Introduction to Digital Asset Treasuries (DATs)

Breaking the Adoption Barrier

This year, 2025 has witnessed a seismic surge in cryptocurrency adoption, driven by institutional and national-level interest. The launch of Bitcoin and Ethereum ETFs last year opened the floodgates, channeling massive institutional inflows into the digital asset market, breaking new highs in total crypto market cap.

Yet, alongside ETFs, Digital Asset Treasury companies (DATs) have emerged as an alternative, offering new and unique ways to gain exposure to crypto. By breaking the friction of direct ownership, eliminating wallet hassles and custody risks, DATs are accelerating institutional inflows, positioning themselves as a hot topic this year.

OAX Foundation is committed to digital asset adoption, this article dives into what you need to know about DATs, how they fit into the bigger picture, their implications for the digital asset industry, and what are the risks associated with it.

What Are DATs?

Digital Asset Treasury companies (DATs) are publicly traded firms that allocate significant balance sheet portions to cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH), treating them as core assets.

Emerging in 2020 amid low interest rates and inflation, DATs offer investors indirect crypto exposure via stock markets, positioning BTC as “digital gold” and ETH as a yield asset through staking. Their billions in on-chain holdings blend TradFi capital-raising with blockchain transparency, which sees DATs boosting asset prices across their portfolios.

DATs vs ETFs?

DATs differ from ETFs, which passively track crypto prices (e.g., Bitcoin spot ETFs with 0.2-0.4% fees) and suit risk-averse investors. DATs actively accumulate crypto using equity and debt, often outpacing ETFs crypto per share, amplifying bull market gains but adding volatility.

ETFs avoid complex strategies, while DATs leverage premiums and staking yields (3-5% for ETH), making them riskier yet potentially more rewarding. DATs have a role in supporting the underlying prices with accumulation, a benefit ETFs lack due to their passive nature.

How DATs Work: Financial Engineering

DATs use financial engineering to scale crypto holdings. They raise funds via equity (e.g., PIPE deals, ATM sales) and low-cost debt (e.g., convertible notes), channeling proceeds into OTC crypto purchases to minimize slippage.

On-chain tracking ensures transparency, with ETH staking adding yield. DATs buy locked tokens from early investors, easing sell pressure, and some, like ETHZilla (ETHZ), deploy funds into DeFi for higher returns.

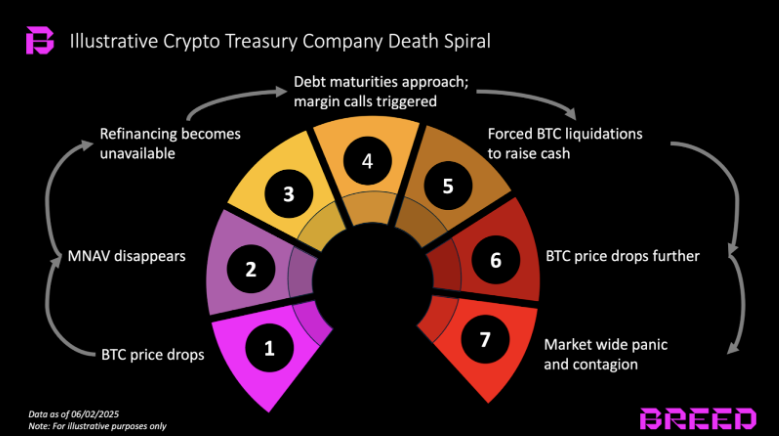

In bull markets, raising capital at premiums enables “infinite accumulation” of digital assets, though bear markets risk forced sales or impairments.

