The Meme Mania Returns: A Macro View and Rational Lens on Meme Coins

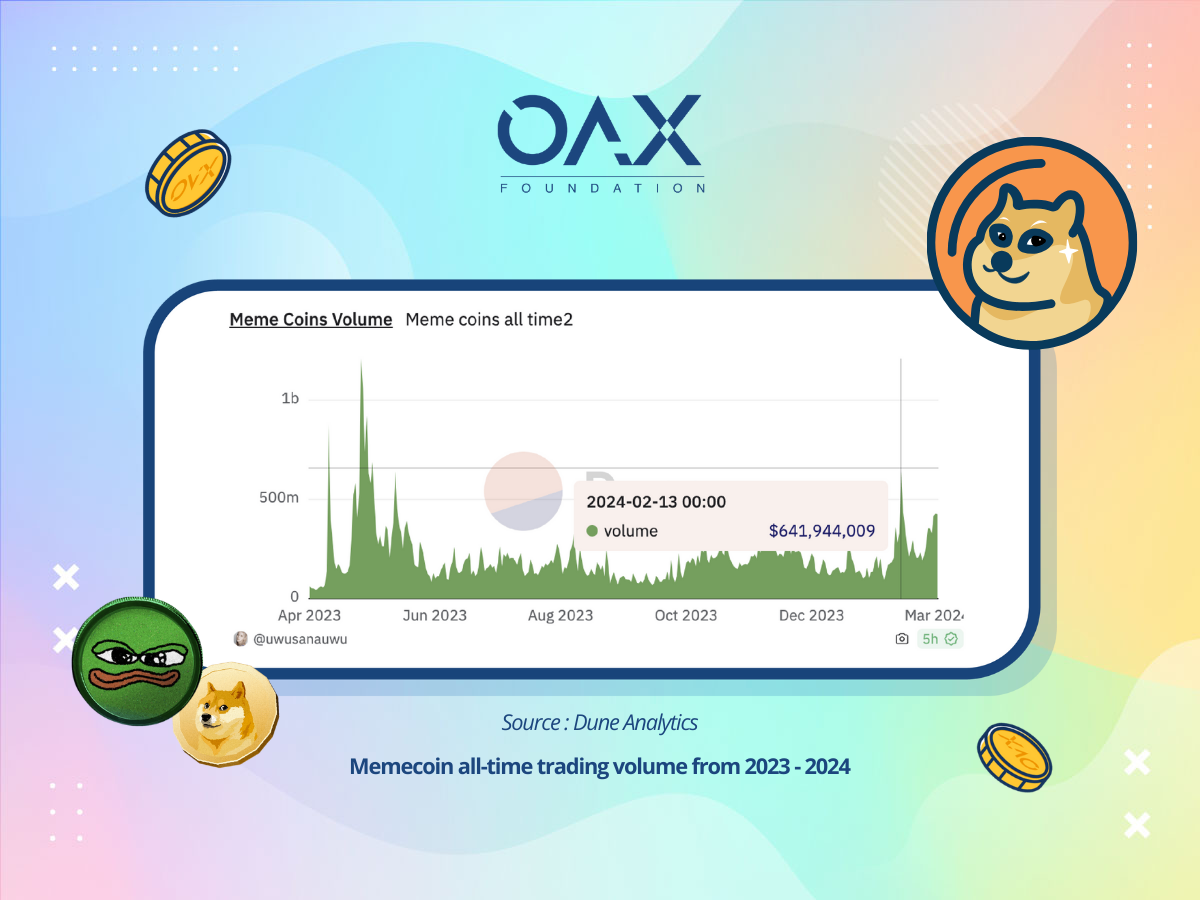

The recent bull run of Bitcoin has ignited a frenzy in meme coins such as DOGE, SHIB, PEPE, and WIF. As Bitcoin reaches new highs following a sell off, profits have been flowing into speculative assets, causing meme coins to gain traction. In this article, we will explore the resurgence of the meme wave, the flagship meme tokens on various chains, and what to consider when assessing this trend.

Refresher on Meme Coins:

Memecoin projects like DOGE, WIF, SILLYCAT, and POPCAT are gaining popularity due to their unique nature and profit potential. Projects like SHIB are expanding their ecosystems with initiatives like Shibarium, ShibaSwap, NFTs, and digital identity projects. Meme coins often present themselves as an exciting investment opportunity, particularly for newcomers in the crypto space, due to their engaging and accessible nature.

However, it is important to note that we have seen many cases in the past where there is no inherent value in many of these projects and not short of cases in rug pulls and scams. Many meme tokens are being minted by the hour, with hardly any screening to validate their legitimacy before making available for retail users to trade. Moreover regulatory scrutiny from the SEC is a potential risk for meme coin projects, as marketing and development efforts could be seen as securities offerings.

