How DeXes and DeFi Respond to an Evolving Industry

Liquidity is universally regarded as a good thing for trading assets on public markets. The deeper the liquidity pool, the better the trading economics for market participants; and the more liquidity there is, the more will come as more participants are attracted to the venue’s attractive economics. But it has a third quality: stickiness: the deeper it is, the harder rival venues will have to try to dislodge it – and the stickier the liquidity, the greater the exchange’s ability to scale and grow.

In a fast-pace environment such as the digital asset economy, and particularly DeFi within that space, platforms need to be receptive to change: whether it be adapting to liquidity needs or to the business development of the platforms in effort to stay ahead of the curve and the competition.

The benefits of deep liquidity are well understood and pursued by exchanges in crypto markets. Most opt for some form of market maker (MM) system: decentralised technology can automate market-making via atomic contracts, giving rise to the Automated Market Making or AMM model. Others issue liquidity provider (LP) tokens to incentivise counterparties: when these MMs add their tokens to the pool, they are rewarded with LP tokens.

Shifting Liquidity

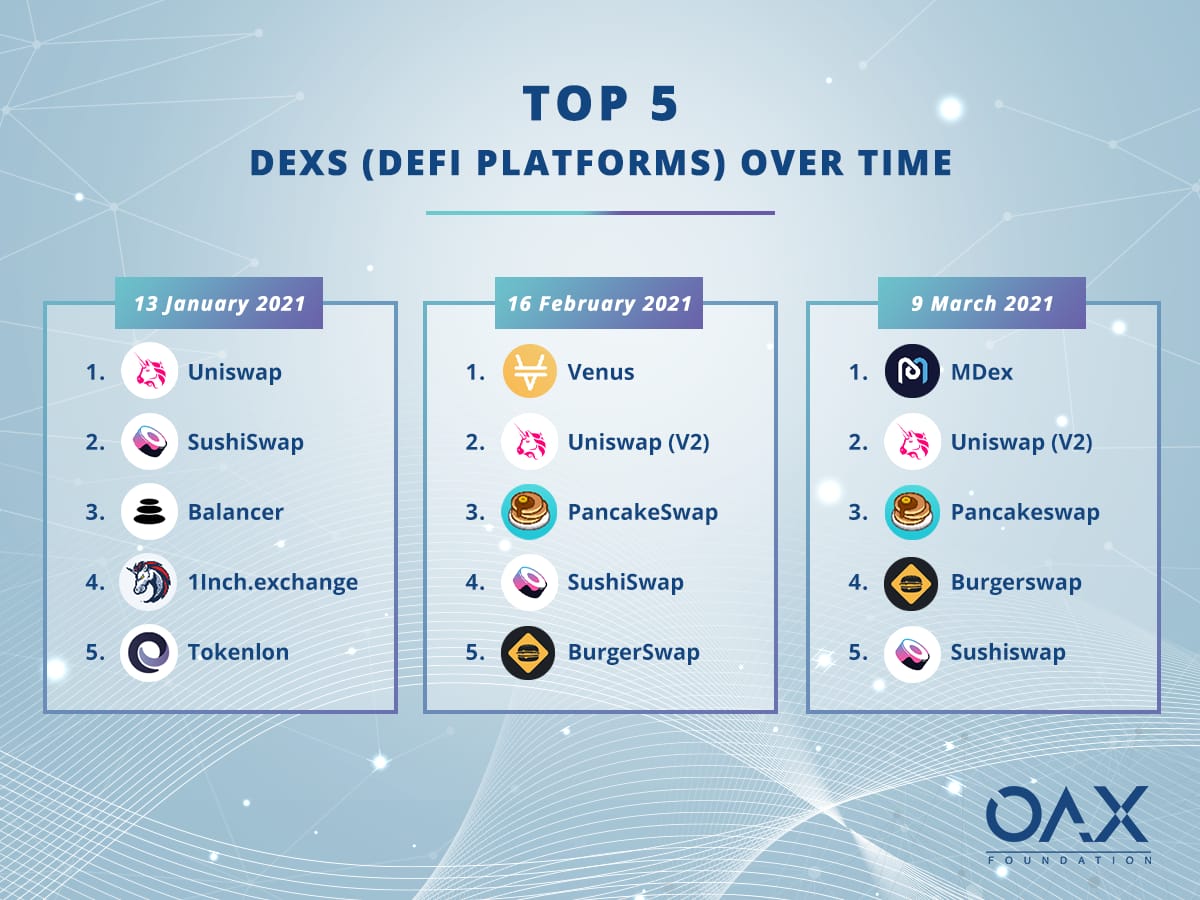

But although it is possible to create a deep pool of liquidity on both decentralised and centralised exchanges, it is proving difficult to create liquidity stickiness on current AMM platforms. A look at the leaderboard for trading venues on Coinmarketcap reveals a volatile situation.

