SocialFi back on the Spotlight - Part 2

In our previous exploration of the burgeoning SocialFi sector, we introduced the core concepts and the rapid rise of this innovative fusion of social media and decentralized finance. One key challenge we briefly touched on was the issue of scalability, as these platforms seek to onboard millions of users. Just last week, we saw a prominent SocialFi project, Friend.Tech, announce plans to migrate from the Coinbase-backed Base blockchain to its own proprietary Friendchain network. This strategic shift highlights the evolving landscape of the SocialFi space, as leading projects strive to balance decentralization, scalability, and platform-specific optimizations. In this article, we’ll take a deeper dive into opportunities, challenges and what we believe the potential paths forward for the emerging SocialFi initiatives.

A disruptive business model

Potential to unlock greater revenue per user

Advantages that SocialFi offers to users are direct monetization, ownership of data, fair distribution of rewards, and the ability to shape platform rules through decentralized governance. This explains why socialFi needs to be on-chain, emphasizing the benefits of blockchain technology in ensuring transparency, security, and trust within the socialFi ecosystem. Compared to traditional creator monetization platforms, tokenization-based models have a key advantage in their ability to capture value on both the buy and sell sides of transactions. This results in a significantly higher revenue potential per customer, leading to a more favorable business model economics for these types of platforms.

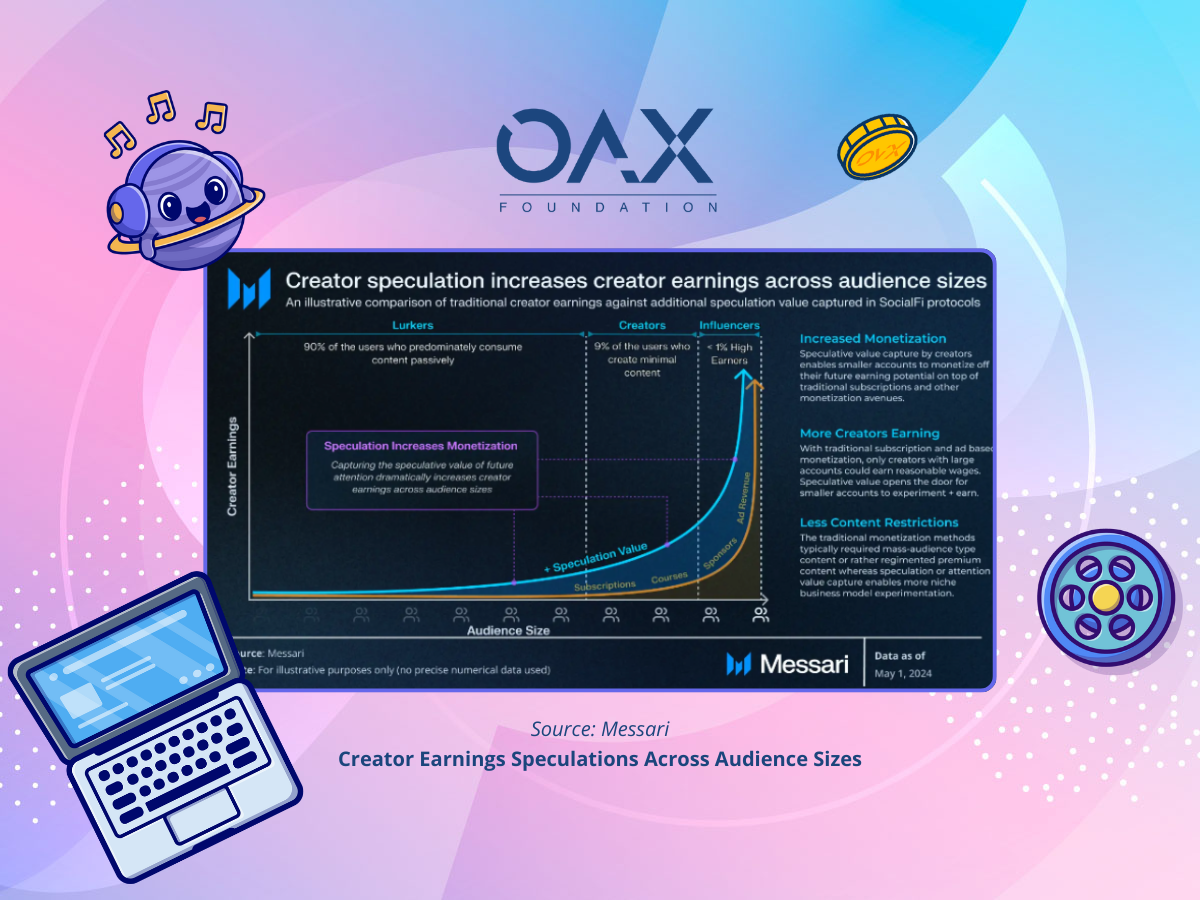

Revolutionizing incentive models vs. traditional social platforms

The main reason why only large social media accounts can earn a decent living has to do with the business model of major platforms that rely heavily on advertising revenue, requiring large audiences for sponsored content and ads to be profitable. As a result, new creators with small followings have very limited earning potential, forcing them to invest significant time and effort to build up a large audience before monetizing effectively, putting financial risk and pressure that can compel them to prioritize rapid audience growth over creativity and authenticity. However, new “creator financialization” innovations are opening alternative monetization paths, allowing creators to capture value from their online presence’s speculative activity and future earnings, similar to how venture capital enables software creators to earn upfront salaries. These new financial tools have potential to spur business model innovation for both creators and platforms.

