China’s AI Surge: DeepSeek and Beyond

The global AI revolution runs on Nvidia’s chips, powerhouses fueling everything from generative models to autonomous systems. The U.S. tightened its grip, restricting exports of Nvidia’s cutting-edge chips to China to slow its AI ambitions. In a workaround, Nvidia offered the H20, a downgraded chip for the Chinese market. A win-win? Not quite.

In September, China’s Cyberspace Administration (CAC) dropped a bombshell, banning giants like ByteDance (parent of TikTok and Douyin) and Alibaba from purchasing even these chips, citing data security and antitrust concerns. The message was clear: China’s AI future won’t lean on foreign silicon.

This seismic shift is accelerating China’s push for self-reliance AI supply chain, with homegrown giants like Huawei, Alibaba, and Tencent doubling down on domestic chip R&D.

At the forefront of China’s foundation model is DeepSeek, but it is no longer a lone wolf. A constellation of Chinese AI stars is rising, fueled by government mandates, massive data troves (from 1.4 billion people and 1.1 billion mobile users), and a relentless focus on practical, cost-effective models is emerging.

As China’s AI ecosystem explodes, what’s the strategic play among AI juggernauts? How does Asia’s AI arsenal stack up against the U.S. and crucially, what does it mean for you, the user, entrepreneur, or executive navigating this new landscape? Let’s dive in.

The Force Behind China’s AI Growth

This isn’t just about raw power, it’s about integration, where AI seamlessly weaves into apps, workflows, and economies. China’s edge? Unmatched data scale from its native market, $98 billion in 2025 investments, mostly government-led at $56 billion, 47% of the world’s top AI researchers, and over half of global AI patents, driving rapid diffusion despite U.S. export controls.

