Professor Syren Johnstone Q&A: Paper 3 “Inhabiting Different Realities: Incrementalism, Paradigms and the New Prospect” Part 1

The release of “Inhabiting different realities: incrementalism, paradigms and the New Prospect” by Professor Syren Johnstone from The University of Hong Kong marks the third and last paper for which OAX has provided funding support to explore the regulatory perimeters of digital assets. It’s been some time in the making, and we wanted to invite Professor Johnstone to reflect on the time spent and the material the papers cover, while setting it in the landscape that we face today.

Professor Johnstone, perhaps we can start first with how you feel now that you’ve finished the third paper?

I’m very pleased that OAX has been generous enough to provide the support, which took various forms. Before starting the first paper I sat down with a blockchain developer OAX introduced me to who helped me connect programming experience from my neuroscience days (back in the days of C+) with what he was doing in a new environment. To use an analogy I often use: I felt it was necessary to appreciate the engineering before considering the possible uses of the structure (building, bridge etc). There is definitely an element in the third paper where the beginning and end points of this series of papers have come together, without forming any intention to make that happen.

I just want to set the context of Paper 3 in this series for those that are hearing about it for the first time. Could you broadly outline how the three papers took its form, and how the first two papers created the foundation for this recently released paper?

From the outset I wanted to look for new perspectives on how we think about regulating the outputs of this new technology, which I’ve dubbed cryptographic consensus technology (CCTech) because that keeps close to the science and avoids labels like blockchain and DLT which can mean different things to different people. Starting with the primary market was an obvious choice for Paper 1: Regulating Cryptographic Consensus Technology: Oxymoron or Necessity” because regulators and the industry were struggling with the perimeters of financial regulation at that time (and continue to do so). After finishing the first paper the secondary market was getting more active, and it made sense for Paper 2: “Requisites for Development of a Regulated Secondary Market in Digital Assets” to explore this evolution, particularly as the market was getting well ahead of where regulatory policy thinking had reached.

Paper 3 looks much further ahead of the policy development curve and asks a more fundamental question about the appropriateness and sustainability of applying financial regulation to crypto-assets.

What would you say are some of the biggest changes in the arguments that have taken place over the last 2-3 years that you’ve been working on these papers?

Sadly I’d have to say very little, which is really the context for Paper 3. Regulatory agencies continue to adopt familiar tools that organize their diagnostic and prescriptive enquiries. From the industry perspective there has been limited innovation to solve prospective regulatory problems proactively, since there has been little motivation or reward for doing so, with the exception of the industry coming together to respond to the FATF travel rule.

Regulators and industry players in jurisdictions that have been regulating cryptoexchanges are getting a deeper understanding of each other’s needs and constraints but that hasn’t caused the more fundamental question to be queried, i.e., whether financial regulation is appropriate and sustainable when the fuller possibilities of CCTech are considered. It’s been more of a process driven working relationship within existing parameters, as opposed to anything more novel and forward looking.

In your paper you suggest that applying financial regulation to crypto-assets has had negative consequences as well as positive ones. Is that just a result of financial regulation getting up to speed with activities in the crypto-market?

Applying financial regulation has definitely helped eliminate a lot of dodgy activity we saw in the ICO era. But it has also pinioned crypto-assets as financial investments, which I argue has telescoped the wider commercial prospects offered by CCTech - the other non-financial uses of the technology that have been proposed or thought of lag in terms of development and implementation. What is sometimes forgotten is that the overarching purpose of securities laws is not to identify securities or investment contracts – that would be the tail wagging the dog. Rather, its purpose is to promote a larger social objective and there is a risk that bisecting tokens into “securities” or “not securities” based on established institutional norms is a somewhat blunt tool that obstructs rather than facilitates the innovation of new institutional arrangements that may be of wider economic benefit of society.

You’ve actually outlined five proposals in this latest paper that would help to enable what you have called the “New Prospect”, namely, the possibilities offered by CCTech to form new commercial relationships, institutional arrangements and interactions. You mention a new “DBA” taxonomy. What do you envision the benefits of it to bring?

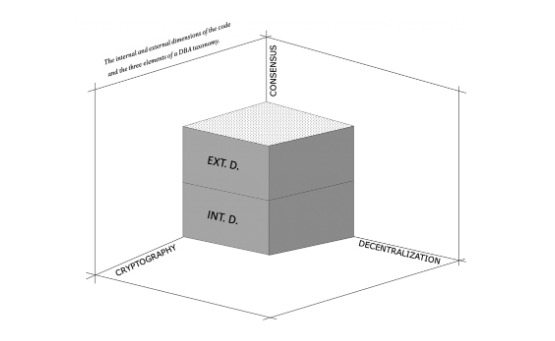

A “Designed-by-Architecture” taxonomy presents an alternative to the existing approach, which is what I call a “fit to existing regulation” taxonomy that is full of flaws and weaknesses. A DBA taxonomy acknowledges the technology and doesn’t impose constructs that are derived from times when the possibilities created by the technology didn’t exist. As such, it allows a more meaningful exploration of technology neutrality – which doesn’t mean the same thing as technology agnosia. Similar to the GATC bases comprising DNA, there are three core building blocks that can be implemented in innumerable ways: (1) cryptographically secure technology (2) able to implement a consensus mechanism (3) across a decentralized network – hence CCTech .

The construction of a DBA taxonomy will also take note of what I’ve referred to as the internal and external dimensions of the code implementing CCTech – for example, consider the differences between the engineering of the stack, which might impact on interoperability, and the higher-level mechanisms that govern the relationship between token holders and the network on which the tokens reside. If these things were to be regulated, they would invoke different considerations. As to the other utilities and applications, perhaps that might be a topic of a subsequent paper – happy to hear from anyone that would like to explore it with me.

Is there a specific proposal that you would consider to have greater importance for the industry, or do you think all proposals are equally crucial for the development of CCTech moving forward?

My fifth proposal is that there needs to be an international effort to explore what type of regulator is appropriate, which likely requires a G20 initiative – this was needed to stimulate a globally consistent response to known problems in the credit rating agency business and opacity in the OTC derivatives markets that created systemic risks. This time it’s about fostering innovation. The new regulator would need to have powers sufficient to ascertain and limit the boundary lines of where financial regulation does and does not apply. And of course I think it should have regard to the other four proposals I’ve made.

Stay tuned as we discuss more about the paper and the current environment next week.

The full paper can be downloaded here:. Registration to download the paper is not required and can be accessed by scrolling down to the “download without registration” link.