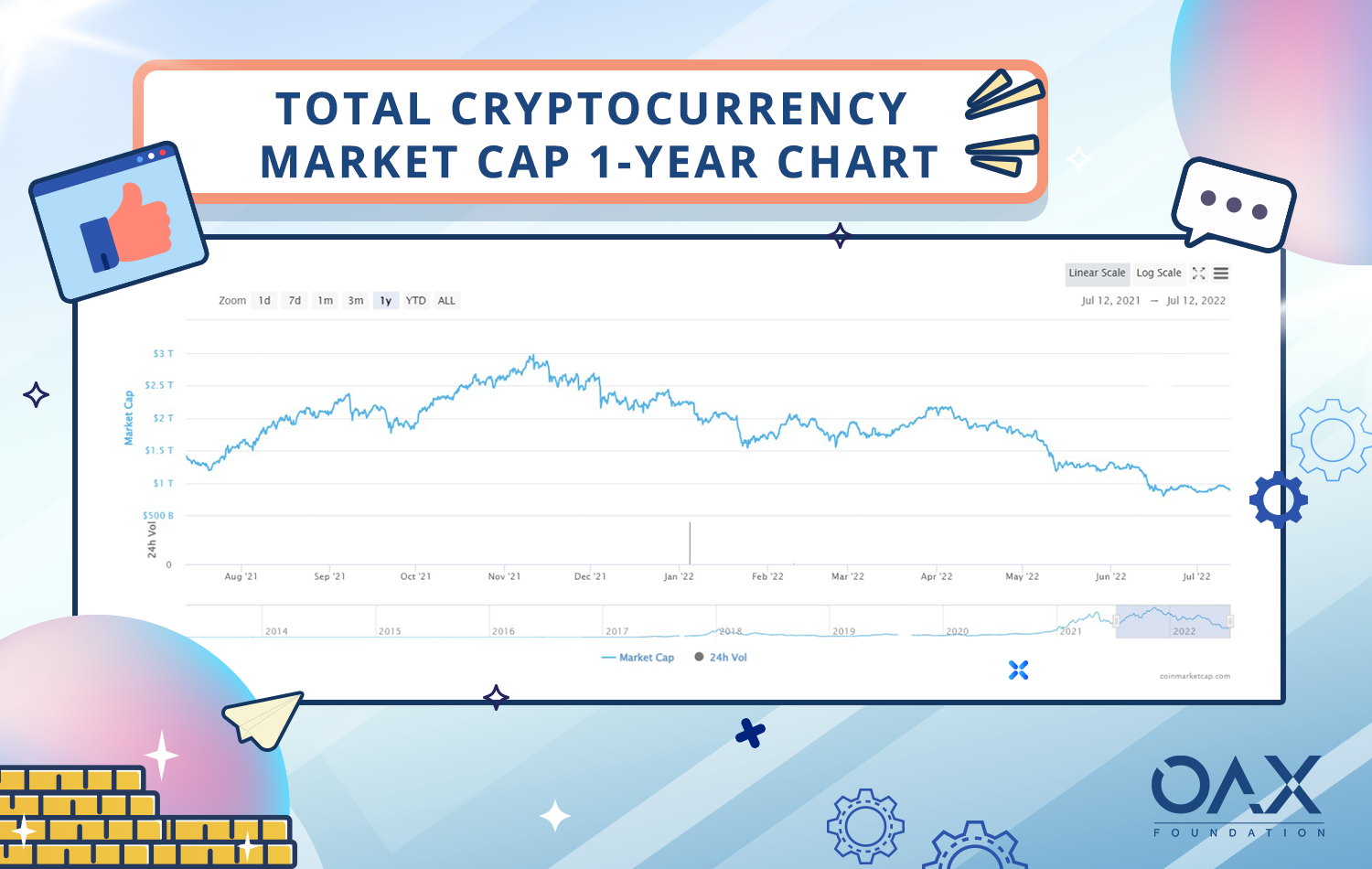

In a bear market, we often face doom and gloom in every article. Of course some of it is truly quite depressing news, and real people get affected in very real ways. However, with every gray and raining storm cloud, there’s a fine silver lining.

Depending on whether it’s short-term considerations or just the general sentiment alone, things are never clearly black and white. Whilst some headlines have very clear implications, others may offer opportunities for the overall ecosystem.

We begin with the obvious. Without a doubt, the two key players, BTC and ETH have taken a hit over the last few months and whilst some believe the end of the two token, those such as JPM believe that BTC is now undervalued by 28%, and informing their clients that crypto is now replacing real estate as its preferred alternative asset class.

And while Ethereum average gas fees have fallen to $1.57, the lowest since 2020, one of the biggest headaches for the developers during the latest bull run was the staggering gas fees. Despite investors who were eagerly shouting “to the moon!”, it was also fair to say that development costs and budgets exploded while bringing things to market. As a result some platforms may have felt a certain pressure to push to market to catch the skyrocketing trends.

Slowing it down not only means more time for research and strategic development, rather than just a rush to market or FOMO, but it also applies for funding as well. While it’s true that overall funding for projects have slowed down, it does give a bit more attention to those that still manage to secure investment during these times. According to Forbes, Ethereum scaling startup Starkware raised $100 million while venture capital Andreessen Horowitz announced it had raised $4.5 billion for its fourth crypto fund.

Meanwhile, the bear market has also had benefits for another group of stakeholders: regulators. In recent weeks, the US and EU have been sharing information and proposals about crypto regulation. The draft bipartisan bill from the US attempts to bring definitive guidelines for identifying cryptocurrencies as commodities, and establishing transactions under US$200 tax free. The bill was later uploaded to Github, with Senator Cynthia Lummis asking for feedback on the bill. Unfortunately, trolling ensued once posted to GitHub; but perhaps a certain appreciation can be gained for a Senator that knew the existence of GitHub and in an attempt to reach the right audience, interacting using such a platform gives us hope that there likewise is progress being made.

The EU also released the provisional agreement for MiCA regulation, making more stringent rules for crypto issuers and service providers. Many naysayers have argued that enforcing such rules for decentralized stablecoins makes it impractical.

Despite the difficulties, and at times the impracticality, our team has always felt the necessity of regulations despite likewise believing in decentralization. Working with regulators in this space can help to weed out bad players that will ensure the longer term success. Furthermore, with areas outlined, it can also provide more opportunities for developers to work in thanks to clearer parameters, especially smaller entrants without the large legal teams. Investors, likewise, may feel additional reassurance allowing them to act within clearly defined areas without the fear of sudden clampdowns.

We all see regulators as large entities with a lot of red tape, but ultimately they are there to protect various stakeholders. And as the industry requires time to finetune their product offerings and technology, likewise regulators may be slow to provide direction and constantly seem a step behind. Bear markets allow for various stakeholders to step back and play a bit of catchup before the next cycle begins.

Wrapping up our good news edit? Some have doubled-down on.