SocialFi projects worth paying attention to

Farcaster

Farcaster is a decentralized social protocol that offers a new approach to online content and creator monetization - it records user profiles and social interactions on the blockchain while processing daily activity through an off-chain network, allowing apps built on Farcaster to tap into a shared social graph and content ecosystem with innovative “Frames” that let third-party apps embed interactive features in posts and “Actions” that add custom functionality like tipping, giving users and developers much more flexibility to experiment with new monetization models and loyalty programs in ways that are difficult to achieve on traditional centralized platforms.

Friend.Tech

Friend.Tech is a leading creator tokenization platform that recently launched its V2 version, allowing creators to attach a “Key” token to their profiles that can be bought and sold by users to access gated group chats, with these Keys accruing speculative value and generating a 10% fee split between the creator and the platform - this initial wave of excitement from August to November 2023 accrued $50 million in fees, highlighting the earning potential, and the V2 release introduces a new DEX, FRIEND token, and “Clubs” with customizable Keys priced against FRIEND to drive demand and generate additional fee revenue, with further features hinted at to expand creator monetization capabilities.

OpenCampus

Open Campus is a pioneering SocialFi platform that leverages blockchain technology to revolutionize the educational sector. It connects learners, educators, content creators, and educational institutions in a decentralized environment where participants can monetize educational content, access it, or engage with it through integrated third-party platforms.

With EDU Chain’s rollout plans announced in April, the vision of the project is to build an ecosystem of decentralized applications (dApps) on the EDU Chain to embark on an innovative ‘Learn Own Earn’ model for the education sector. The platform’s EDU token is integral for transactions, payments, governance, and donations, and token holders can participate in the Open Campus DAO to vote on upgrades and propose new features. The EDU tokenomics are designed to support a sustainable economic model for all stakeholders, incentivizing content creation and engagement through a steady flow of resources and rewards.

What are the challenges ahead

The SocialFi space has focused on two main innovations, content tokenization and creator tokenization. Creator tokenization has generated more revenue and enthusiasm from the market compared to the slower adoption of content tokenization. The key issue with content tokenization is the friction it creates for collectors, they have to spend money to acquire the content, but then often lack a clear way to display or use that content. In contrast, innovations that center on monetizing the creators themselves, rather than just their content, so far data shows a more positive avenue for social financialization. This is because the challenges with content tokenization highlight the potential for innovations that treat the creators and their online presence as the primary asset to be financialized.

Given the nascent nature of the SocialFi space, there are other key challenges these platforms must navigate as the ecosystem continues to evolve:

- Scalability: Handling large volumes of data and interactions without centralized control remains a technical hurdle. We are seeing projects building their very own chain.

- Market Volatility: The reliance on crypto-economic models exposes users and creators to financial instability due to token price fluctuations.

- Regulatory and Security Concerns: As with any emerging technology, navigating the regulatory landscape and ensuring user security are critical for gaining mainstream trust.

- Tokenomics and Economic Sustainability: Understand the economic model behind the project, including token distribution, usage, and incentive structures. Projects that rely heavily on token rewards need a sustainable model to maintain user interest over time.

- Technological Robustness: Look for projects demonstrating advanced technological infrastructure that can handle scalability and security demands. This includes efficient transaction processing and robust data handling capabilities.

Future outlook of SocialFi

In summary, our discussion on the social financialization (SocialFi) space has covered a lot of ground. We’ve delved into what SocialFi is, how these models have emerged, and the underlying business dynamics that have driven growth and attracted interest from both users and venture investors. At the same time, we’ve also explored some of the key challenges facing this nascent industry. The varying adoption rates between content tokenization and creator tokenization, for example, highlight the need for continued innovation to overcome frictions and deliver compelling value propositions for all stakeholders.

However, despite these early growing pains, the OAX Foundation believes the long-term relevance and potential of SocialFi is greater than ever before. Models like SocialFi have the power to radically reshape how value is created and distributed online, placing greater control, ownership, and financial rewards directly in the hands of users and creators. In this way, SocialFi stands as a testament to what is possible when emerging technologies are harnessed to serve the interests of the broader community, rather than being exploited by centralized entities. As the ecosystem continues to evolve, we can expect to see even more groundbreaking innovations that further empower people to take control of their digital lives and financial futures.

Disclaimer: The above is an opinion piece written by an authorized author, but in no way represents the official standpoint of OAX Foundation Limited, nor should it be meant to serve as investment advice.