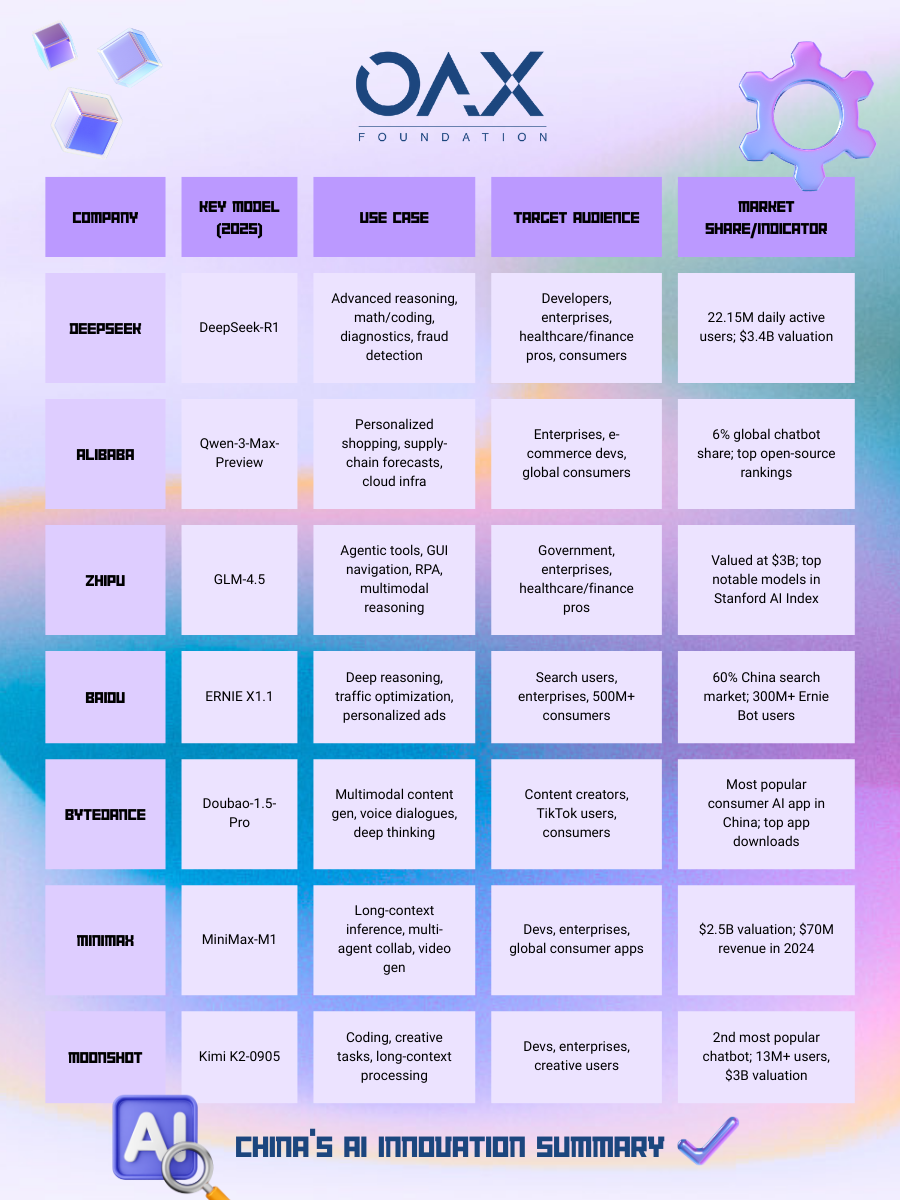

Asia’s Rising Stars: Meet the Contenders

While a day to day user of AI are more exposed to general AI such as Grok, Claude, ChatGPT, China AI innovation is all about being industry specific, hence they aren’t copycats; they’re innovators, often open-sourcing that leads to breakthroughs as well as to accelerate adoption. Here’s a spotlight on six powerhouses driving this surge:

1. Alibaba: Powering Your Online World

Alibaba’s Qwen AI is like a super-smart assistant woven into the fabric of online shopping, cloud services, and logistics. It personalizes your shopping experience, predicts what you’ll love, and streamlines everything from warehouse operations to delivery routes.

Scalability and affordability. Qwen runs on everyday hardware, making it cheaper to deploy at scale. It’s built to handle massive datasets, giving Alibaba an edge in crunching numbers for its enormous database from e-commerce and cloud empire.

Imagine getting spot-on product recommendations or faster deliveries because AI optimizes every step of the supply chain. Qwen powers Alibaba’s platforms, serving millions, and its cloud services help businesses worldwide tap into AI without breaking the bank.

2. Zhipu: The AI That Thinks for Itself

Zhipu’s AI, GLM, is a game-changer in “agentic” intelligence, think AI that doesn’t just answer questions but takes action, like automating tasks or navigating complex systems. It’s a whiz at coding, reasoning, and handling text, images, and even business workflows.

Autonomy and versatility. GLM shines in running on smaller devices and processing huge documents, making it perfect for real-world applications where speed and flexibility matter. Backed by $1.4 billion from giants like Alibaba and Tencent, it’s a global contender.

From automating government services under China’s Digital Silk Road to powering enterprise tools that streamline operations, Zhipu’s AI is a go-to for healthcare (think smarter diagnostics) and finance (like fraud detection). Its ability to handle multiple data types makes it a Swiss Army knife for businesses looking to innovate fast, earning it a top spot in Stanford’s 2025 AI Index.

3. Baidu: Making Search Smarter and Beyond

Baidu’s Ernie AI takes search to the next level, blending deep reasoning with real-time insights. It’s not just about finding answers, it’s about understanding complex questions and delivering precise solutions, often for free through Ernie Bot.

Deep integration with Baidu’s search engine and affordability. Ernie’s razor-sharp accuracy and ability to process diverse data make it a powerhouse for over 500 million users, all at a fraction of competitors’ costs.

Ernie optimizes city traffic, crafts personalized ads, and powers smart assistants that make life easier. Businesses use it to analyze data in real time, while everyday users get smarter search results. Its free access and massive reach (60% of China’s search market) make it a cornerstone of China’s AI adoption.

4. ByteDance: The Creative Spark Behind TikTok

ByteDance’s Doubao AI fuels TikTok’s magic, creating videos, enhancing chats, and powering smart content recommendations. It’s a multimodal maestro, handling text, video, and voice with a knack for deep, thoughtful responses.

