Payments of the Future

We face an interesting conundrum on the road to advancing the digital asset ecosystem. As crypto continues to pick up around the world, platforms and users strive to find more use case scenarios for digital assets, and we’re constantly looking at the accessibility and practicality of using digital assets on a daily basis.

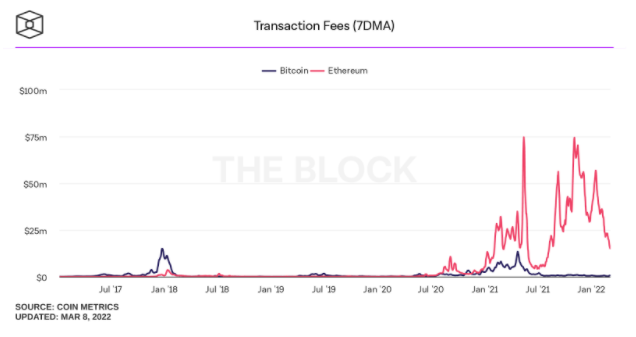

Earlier last year, as ETH reached all time highs, it also resulted in gas fees skyrocketing. While higher ETH levels were great for investors trading for investment purposes, the real case scenario became difficult to work around as the fees were tied to the price of ETH. In a similar timeframe, we saw the NFT market gaining in popularity, but higher gas fees also resulted in difficulty for some community members to partake. NFTs that were worth thousands (or even millions) wouldn’t flinch at such gas fees, but if NFTs being sold were on the lower end of the spectrum, the resulting fees would at times be higher than the NFT itself, or often outweigh the benefits of having said NFT.

The cost of transacting in crypto requires lower fees; and a safer space for new adoptees to partake. We speak of cross-border and simplified transactions, lower transaction fees compared to traditional financial institutions, yet if the daily use case fees are so high; how will we expect it to be used in a mainstream scenario?

Which is the cause and which is the effect – DeFi then the rise of NFTs causes a spike in demand, ETH prices rise due to demand, and as a result, interest eventually wanes due to inaccessibility. But likewise, the spike in interest and fees also resulted in alternative chains with lower fees, such as Binance Smart Chain, Solana, Cardano, or FLOW. These platforms have helped to drive the DeFi industry in the last year, but furthermore, may also be the basis of something more.

It’s with this in mind that we find alternative platforms such as Solana and their recently launched Solana Pay particularly interesting for our industry. Providing alternatives in this digital space where the transactions and gas fees are not tied directly to the price (and the success) of the token, or limiting the costs of said transactions may be the way forward for real use case scenarios.

According to the release “Solana Pay, a new payments protocol, ushers in a new era of payments and commerce… [creating] the building blocks for a decentralized, open and truly peer-to-peer payment protocol.” By sending USDC and transaction fees “fractions of a penny” the direction of the digital payment future opens up possibilities for merchants and consumers. Working with various parties and ensuring low fees and reliability will be the main points of considerations to see whether platforms like Solana Pay will be a success.

On the other end of the spectrum, we also have classic payment platforms like Paypal, Mastercard and Visa who have all begun exploring forays into the digital asset industry, the results still remain spotty at best, with usage and accessibility largely dependent on where the users are based. And while the initial approach has been purchasing crypto currency on these platforms, the use of it as a payment is still to be refined until easily accessible. Building the ecosystem and having a wide network of merchants that accept digital asset payments of course is something the entire industry must expand on, but it’s yet to be seen whether payment through these traditional platforms will require additional fees in addition to gas. Are traditional platforms the route to go, or will the Solana Pay’s of the industry be the way of the future? While development is still early, the prospective of easily accessible digital asset payments at low prices and lightning fast transaction speeds remains one of the keys to bringing digital assets into a truly mainstream way. At OAX, we continue to seek industry drivers within this space that can break the status quo and expand digital assets to a wider audience, and demonstrate a vision for what the future of digital assets can look like.