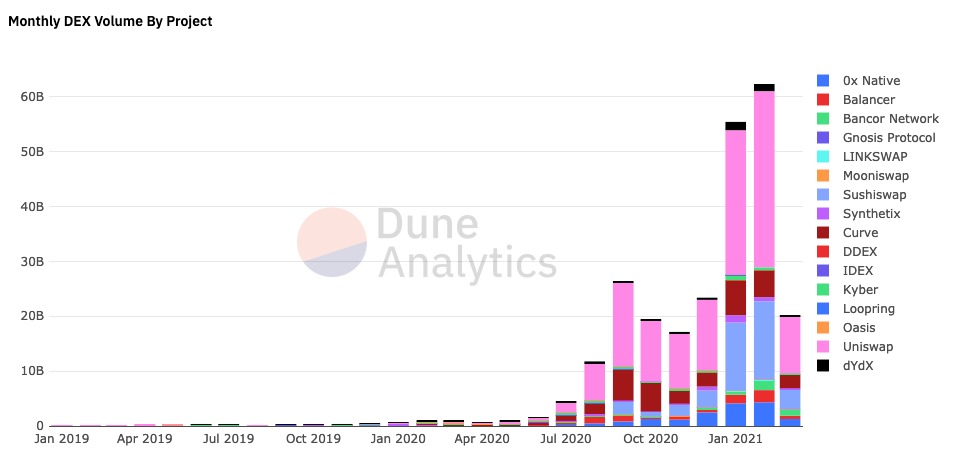

The rise of AMM swaps is tied closely to the rise in attention to DeFi, but it’s interesting to see the trends. We’ve seen the dominant AMM swap DeXes Uniswap and Sushiswap losing liquidity to a new entrants such as PancakeSwap, an AMM-based DeX which runs on Binance Smart Chain (BSC). BSC offers traders lower fees than on the Ethereum network which hosts Uniswap and Sushiswap. Based on its attractive economics, Pancakeswap’s market share rose 73% last week, giving it a market share of 16.5%, close behind Uniswap’s 16.9% and ahead of Sushiswap at 6.9%. This rise, which equates to US$ 4 billion in total value locked, is due to increasing fees on the ETH blockchain which has driven MMs to find more attractive trading terms.

PancakeSwap’s strengthening position based on its more attractive participation incentives illustrates the back-and-forth nature of cryptoasset liquidity depending on the changing advantages they offer to liquidity providers. It’s worth recalling that Sushiswap’s debut followed a boom-and-bust trajectory as liquidity flooded toward its attractive incentives, then fled on rumours that its founder had dumped his stake [link to our article]. That it recovered swiftly after confidence was restored demonstrates the fickle nature of crypto liquidity.

Source: Dune Analytics

Source: Dune Analytics

Governance Matters

On conventional centralised exchange for equities and derivatives, liquidity stickiness comes from factors that create and protect the venue’s cost-efficiency/profitability: governance hierarchy, regulations, default fund, brand. But DeFi and DeXes are autonomous and do without the paraphernalia of the old, monolithic exchanges, giving them more flexibility to change and develop as the fast-moving cryptoasset market evolves.

To capitalise on this flexibility, some decentralized exchanges are run entirely by the people trading on them, who gain a voice through governance tokens. For example, Uniswap and Sushiswap give governance power and protocol ownership to their liquidity providers, creating a focused community with a stake in the platforms’ future direction. Uniswap announced its governance token, UNI, last September, in a bid to win back TVL from newly-launched Sushiswap. Governance tokens now play an important role in establishing the economic model and rules of these DeXes.

But with governance being managed by the community, the onus is on the DeXes to react quickly to the proposals that have been approved by their voting protocols. Longevity of the DeX relies not only on the LPs ability to farm yields with the DeX that offers the best terms, but the creation of a community and the influence they yield in actually being able to shape the future direction of the platform.

Making the DeXes Flex

In the fast-changing crypto trading world, being able to influence the future strategy and features of DeFi and DeXes could prove more profitable to LPs than yield-hopping in the longer term. In turn, these platforms need to future-proof their models by ensuring they can be flexible and responsive to the requirements of their governing communities. To provide services and incentives that attract and retain liquidity, DeXes need to leverage DeFi’s decentralized technology inherent flexibility and automation to build agile platforms that are responsive to traders’ evolving requirements.

A dedicated community with a stake in the success of the platform is key to keeping it current, efficient and attractive, enabling it to foster deeper, stickier liquidity – and all the attractive benefits that come with it.