Massive data and low costs. With over 1 billion users’ data to tap, Doubao delivers personalized experiences at a fraction of Western competitors’ prices, boosting engagement by 20-30% in tests.

Doubao makes TikTok videos pop with seamless editing and real-time voice interactions that feel human. It’s also a hit for developers, offering tools to build smarter apps. As China’s top consumer AI app, it’s redefining how we create and consume content, making creativity accessible to all.

5. MiniMax: The Efficiency Champ

MiniMax’s AI is a lean, mean efficiency machine, tackling massive documents and complex tasks like software engineering or video creation. It’s built to work fast and smart, even on modest hardware.

Unmatched efficiency. MiniMax processes huge datasets with minimal computing power, costing just $534K to train, a fraction of competitors. Its open-source approach makes it a developer favorite.

From crafting enterprise reports to coding apps, MiniMax excels in industries needing heavy-duty data crunching without hefty budgets. Its ability to collaborate across tasks (like multi-agent systems) makes it ideal for businesses scaling AI on a dime, earning a $2.5B valuation and $70M in 2024 revenue.

6. MoonShot: The Creative Code Wizard

MoonShot’s Kimi AI is a creative powerhouse, excelling in coding, writing, and handling text, images, and video. It’s designed to spark innovation, from Discord bots to enterprise solutions.

Accessibility and speed. Kimi’s free for most users, with costs 100x lower than competitors, and its open-source licensing fuels viral adoption, reaching 400 million weekly users.

Developers love Kimi for building apps, while creatives use it for writing and design. Its low-cost, high-speed performance makes it a global hit, ranking second among chatbots with a $3B valuation. It’s the go-to for anyone wanting to create without barriers.

Don’t sleep on Stepfun, pushing AGI with 11 models; ModelBest, crafting small, privacy-focused AIs; or Infinigence AI, slashing training times by 30%. These companies build their own models to tailor solutions for specific needs, like Tencent’s gaming or Alibaba’s e-commerce, ensuring control and avoiding reliance on generic open-source options.

Not East vs. West, It’s Integration vs. Isolation

The U.S. holds the global AI innovation crown, but don’t mistake leadership for complacency. China’s not conquering, it’s collaborating, with open models accelerating breakthroughs worldwide, fueled by government support and efficiency focus.

This isn’t a zero-sum East-West war; it’s a proliferation of tools, where more models mean more integration. Savvy companies blend China’s agile, deployment-ready stack (e.g., DeepSeek-R1 matching GPT-4o at fraction of resources with Western research for a multipolar future, not choosing sides, but unlocking growth.

Leading Chinese firms are pivoting to agentic frameworks: Autonomous “thinkers” for complex tasks, with UBS predicting monetization as early as 2026, $15-20B annually in the U.S. already, now hitting China’s consumer apps like shopping and entertainment, evolving to finance and wealth management. AI could add 0.2-0.3% to China’s GDP yearly, powering productivity.

Closing: There’s no one size fits all

China’s AI boom, led by innovators like DeepSeek, Alibaba, and ByteDance, is transforming daily life and business with cost-effective, scalable models that rival U.S. giants. For users, expect smarter apps, think TikTok’s voice-driven edits or Qwen’s tailored shopping, making everything from translation to health nudges seamless, with 78% of organizations now embracing AI. Although we may see a slight drop in AI inefficiencies due to the recent ban of using Nvidia chips, we believe the emphasis in developing China homegrown chips will eventually catch up in the near future.

From the OAX Foundation perspective, AI’s true winners will integrate boldly. China’s stars remind us: Innovation thrives on access, not isolation. There is no one size fits all, tech and business leaders need to understand the nuances of these foundation models as well as their purpose at hand, and choose the right model that fits them. In China, they are choosing to build. The ambitious play signals not even an option but a must to survive for business in the AI era.

Disclaimer: The above is an opinion piece written by an authorized author, but in no way represents the official standpoint of OAX Foundation Limited, nor should it be meant to serve as investment advice.