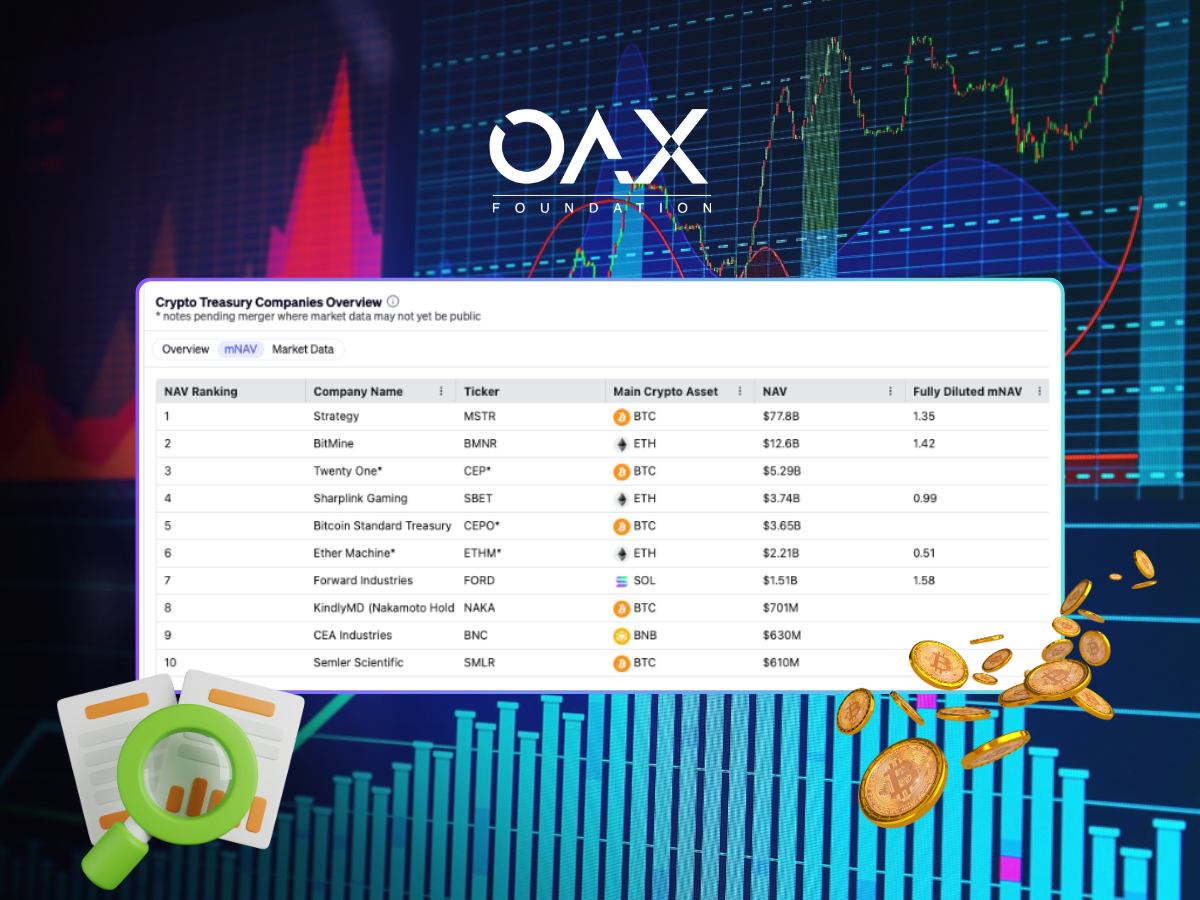

Notable examples of DATs

Leading DATs showcase diverse tactics. Strategy (MSTR) holds over 640,000 BTC, pivoting from software to a BTC treasury since 2020. Marathon Digital (MARA) mines and buys BTC, thriving in the 2024-2025 bull run. BitMine Immersion (BMNR) stakes ETH for yields, while Forward Industries (FORD) holds 6.78M Solana (SOL) worth $1.5B, backed by Galaxy Digital. ETHZilla recently announced $100M in ETH for Ether.fi (DeFi exposure), and SharpLink Gaming, co-founded by Joe Lubin, plans a $1.5B share buyback. Japan’s MetaPlanet holds 20,000 BTC, reflecting global adoption.

Assessing DATs: NAV and mNAV

Investors should track Net Asset Value (NAV), the market value of crypto holdings (e.g., 10,000 BTC at $100,000 = $1B NAV), and Multiple of Net Asset Value (mNAV), where a 1.5 mNAV indicates a 50% premium, signaling growth confidence.

Blockworks notes mNAV compression may lessen investor interest, with discounts prompting buybacks (e.g., SharpLink’s $1.5B plan). Compare NAV/mNAV with on-chain data and yields to gauge value, balancing bullish bets against overvaluation risks.

Sustainability and Risks

DATs shine in bull markets but face challenges. Crypto volatility can crash stock prices, triggering impairments or debt-driven sales, as Strategy experienced previously. Regulatory uncertainty around taxes and accounting adds risk, and prolonged downturns could drain treasuries.

NASDAQ’s stricter PIPE rules, pushing DATs to buy locked tokens or use cash, while DeFi participation (e.g., ETHZilla’s move) sets a precedent but introduces smart contract risks. Disciplined management and staking yields bolster long-term viability.

Market Impact: Short-Term and Long-Term

Short-term, DATs drive crypto demand, fueling 2025’s bull surge and attracting TradFi capital, with price support. Long-term, they bridge traditional and decentralized finance, potentially multiplying if BTC and ETH hold strong.

Innovations like tokenized shares or DeFi integration (e.g., FORD’s on-chain activity) could expand the model. However, Blockworks data suggests compressing mNAVs may reduce arbitrage appeal, and regulatory shifts or bear markets could temper growth.

Two Sides of the Coin

DATs present a dual narrative. Critics argue they’re pure financial engineering, capitalizing on a glitch in modern markets with no inherent value creation, akin to SPAC mania or a last gasp of an industry struggling with weak fundamentals.

This perception paints DATs as frothy, especially as crypto adoption shifts from ideology to speculation.

Conversely, benefits are in the spotlight: Dr. Xiao Feng of Hashkey compares DATs to ETFs, signaling potential, and views them as a low-friction path for Bitcoin adoption across governments, institutions, and retail.

Closing thoughts:

For investors who have preferences or limitations in managing their own keys, crypto ETFs and DATs do offer an alternative way to gain exposure to digital assets.

While ETFs track the prices of underlying assets in a regulated and efficient manner, DATs, on the other hand, could enable investors to gain exposure not only to the underlying assets but also to tokens per share, resulting in greater gains during a bull market, but also significant losses in a bear market. This makes DATs a high-beta alternative.

Key summary of DATs and a general overview of DATs vs ETFs.

Key summary of DATs and a general overview of DATs vs ETFs.

From OAX Foundation’s perspective, it’s too early to judge DATs’ path forward. With interest rate cuts making borrowing cheaper as of October 2025, DATs could more efficiently accumulate crypto, driving up tokens per share, a catalyst in this bull market. Yet, the real test looms when the cycle ends: how many will survive without calling in loans? Larger treasuries (above $1B) hold an edge, better equipped to weather black swan events, especially with large-cap assets like BTC, ETH, or SOL.

We urge the community to DYOR in this emerging space. To that end, this article serves as a starting point for understanding what these products are, which is ever so important as we see more DATs popping up in the market.

Disclaimer: The above is an opinion piece written by an authorized author, but in no way represents the official standpoint of OAX Foundation Limited, nor should it be meant to serve as investment advice.