Common Indicators to Consider:

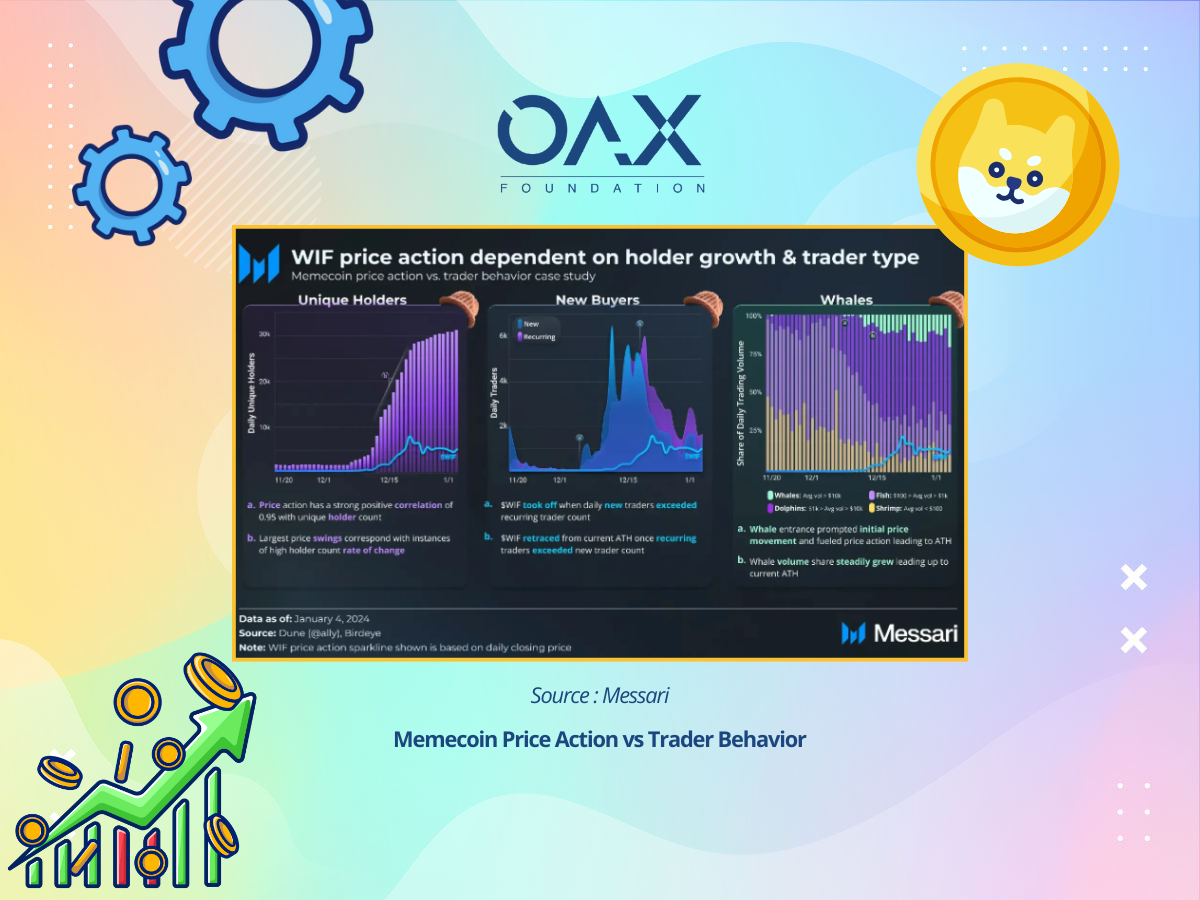

Establishing meme coin as a highly speculative digital asset class, we’ve seen market leaders sharing their approach to gauge a meme coin project’s traction and growth potential. Metrics such as the number of holders and types of buyers are tracked. Key indicators of early growth include a sharp rise in holder count and trading volume, as well as an expanding, diverse holder base. Additionally, small-scale trader dominance fosters organic and sustainable growth versus participation by large whales. Continued traction relies on consistent increases in holder count and trading volumes. Signs of a reversing trend include a decrease in new user acquisition rate, dominance of recurring traders, erratic price fluctuations, or sudden whale activity. Thanks to blockchain, much of this information is made available for users doing their research on meme projects.

Catalyst for On-Chain Activities:

With each blockchain having its flagship meme token, high levels of participation have driven up new users and on chain activity. Notably, activities on Solana have caught fire, attracting attention within the meme coin space as well as new retail investors to explore the ecosystem.

Recent trends on social media show a meme token Book of Meme (BOME) on the Solana token has been outperforming ETH and BTC. Solana’s SOL has surged by 45% in 7 days, surpassing $200 for the first time since December 2021. BOME rose significantly since its debut and is now listed on prominent CEX including Binance. While Ether (ETH) declined slightly, Solana’s DeFi ecosystem is gaining interest, with $30 billion in trading volume on decentralized exchanges this month. Increased chatter around SOL suggests a potential retail investor hype, reminiscent of late 2021 trends.

Closing thoughts:

Although the longevity of every memecoin is not guaranteed, their undeniable presence in the current cycle is apparent. The recent increase in memecoin activity and user engagement suggests growing appeal in the coming months, attracting the interest of the broader cryptocurrency community and new retail investors. OAX Foundation is excited to see how meme coin has been a driver to grow digital asset communities and found new ways to distribute value. However, newcomers should exercise caution due to the volatility and speculative nature of meme coins, emphasizing the importance of thorough research before making any investment decisions. By understanding the macro view and approaching meme coin with a rational lens, participants can stay informed and make educated decisions in this dynamic market.

Disclaimer: The above is an opinion piece written by an authorized author, but in no way represents the official standpoint of OAX Foundation Limited, nor should it be meant to serve as investment advice.